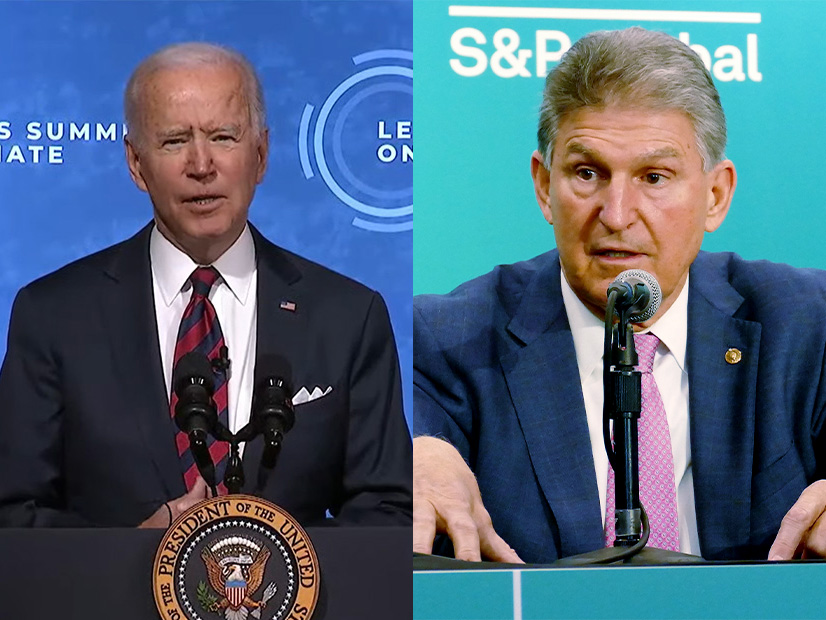

With Sen. Joe Manchin (D-W.Va.) once again shutting down negotiations over a budget reconciliation package that includes clean energy incentives, a range of voices and views have emerged to answer the crucial question of what comes next.

President Biden and Energy Secretary Jennifer Granholm both struck a note of defiance. In a statement released by the White House on Friday, the president said the need for climate action remained as urgent as ever, and he vowed not to back down.

“If the Senate will not move to tackle the climate crisis and strengthen our domestic clean energy industry, I will take strong executive action to meet this moment,” Biden said. “My actions will create jobs, improve our energy security, bolster domestic manufacturing and supply chains, protect us from oil and gas price hikes in the future, and address climate change.”

Granholm took to Twitter with a thread acknowledging her frustration while calling for broad action at all levels. “We will fight like hell with the tools we have to build a clean energy future and move forward on climate action,” she said. “This moment calls [for] every city, state, tribe, business, community and organization to get in the fight if you’re not already. We have to leave it all on the field.”

In an interview on West Virginia MetroNews radio on Friday, Manchin maintained that he wants action on climate, but in the wake of June’s 9.1% consumer price index — up 1.3% from May — fighting inflation and reducing the federal deficit have to come first.

Manchin in December gave similar reasons for pulling out of negotiations over the original Build Back Better Act. The bill was passed by the House of Representatives, but all 50 Republicans in the Senate are opposed. Democrats want to use the reconciliation process, which would only require a simple majority vote (with Vice President Kamala Harris breaking the tie) if Manchin joined in support, to bypass a filibuster.

“We’ve had good negotiations. … Our staffs have been working diligently for the last two to three months,” Manchin told Hoppy Kercheval, host of “MetroNews Talkline.” But he also said he had been clear with Senate Majority Leader Chuck Schumer (D-N.Y.) and other Senate staffers that his support would depend on the June inflation figures that were released on Wednesday.

“They knew exactly where I stood,” he said. “When we saw 9.1%, that was an alarming figure to me … so I said, ‘Oh my goodness, let’s wait; this is a whole new page.’”

With the war in Ukraine, and Europe looking to the U.S. to replace Russian fossil fuels, Manchin argued that the U.S. can decarbonize while continuing to “produce more fossil [fuel] cleaner than anyone in the world and replace that dirty fossil going into the atmosphere.”

“Also, what you can do is invest in the cleaner technologies that we know that will work,” he said. “We know hydrogen is going to work; we know we need storage for batteries, and battery storage takes care of wind and solar; we know that. New transmission — we know all these things. Geothermal and small nuclear reactors, I’m for all these things.”

Manchin said he is also consulting economic experts to ensure that any tax increases that would be used to fund clean energy incentives don’t cause further inflation or cause companies to cut back production or lay off employees. A budget reconciliation package, with or without energy incentives, could still be passed when Congress returns from its August recess in September, he said, “if it’s a good piece of legislation.”

Post-election Green Pivot?

