Duke Energy (NYSE:DUK) and France’s TotalEnergies (NYSE:TTE) agreed Wednesday to pay a combined $315 million to lease 110,000 acres off North Carolina that could produce 1.3 GW in offshore wind.

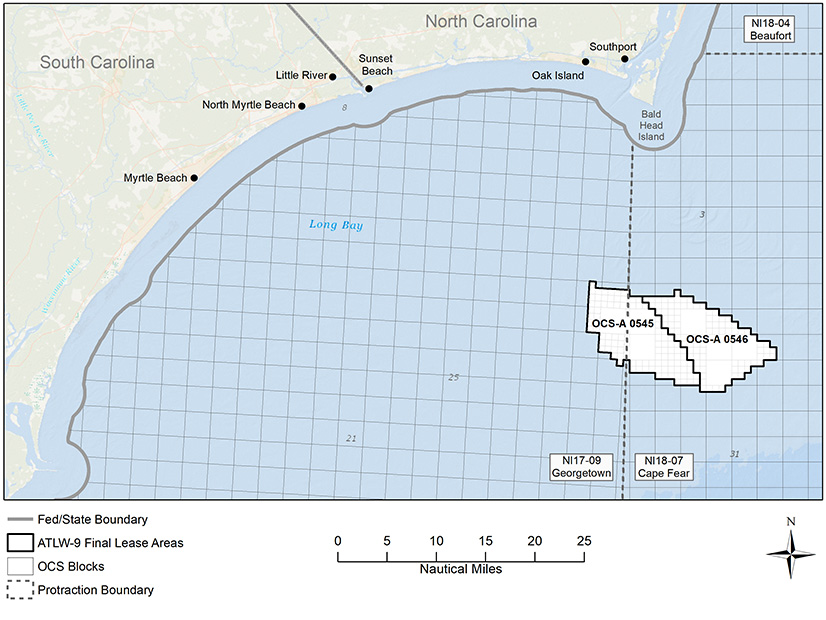

After 18 rounds of bidding, TotalEnergies Renewables USA agreed to pay $160 million for Lease OCS-A 0545 and Duke Energy Renewables Wind will pay $155 million for Lease OCS-A 054, the Bureau of Ocean Energy Management (BOEM) reported.

The winning bids in the Carolina Long Bay auction averaged almost $2,900 per acre, more than double the prices paid in BOEM’s 2018 auction for three sites off the Massachusetts coast, but a fraction of the record $8,837/acre paid for sites in the New York Bight in February. (See Fierce Bidding Pushes NY Bight Auction to $4.37 Billion.)

Lower prices were expected, because unlike many other East Coast states, North Carolina has no statutory offshore wind goal, although Gov. Roy Cooper issued an executive order in 2021 calling for 2.8 GW of offshore wind capacity by 2030 and 8 GW by 2040.

North Carolina House Bill 951, enacted in October, requires the state Utilities Commission to cut the state’s electric sector carbon emissions to 70% below 2005 levels by 2030, with carbon neutrality by 2050.

Duke Energy, the state’s largest utility, has proposed 2,650 MW of OSW by 2035 in two scenarios in its 2020 integrated resource plan.

ClearView Energy Partners said H.B. 951 was “a primary motivator” for bidders in the auction. “The law did not create offshore wind-specific targets, but it does require each electric public utility to submit a ‘Carbon Plan’ describing how it intends to achieve the targets” to the NCUC by May 16, ClearView said. “The law also compels electric utilities to propose a program for the competitive procurement of energy and capacity from renewable energy facilities, inclusive of offshore wind.

“We regard state-led offshore wind solicitations as the most important policy driving offshore wind in the U.S. today. However, today’s winning bids exceed that of all other offshore wind lease auctions held prior to the New York Bight sale,” ClearView added. “This could suggest that an emerging domestic offshore wind supply chain and demonstrable under development and in-service projects over the last few years may sufficiently validate the viability of some offshore wind in waters that do not directly serve active state solicitations.”

Bidding

BOEM removed hundreds of thousands of acres from consideration since its 2012 North Carolina call for information and nominations to avoid conflict with the habitat of the North Atlantic Right Whale. It also eliminated areas within 20 statute miles of the shoreline and areas that would have overlapped with a navigational fairway proposed by the U.S. Coast Guard.

Following the removals, BOEM said it divided the remaining lease area into two nearly equal lease areas with similar acreage, distance to shore and wind resource potential.

Bidding for the two 55,000-acre leases increased in virtual lockstep for the first 11 rounds, beginning at the minimum bid threshold of $2.75 million with a total of nine bidders. By round 11, prices had risen to $100 million each while the number of bidders dropped to three. Sixteen companies had qualified to bid.

Heather Zichal, CEO of the American Clean Power Association, said the lease sale should “be a sign to Congress to repeal the 10-year moratorium on offshore wind leasing off the coasts of North Carolina, South Carolina, Georgia, and Florida. Creating a stable policy platform for offshore wind development and facilitating the first wave of significant projects will provide certainty for the industry, strengthen the workforce, and bolster domestic supply chains up and down the coasts and across the country.”

Stipulations

BOEM included stipulations to encourage “construction efficiency” and development of a domestic supply chain. Lessees will be required to make reasonable efforts to enter a project labor agreement covering construction. (See Ørsted Inks Labor Agreement for US OSW Construction.)

“For the first time, the federal government used an auction system designed to spark investment directly into U.S. manufacturers, small businesses, shipbuilders and new workforce training, accelerating development of the already-emerging domestic supply chain,” said Liz Burdock, CEO of the Business Network for Offshore Wind.