A New Jersey straw proposal to award solar renewable energy credits (SRECs) through annual procurements, with incentives for projects incorporating storage, won initial support from stakeholders in a Board of Public Utilities meeting May 26.

Representatives of the Division of Rate Counsel, the Solar Energy Industries Association (SEIA) and a solar developer expressed broad support for the Competitive Solar Incentive program (CSI), developed by BPU staff and Daymark Energy Advisors (Docket QO21101186).

The CSI program is one half of the Successor Solar Incentive program adopted by the BPU in July 2021 to implement the Clean Energy Act of 2018 and the Solar Act of 2021 and double the state’s solar footprint by adding 3,750 MW of new capacity by 2026. (See NJ Sees Solar Growth in Reduced Incentives.)

The other half of the BPU’s initiative is the Administratively Determined Incentive (ADI) program, which offers a fixed incentive for net-metered residential projects, net-metered nonresidential solar projects of 5 MW or less and community solar programs.

The 2018 law directed the BPU to redesign the state’s solar incentives and close the Legacy SREC program once it reached 5.1% of the power sold, a threshold attained on April 30, 2020. (See Solar Subsidy Program Ending in New Jersey.)

As required by the 2021 law, the CSI program will use competitive procurements to target an average of 300 MW of new solar projects annually. All grid supply projects — front-of-the-meter projects that sell into the PJM wholesale market and net-metered non-residential projects greater than 5 MW — will be eligible to participate. (See NJ Solar Proposal Seeks More Market Competition.)

Five Tranches

The straw proposal recommends that the CSI program be structured as five separate procurement tranches to ensure that a range of types of competitive solar projects qualify to receive payments (called SREC-IIs) despite their different project cost profiles:

- Basic Grid Supply: All grid supply projects that do not qualify for one of the other tranches below (e.g., greenfield solar projects).

- Grid Supply on the Built Environment: Solar installed on rooftops, raised carports or similar installations.

- Grid Supply on Contaminated Sites and Landfills: Any currently contaminated portion of a property on which industrial or commercial operations were conducted and a discharge of contaminants occurred; or a properly closed sanitary landfill facility.

- Net-metered Nonresidential Projects above 5 MW: Under the Solar Act of 2021, net metered solar projects of 5 MW or less qualify for inclusion in the ADI program.

- Storage Paired with Grid Supply Solar.

Projects eligible to compete in Tranche 2 or 3 would automatically also be eligible for Tranche 1. If some of the Tranche 1 awards go to projects that qualify in the specialized tranches, they would be removed from consideration in the subsequent tranches.

Price Premium to Reduce Open Space Development

The 2021 law requires that the “development of grid supply solar should be directed toward marginal land and the built environment and away from open space, flood zones and other areas especially vulnerable to climate change.”

The straw proposal said that considering the projects in separate tranches “recognizes that NJBPU may choose to select these projects even if they come at some premium over greenfield solar development, while establishing a competitive structure to set an appropriate market price for these projects.”

Staff noted that solar on contaminated sites and landfills might face higher costs of mitigating contamination and securing permits but that encouraging projects on such sites would reduce development pressure on open space. The state had 230 MW of solar operating on landfills and brownfields as of the end of February.

Staff said it is uncertain how many qualifying large net-metered projects are likely to compete in the CSI program because of the “unpredictability of a competitive procurement” and limitations on the number of appropriate sites.

“However, the [Transition Incentive program that succeeded the Legacy program] received a robust response from large (> 5 MW) net-metered projects of approximately 120 MW, suggesting that there could be significant potential participation by large net-metered projects,” staff said. “In fact, net-metered projects may have some inherent advantages in a competition against wholesale projects, since they already receive some degree of subsidy, compared to wholesale projects, in the form of net metering credits higher than the wholesale cost of power.”

To ensure the continued diversification of resources as required by the 2021 law, “it would not be desirable to risk awarding all CSI program capacity to net-metered projects,” staff said. “By breaking these projects out into their own tranche, NJBPU will be able to award SREC-IIs to the most competitive net-metered projects, while ensuring that there is still room in the program for other types of projects.”

Storage Adder

Although the 2018 law requires New Jersey to achieve energy storage goals, the state currently lacks an independent energy storage program.

The straw proposal notes that solar projects with storage can obtain higher capacity ratings in PJM markets and are able to arbitrage by storing energy produced when wholesale prices are low and selling when they rise.

Staff said the dedicated storage tranche in the CSI program would provide a storage adder to solar projects that qualify for SREC-IIs in competition with other solar projects and also offer storage competitive within the storage tranche.

Solar-plus-storage projects would make two-part bids: a solar-only SREC-II price and a storage adder price. The project would first be considered as a solar-only project; if it receives an award, its proposed storage adder price would then be considered separately in the storage tranche.

The storage incentive would be limited to four times the total MW of the solar project (e.g., 4 MWh of storage per MW of solar capacity).

Bidding, Maturity Requirements

Staff recommended adopting project qualification and maturity requirements to ensure that selected projects are likely to reach commercial operation.

