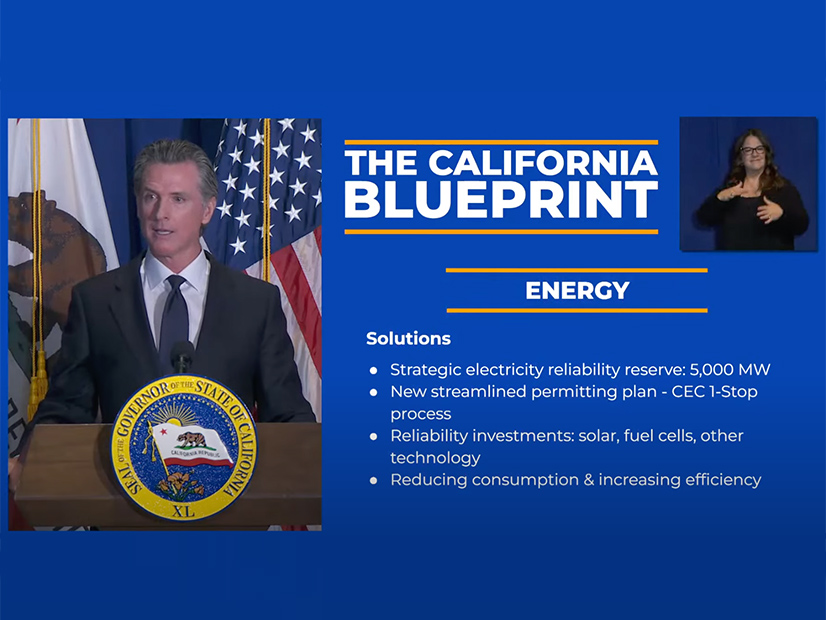

California Gov. Gavin Newsom said Friday that the state needs a $5.2 billion “strategic electric reliability reserve” to meet the challenges of extreme heat, wildfires, drought and the West’s changing resource mix.

Newsom proposed the reserve as part of the May revision to his FY 2022-23 budget, originally released in January.

He also cited supply-chain problems, including with imported solar panels, as contributing to potential supply shortfalls this summer and beyond.

“When you stack all these together, and you reflect those extremes on wildfire, heat [and] drought, we’re looking at potentially filling [supply] gaps that weren’t there even a year or two ago,” Newsom said in a budget briefing. “So how do we do that? We are requesting [that] the legislature … [create] a new strategic electricity reliability reserve, which is just a fancy way of saying ‘putting together 5,000 megawatts that’s available at a moment’s notice.’”

A summary of the governor’s budget plan says the reserve could consist of “existing generation capacity that was scheduled to retire, new generation, new storage projects, clean backup generation projects, diesel and natural gas backup generation projects … and customer-side load reduction capacity that is visible to and dispatchable by the [CAISO] during grid emergencies.”

Officials have not said whether the reserve funds would be used to keep the state’s last nuclear generator, PG&E’s Diablo Canyon Power Plant, operating beyond its planned retirement in 2024-25 for reliability, as some have urged.

In late April, Newsom told the Los Angeles Times editorial board that California would seek a share of $6 billion in federal funds intended to keep aging nuclear plants open. The Biden administration announced the program last month.

“The requirement is by May 19 to submit an application, or you miss the opportunity to draw down any federal funds if you want to extend the life of that plant,” Newsom said, according to the Times. “We would be remiss not to put that on the table as an option.”

His cabinet secretary, Ana Matosantos, told reporters at a May 6 briefing the state needs to consider all possibilities.

“We can’t keep any options off the table,” Matosantos said. “And we are clearly looking at planned retirements and making sure that we’re looking at all options associated with those planned retirements.”

During the briefing, officials from the governor’s office, CAISO, the California Public Utilities Commission (CPUC) and the California Energy Commission (CEC) said this summer’s potential shortfalls could range from 1,700 MW under strained conditions to 5,000 MW under extreme conditions.

Newsom said Friday that the state could face up to a 7,300 MW shortage, though it was unclear where he derived that figure, which was not cited by CAISO, the CEC or the CPUC.

CAISO, CEC Examine Reliability

The governor’s revised budget proposal followed reliability discussions by the CEC and CAISO on Wednesday and Thursday that delved into the likelihood of shortfalls this summer during harsh conditions.

CAISO’s 2022 Summer Loads and Resources Assessment found that the likelihood of having to order rolling blackouts — as the ISO was forced to do in August 2020 — is less this summer than last year, largely because of the addition of 4,000 MW of battery storage since the 2020 blackouts.

“However, available capacity continues to be impacted by well below normal hydro conditions as California is in its third year of drought,” Neil Millar, the ISO’s vice president of infrastructure and operation planning, told the CAISO Board of Governors in a memo prepared for the board’s meeting Thursday.

California’s mountain snowpack, which supplies water during the state’s six-month dry season, stood at 38% of average April 1 after the three driest winter months on record.

As in the past two summers, CAISO’s “greatest operational risk is during a widespread heat wave that results in low net imports due to high peak demands in its neighboring balancing authority areas,” the memo said. “The risk increases in late summer concurrent with the diminishing effective load-carrying capability of solar resources and the wane of hydro generation.”

“Under extreme weather and events such as wildfires that diminish larger amounts of supply, the ISO could still be faced with the necessity to shed firm load,” Millar wrote.

Using a new methodology, the resource assessment found the probability of CAISO declaring a Stage 3 energy emergency is 15% this year compared to about 6% last year, but the possibility of firm load interruption decreased from 4.6% in 2021 to 4% this summer.

More extreme weather than anticipated or procurement delays for anticipated new resources could worsen the outlook, CAISO cautioned.

In a briefing to the CEC, David Erne, with the commission’s Energy Assessments Division, said supply chain issues were especially problematic this year.

High lithium prices are affecting battery production, and the U.S. Commerce Department launched an investigation in April into allegations that Southeast Asian solar panel manufacturers are using Chinese parts while evading U.S. tariffs on China. The situation could interrupt solar panel delivery and the construction of solar arrays.

“What we’ve seen from last summer and moving forward is the energy industry is particularly impacted by supply chain issues, commodity prices and tariff issues, all of which cumulatively impact our ability to build out these new projects moving forward,” Erne said. “Our reliability is dependent upon new buildout, and that new buildout is affected by these particular issues.”