The Bonneville Power Administration experienced two major “price excursion” events in the Western EIM within two weeks of joining the market on May 3, agency staff recounted Thursday.

“This transition [into the WEIM] has not been without trial and tribulation,” Mark Symonds, BPA director of commercial operations, said during an agency workshop to discuss WEIM implementation issues.

In the first event, occurring May 8, an “external technical issue” caused the BPA’s territory to separate from CAISO’s WEIM for more than four hours. BPA attributed the market disruption to the expiration of a third-party software vendor’s digital certificate, which prevented energy transfer schedule tags — or e-tags — from flowing into the market system.

As a result, inaccurate base schedules were submitted to the market, producing “unusual dispatches” and extremely high and low prices, Elsa Chang, BPA’s EIM program manager, told stakeholders during the workshop.

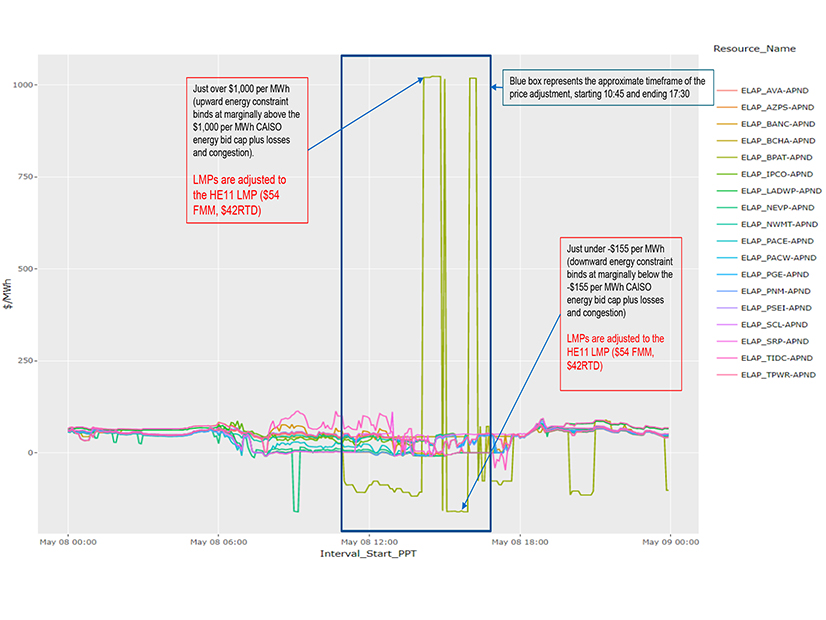

The May 8 issue started at about 9:30 a.m. PT, and WEIM prices in the BPA balancing authority area dropped deeply into negative territory at about 10:45 a.m., then rebounded to over CAISO’s $1,000/MWh energy bid cap just before 2 p.m. What followed was a series of wild fluctuations between those two levels, with prices topping $1,000/MWh and then dipping below the bid floor of $155/MWh. No other adjacent BAAs participating in the WEIM experienced similar price excursions.

After prices broke $1,000/MWh, BPA isolated itself from the market at 1:50 p.m. and remained separated until 4:10 p.m., Chang said.

“Once our vendor got notified, this issue was resolved quickly,” and BPA re-entered the market, she said.

Chang explained that market participants will not be billed or paid at the extreme prices that occurred during the episode. Instead, the event triggered CAISO’s administrative pricing, which in this circumstance is based on the last available prices before the disruption (hour ending 11 a.m.): $54/MWh for the 15-minute market and $42/MWh for real-time deliveries.

“We had exited operationally from the dispatches in the EIM, but that does not mean that we exited from the settlement provisions, which is why the CAISO utilizes this repricing methodology consistent with their tariff,” Symonds said in response to a stakeholder question. “Those prices have been established by the ISO and are flowing through the initial settlement statements received by all participating entities in the EIM.”

Donations Sought

The second price excursion event occurred May 18 after a small plane crashed near the Pacific AC Intertie, causing a curtailment of transmission schedules that cut transmission capacity for about 700 MW of BPA’s scheduled generation.

The result was a temporary surplus of generation in the BPA BAA before the agency could decrease output from its resources. In the interim, BPA was compelled to increase its dispatch into the WEIM and export more power through the market, causing BPA’s WEIM prices to decline to below -$500/MWh for three five-minute intervals.

Symonds said a final verdict on the extreme negative prices was still pending in CAISO’s price validation process.

“There are multiple reasons for which CAISO can and does routinely make price corrections. … At last check, they had not yet made their determination on this [event], and this particular trade date has not yet been settled,” he said.

Symonds cited both events in an appeal for regional stakeholders to “donate” unused transmission capacity to the WEIM to facilitate more transfers into and out of the BPA system, which will help avoid further price excursions. While BPA’s prices have tracked with those of other WEIM participants, “we appreciate that additional transmission can always help,” he said.

Symonds said also that additional transmission donations could assist with the more challenging conditions expected this summer.

“When there are high load events, particularly in the south, for example, there may be benefits of additional export capability to bring Northwest generation down to California, or in other events where we may be seeking to find additional loads for generation out of the Northwest, it can be helpful to also have export capability,” he said.

On the flip side, referring to the record-smashing heat wave the Northwest experienced in June 2021, Symonds said, “It would be good to have that import capability as well.”