Energy prices in PJM increased by 75.5% in the first quarter of 2022 from a year ago, the Independent Market Monitor reported Thursday, driven primarily by higher fuel costs.

In its Q1 State of the Market Report for PJM, the Monitor said the real-time load-weighted average LMP increased from $30.84/MWh to $54.13/MWh. This is the highest first-quarter price since the polar vortex in the first quarter of 2014, the Monitor said, and the third highest increase in first-quarter LMP since the start of PJM markets in 1999. The second highest price occurred in 2003, when winter load increased and natural gas prices doubled to above $8/dekatherm that year.

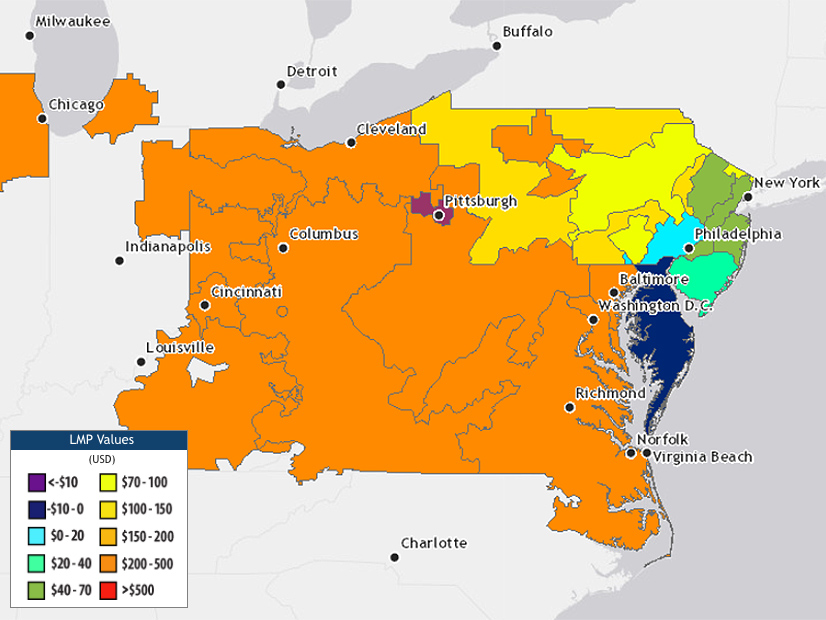

Of the $23.29/MWh increase, 49% was directly from higher fuel and emission costs, especially higher natural gas prices. Both coal and natural gas prices were higher in the first quarter of 2022 compared to 2021, with prices doubling in the eastern part of the RTO.

Real-time hourly average loads in the first quarter increased by 2.4% from 2021, going from 89,887 MWh to 92,007 MWh. The total price of wholesale power increased from $53.30/MWh in the first quarter of 2021 to $80.28/MWh in 2022, an increase of 50.6%. Generation from coal units decreased 3.1% in the first quarter, while generation from natural gas units increased 6.9% compared to the first three months of 2021.

Monitor Joe Bowring said that despite the increased energy prices, PJM’s wholesale electric energy market produced competitive results in the first quarter.

“The steadily increasing role of gas-fired generation and the declining role of coal highlight the importance of ensuring that PJM has real-time, detailed and complete information on the gas supply arrangements of all generators and that PJM consider rules requiring capacity resources to have firm fuel supplies,” the Monitor said in its report. “It is also essential that FERC consider and address the implications of the inconsistencies between the gas pipeline business model and the power producer business model and the issue of market power in the gas markets under extreme weather conditions.”

Theoretical net revenues from the energy market increased for all unit types in the first quarter, the Monitor said, with theoretical energy net revenues increasing by 145% for a new combustion turbine, 94% for a new combined cycle, 54% for a new coal unit and 75% for a new nuclear plant.

Total energy uplift charges decreased by $5.9 million, or 17.2%, in the first quarter, going from $34.3 million in 2021 to $28.4 million.

Total congestion prices increased by $389.2 million, or 321.5%, going from $121.1 million in 2021 to $510.3 million in 2022. The Monitor said only 31.9% of total congestion paid by customers for the first 10 months of the 2021/2022 planning period was returned to customers through the auction revenue rights and self-scheduled financial transmission right revenues offset.

“Congestion belongs to customers and should be returned to customers,” the Monitor said. “The goal of the FTR market design should be to ensure that customers have the rights to 100% of the congestion that customers pay.”