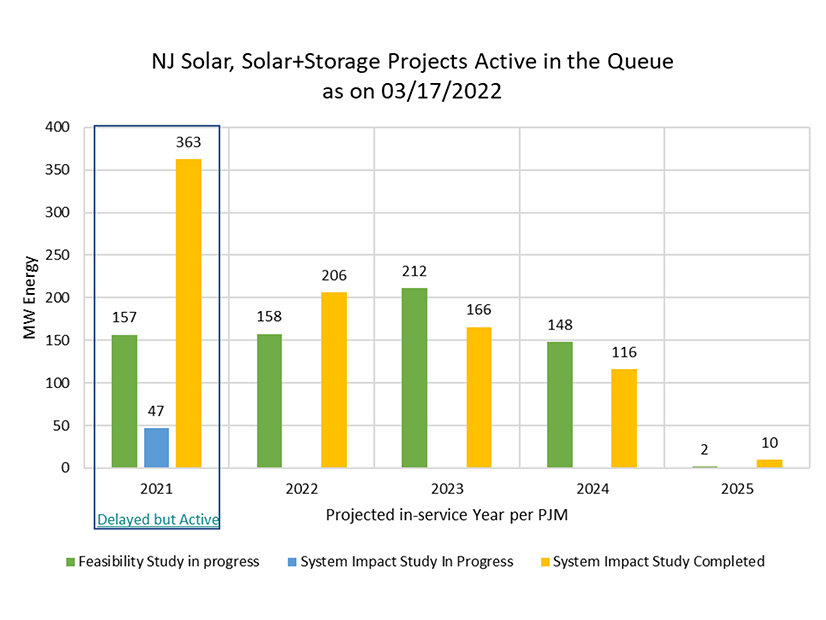

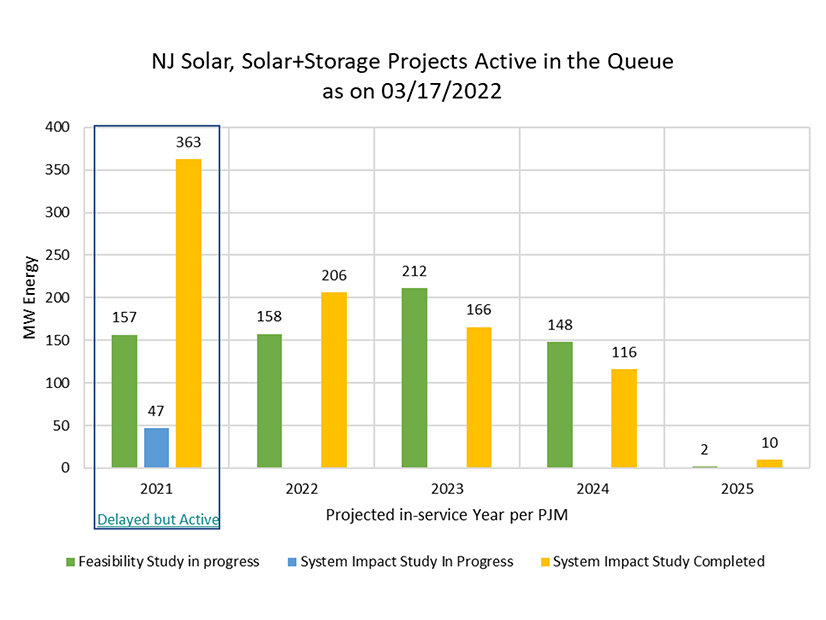

To prequalify, projects would need to demonstrate “a sufficiently advanced position in the PJM queue (taking into account the realities of the ongoing PJM interconnection reform process)” or a comparable interconnection position in a state-jurisdictional queue. Net-metered projects would be required to show conditional approval of their utility interconnection request.

Projects would be required to pay a $1,000/MW nonrefundable solicitation participation fee and achieve commercial operation three years after registration in the program.

“Using prequalification through queue position would avoid having to engage in a more complex, subjective process relating to permitting, securing right of ways or evidence of public support,” staff said.

Staff proposed resources be paid on a price as bid basis with confidential project cost caps. Among the 34 questions staff seeks input on is whether the SREC-IIs should be fixed or indexed to wholesale energy prices.

Staff recommended all tranches be included in a single procurement to be held once per year. “However, some adjustments to this schedule may be appropriate to coordinate with the implementation of PJM’s new queue procedures, should these be approved,” staff said.

Comments

During Thursday’s hearing, Sarah Steindel, of the state’s Division of Rate Counsel, expressed support for the tranches. “We think that the proposed five tranches are a sufficient number to recognize the legislature’s preferences for certain types of projects, but yet, each tranche is still broad enough to create robust competition.”

She said the Rate Counsel “strongly support[s] the proposal to utilize a confidential bid price cap for each tranche” but was still evaluating the proposal for solar-plus-storage. “We have some concern that … some of the tranche targets may be aggressive, and we recommend that the board consider what options it may have should some or all of the specialized tranches go unfilled.”

Speaking on behalf of SEIA, Nitzan Goldberger of Borrego Solar Systems, was also supportive.

“A pay as bid system, coupled with strong project maturity requirements for bidders, should avoid overpayment to bidders and avoid windfall [profits], minimize project attrition and ensures that the awarded projects reach completion,” she said.

Matt Tripoli, of solar developer CS Energy, echoed Steindel’s concerns that some of the tranches might go unfilled and suggested the BPU consider annual rather than monthly MW limits for the storage adder. We’re “glad to see that Daymark and the BPU are drawing lessons from some of those other states and how they’re constructing this program,” he said.

Fred DeSanti, the executive director of the New Jersey Solar Energy Coalition, said that by adopting a two-step process for storage-plus-solar, “we may be losing some economies because a lot of times when we’re pricing projects … if you do it on a joint basis, you can achieve some lower [costs] than you might by doing it independently.”

Feedback Sought

Staff will accept comments on the straw proposal until 5 p.m. June 20.

The BPU will hold two additional stakeholder meetings:

- Wednesday, June 1, 1:00 p.m.: Project prequalification, bid participation fees, and commercial operation date requirements.

- Monday, June 6, 1:00 p.m.: Auction price results, SREC-II payment structure.