MISO’s second competitively-bid transmission project appears dead in the water because new generation in the region has evaporated the line’s benefits, according to the grid operator’s assessment.

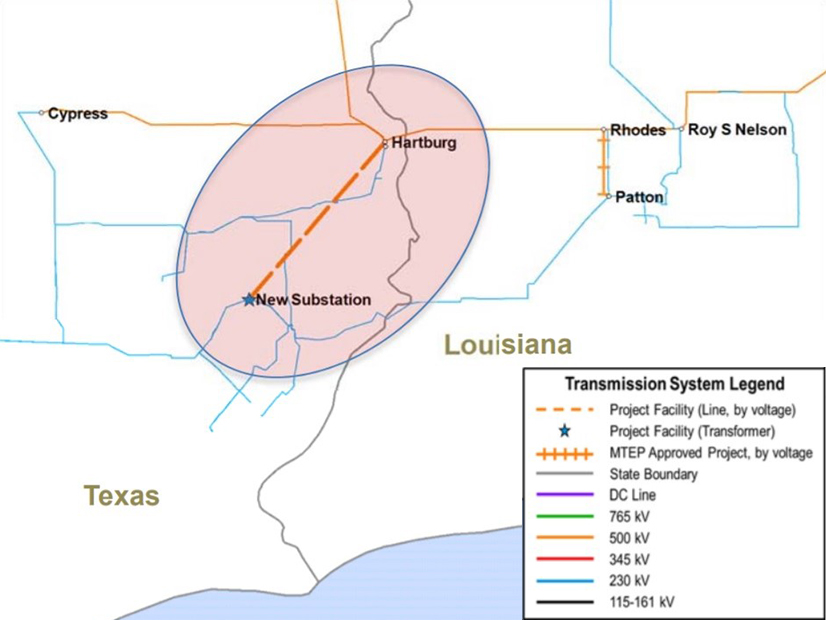

During a special South Technical Studies Task Force meeting Wednesday, MISO planners said about 2.7 GW of planned capacity in southeast Texas negates the Hartburg-Sabine Junction project’s economic benefits. The transmission line was approved in 2017 as a market efficiency project.

“There’s more capacity planned in Entergy Texas that is going to contribute,” said Clayton Mayfield, senior engineer of economic studies.

MISO has not yet officially cancelled the $130 million, 500-kV project in East Texas. Brian Pedersen, senior manager of competitive transmission administration, said planners will share the study results with a MISO staff committee that focuses on competitive transmission. That committee will decide whether to cancel the project or reassign it to a new developer.

Pedersen said MISO will make a formal recommendation in August.

Tea leaves don’t need to be read to deduce which direction the RTO is leaning. The RTO said Hartburg-Sabine “no longer provides any meaningful production cost benefits based on the planning analysis performed and using the latest modeling information.” The grid operator said its analysis couldn’t find “substantive” congestion relief or adjusted production cost benefits.

In 2017, staff said Hartburg-Sabine would alleviate congestion, ease import limitations and allow access to lower cost generation for customers in the chronically congested West of the Atchafalaya Basin and Entergy load pockets in MISO South.

MISO in late April announced it would reassess the Hartburg-Sabine junction project under its variance analysis procedures. Depending on study results, the RTO said it has one of two options: cancel the project or confer the line to Entergy in accordance with Texas’s recent right of first refusal (ROFR) law for incumbent utilities. (See MISO Study to Decide Fate of Texas Competitive Project.)

MISO’s study accounted for last year’s addition of Entergy’s 993-MW Montgomery County Power Station in southeast Texas and assumed the utility builds its planned 1.2-GW natural gas and hydrogen-powered Orange County Advanced Power Station by 2026. The Orange County plant has a signed generator interconnection agreement in MISO.

The grid operator considered that Entergy pushed back retirement of its nearby 500-MW, gas-fired Lewis Creek plant from 2025 to 2034. It also factored in the addition of two small nearby baseline reliability projects, one rated at 138 kV and the other at 230 kV.

Mayfield added that the RTO’s long-range transmission plan will soon study congestion patterns in MISO South and possibly come up with new transmission solutions.

“The Hartburg-Sabine Junction just isn’t economically solving the congestion we’re seeing,” Mayfield told stakeholders.

The line would have been MISO South’s first market efficiency project.

Stakeholders pointed out that the Texas Public Utility Commission has not yet approved the Orange County plant.

“The plant is in a holding pattern,” said Andy Kowalczyk of activist group 350 New Orleans.

“It seems like it’d be an awful shame not to at least do a sensitivity case with regard to the generation addition, whether it changes the outcomes for Hartburg-Sabine,” the Coalition of Midwest Transmission Customers’ attorney Jim Dauphinais said.

He said MISO might find itself “bringing the project back to the table” a year from now if the plant is not approved.

Energy consultant Jennifer Vosburg said the Orange County plant is already a few hundred million above its original budget.

MISO planners said even if plant approvals fall through, it wouldn’t make the line economic or necessary.

But Dauphinais said MISO wasn’t presenting any study results showing that the line remains unnecessary without Orange County.

WEC Energy Group’s Chris Plante said the Hartburg-Sabine was a market efficiency project that overcame several analyses to show benefits.

“I think that just demonstrates that as we go forward, we need to ensure that we have robustness testing, that even with small changes in assumptions … we still have a project that’s beneficial,” he said.

“I do hope that this serves as a lesson for how MISO approaches congestion planning and how durable and defensible these projects are over time,” Kowalczyk said. “I am worried that the market efficiency project tariff doesn’t produce projects, and this one was undermined by the ROFR, by bottom-up [transmission] projects and by signed generator interconnection agreements.”