Biden’s statement did not detail the specific executive actions he might take to provide momentum for his stalled vision for an aggressive climate agenda. Manchin’s latest defection comes two weeks after the U.S. Supreme Court’s decision in West Virginia v. EPA undercut EPA’s ability to cut emissions at existing power plants through generation shifting — changing out dirtier fossil fuels for cleaner low- or no-carbon generation. (See Supreme Court Rejects EPA Generation Shifting.)

Biden has already used executive orders to set the U.S. on a path to a 100% carbon-free electric system by 2035 and a net-zero economy by 2050. More recently, he invoked the Defense Production Act to ramp up clean energy manufacturing and ordered a two-year suspension of potential tariffs on solar cells and panels from Cambodia, Malaysia, Thailand and Vietnam in the face of a pending Commerce Department investigation. (See Biden Waives Tariffs on Key Solar Imports for 2 Years.)

Meanwhile, the Department of Energy is continuing to distribute new funding, much of it from the Infrastructure Investment and Jobs Act, for clean energy initiatives.

If fully funded, the law will continue to pump out funds for clean energy through 2026. For example, on Thursday, the DOE announced $29 million in funding, about a third from the IIJA, to increase the reuse and recycling of solar technologies and develop solar panel designs that reduce the cost of manufacturing.

In the wake of West Virginia v. EPA, California Gov. Gavin Newsom (D) and Washington Gov. Jay Inslee (D) both vowed to step up their efforts to cut carbon emissions. More recently, the D.C. Council passed legislation, pending before Mayor Muriel Bowser, that would ban natural gas hookups in new construction and require all new construction and major renovations in the district to be net-zero by 2026.

But, in its analysis of the post-Manchin state of play, industry analysts ClearView Energy Partners suggest that if the Republicans do gain majorities in the House and Senate in the midterms, Biden might “pursue muscular intervention into energy markets and capital formation … potentially including ‘a climate emergency’ declaration.”

“If the White House was also modulating its oil and gas policy in recent months to woo [Sen.] Manchin’s support for clean energy incentives, then Manchin’s latest defection could bring an even bigger post-election green pivot,” ClearView said.

In the absence of a “mini-BBB” budget reconciliation deal, ClearView also sees the potential for a congressional pivot toward passing a package of clean energy tax credit extenders in the lame-duck session between the midterm elections and the opening of the next Congress in January. Although the option of tax extenders has not been discussed thus far, “we would not be surprised to see extenders text proposed (or at least mooted) by the House Ways and Means and Senate Finance Committees before lawmakers leave for their August recess,” ClearView said.

Some Republicans might support extender legislation for two reasons, ClearView said. First, even if the GOP takes both houses of Congress, Biden will still have veto power, and second, a growing number of red states are now generating about half of the country’s onshore renewable and other clean forms of energy.

Underway and Unstoppable

Perhaps with such tax extender legislation in mind, clean energy advocates and business groups continued to call for congressional action on federal tax credits and other incentives, echoing administration arguments that they will help fight inflation, spur economic growth and protect energy security.

Clean energy tax credits “would deliver much needed relief, helping to cut energy prices and reduce U.S. dependence on price-volatile fossil fuels, by spurring the domestic manufacturing and deployment of clean, affordable and reliable advanced energy technologies,” said Heather O’Neill, president of Advanced Energy Economy. “Failing to use this opportunity to boost the domestic advanced energy manufacturing industry would mean American workers get less benefit from the world’s transition to clean energy, and would all but assure that our economic competitors, particularly China, reap the economic rewards instead.”

O’Neill and others also pushed hard on the business case for clean energy. The transition is “underway, and it is unstoppable,” O’Neill said. “We see it in corporate procurements driving clean energy investment across the country. We see it in consumer demand for electric vehicles as drivers seek to free themselves and their pocketbooks from the volatility of gasoline prices.”

“The private sector is making record-level investments in the clean energy transition, but a predictable and long-term national tax and policy framework is needed to support accelerated and expanded deployment,” said Lisa Jacobson, president of the Business Council for Sustainable Energy.

Any effort to find common ground on tax credits might begin with carbon-capture technologies and that industry’s 45Q tax credit, both of which have had strong support from Manchin, whose family still operates the coal company he started.

“While there is uncertainty about next steps with the reconciliation process, it remains clear that there is broad, bipartisan support for Congress to provide robust investments in carbon-management policies,” said Madelyn Morrison, external affairs manager for the Carbon Capture Coalition. “To achieve carbon capture and removal at climate scale, Congress must deliver the full portfolio of federal policy support for carbon management in any moving legislative vehicle, including a direct-pay option for the 45Q tax credit.” Manchin has recently opposed any direct-pay options for clean energy tax credits.