Southeast Energy Exchange Market (SEEM) members began an informational series Wednesday to educate existing and prospective participants on how the market will function and what to expect before it goes live.

With a planned launch in the fourth quarter, SEEM’s founding utility members worked this spring to design the optimization platform that will drive the market, according to Chris McGeeney, manager of transmission services at Associated Electric Cooperative, a SEEM member.

“In late May, we’re going to start kicking the tires on the system and onboarding participants, and training will continue through the end of June,” McGeeney said during the first of three introductory webinars.

Participants will begin submitting their company information into the SEEM platform prior to the start of market trials scheduled for late summer, he said.

The region-wide, automated intra-hour platform will function as SEEM’s optimization engine based on inputs from market participants, such as bids and transmission capacity, to create bilateral matches between participants, according to McGeeney. An algorithm will process market participants’ inputs every 15 minutes for bids and offers, consider participants’ constraints, such as trading restrictions, and identify matches between the bids and offers.

Automated transactions, he said, will go to relevant transmission service providers, balancing authorities and generators for approval, and the SEEM platform will create transaction records between participants. At that point, energy flows will occur in the same way they do in the bilateral market.

“There’s no single clearing price or concept of financial congestion,” McGeeney said. “What’s going to turn the crank is this optimization engine looking for the optimal set of trades that benefits the entire region.”

Participation

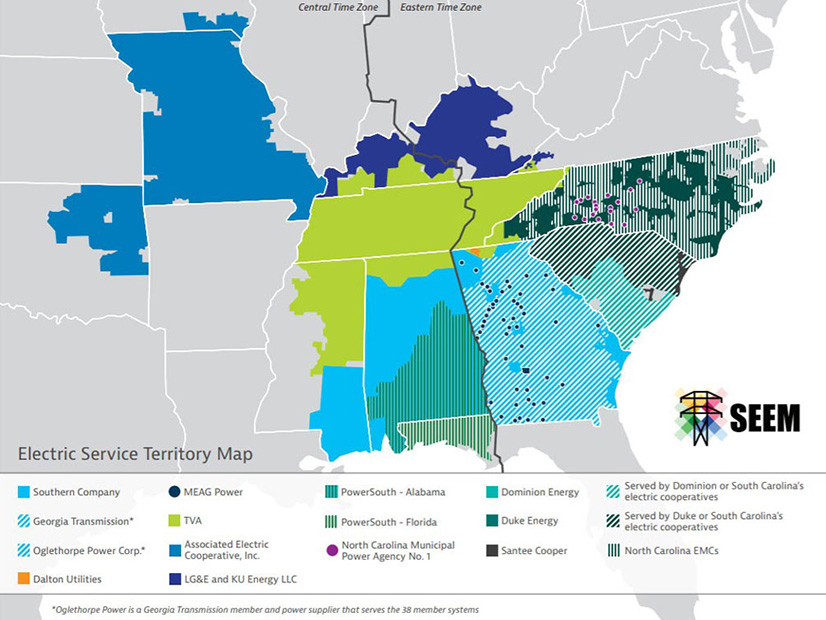

Entities that want to voluntarily buy and sell within SEEM and are not formal market members must have control of a valid energy source or sink within the market’s footprint, according to Molly Suda, associate general counsel at Duke Energy (NYSE:DUK).

If that basic criterion is met, participants can sign up by executing the SEEM participation agreement, which is on file with FERC for review, she said.

Prospective participants also must have transmission service arrangements in place for the new non-firm energy exchange transmission service (NFEETS) product that all the transmission-owning members of SEEM will be offering.

Duke, Southern Company (NYSE:SO), LG&E and KU Energy, and Dominion Energy South Carolina (NYSE:D) have all filed with FERC and have, as part of their open access transmission tariffs, a form transmission service agreement for the NFEETS product that participants can execute, Suda said.

In addition, participants must have at least three enabling agreements with other non-affiliated participants. The enabling agreements function as an underlying bilateral contract that will allow participants to settle trades matched by the SEEM platform.

“That three-counterparty rule was put in place and contained in the market rules to establish a mechanism to prevent opportunities for parties to collude to gain preferential access to this new transmission service,” Suda said.

Operations

Matt O’Neal, project manager for energy policy at Southern, outlined some functional capabilities of the SEEM system during the webinar that attendees can discuss with their IT teams in advance of onboarding.

The SEEM platform will have several different authentication options for participant login, he said. And participants need to be thinking ahead to how they will access the platform. They can use the SEEM platform via a web user interface or APIs that connect to a company’s back-end systems.

“Many of our existing participants are building up internal systems that will formulate bids and offers, submit bids and offers or pull results back down to store in their energy trading risk management systems,” O’Neal said. “Many of the large vendors out there are offering SEEM add-ons or features to their products to interact with the SEEM.”

The onboarding process will also require participants to provide important details to help with the SEEM functionality, according to O’Neal. Those details include source and sink locations, tagging requirements and geographic constraints.

Consideration early in the onboarding process should go to how participants will formulate their bids and the volume of bids, O’Neal said, adding that with a fast-moving, 15-minute market, system automation could be “worthwhile.”

“If you do the math and think about a 15-minute market, that means you have … close to 35,000 trading intervals within a single year,” he said. “There is a lot of potential for deals; maybe more deals than you traditionally have today.”

Upcoming webinars in the series will take place May 20 and June 20 to give participants an overview of the SEEM network infrastructure and a closer look at tagging process and settlement.