The text of the Inflation Reduction Act (IRA) of 2022 released by Senate Democrats on Thursday carries the same number (H.R. 5376) as the ill-fated Build Back Better Act passed by the House of Representatives last November, but its $670 billion falls far short of the original $2.2 trillion.

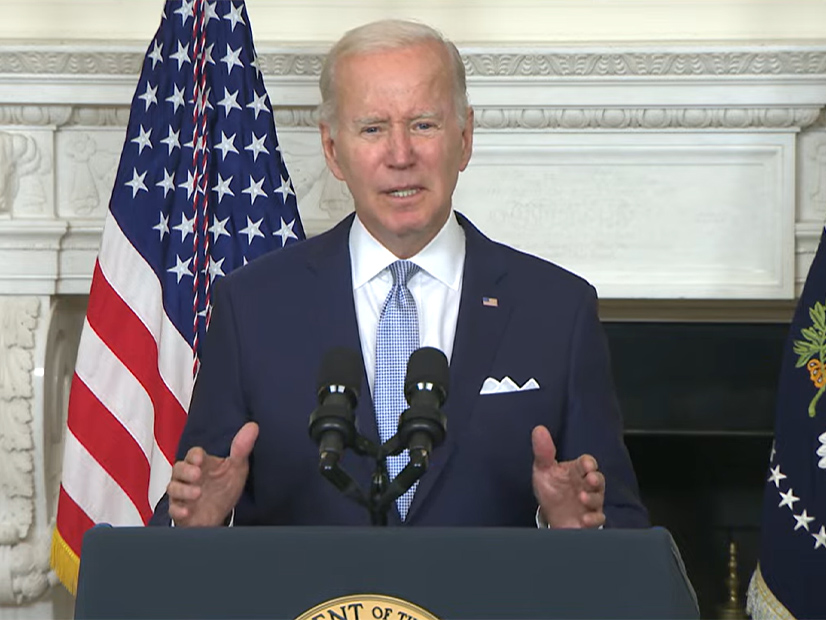

“Look, this bill is far from perfect. It’s a compromise,” President Biden said Thursday. “But it’s often how progress is made: by compromises.” He hailed the bill, rescued by Senate Majority Leader Chuck Schumer (D-N.Y.) through negotiations with Sen. Joe Manchin (D-W.Va.), as the strongest that could be passed right now to lower inflation and advance clean energy.

Energy industry leaders and advocates had already welcomed the IRA’s $369.75 billion for clean energy on Wednesday, after which they started digging into the bill’s 725 pages to parse out how that money is allocated and will be spent. (See Schumer, Manchin Reach Climate Deal.)

Reflecting Manchin’s thinking on the U.S. energy transition, the bill leans toward a broad definition of clean energy technologies, encompassing solar and wind, as well as nuclear, green hydrogen and carbon capture.

For example, in its provisions on rebates for zero-emission vehicles, mentions of “qualified plug-in electric motors” have been changed to “clean vehicles,” allowing fuel-cell vehicles to qualify for the incentives.

Similarly, investment and production tax credits for solar and wind are extended through the end of 2024, after which they become technology-neutral clean energy credits, according to an analysis from the American Council on Renewable Energy (ACORE).

Experts and advocates continued to comb through the bill on Thursday, nailing down details, but here are some key takeaways.

Energy Efficiency

Energy efficiency is a big winner. The top line numbers in the bill summary provided by Senate Democrats include $9 billion in rebates to help low-income consumers perform energy-efficient home retrofits and electrify home appliances.

The summary also mentions tax credits for energy-efficient home improvements, which the bill spells out in more detail. For example, tax credits for installing energy-efficient windows or skylights top out at $600 per year, while credits for heat pumps and biomass stoves and boilers go up to $2,000.

Such “historic investments … will reduce energy waste, cut costs for homes and businesses and slash greenhouse gas emissions,” said Steven Nadel, executive director of the American Council for an Energy Efficient Economy. “It would enable major efficiency and electrification upgrades in millions of homes and buildings to save energy and improve comfort and health, especially for low- and moderate-income households.”

EVs

Manchin has often criticized EV incentives as rewarding the wealthy, who don’t need rebates to afford new EVs. While the IRA does provide rebates for both new and used EVs, it also limits which cars and consumers will be eligible.

Rebates for new EVs, topping out at $7,500, will only be available for passenger vehicles that cost $55,000 or less, while the cap for electric SUVs, pickup trucks and vans will be $80,000. Income caps for prospective buyers range from $300,000 for couples filing joint tax returns to $150,000 for individuals.

The law also contains a $4,000 rebate for “previously owned” EVs, which it defines as vehicles “the model year of which is at least two years earlier than the calendar year in which the taxpayer acquires such vehicle” — so, no rebates for buying a year-old EV. The cap on sales price in this case is $25,000, and the rebate is only available on the first resale of the EV; that is, from its original owner.

The income caps for the used car rebates are $150,000 for couples and $75,000 for individuals.

Supply Chain and Transmission

The law also supports the buildout of a clean energy supply chain with new tax credits for advanced manufacturing of a range of solar, wind, storage and inverter components. The bill summary lists $10 billion for investment tax credits for “clean technology manufacturing facilities, like facilities that make electric vehicles, wind turbines and solar panels.”

Christian Roselund, senior policy analyst at Clean Energy Associates, said the tax credits for manufacturing could have a big impact on the solar supply chain in the U.S. “One of the fundamental challenges to onshoring U.S. solar manufacturing has been cost and specifically [operating expense] costs,” Roselund said. “It’s been the cost of not just building factories … but the cost of running factories.”

The bill provides a detailed list of tax credits for specific technologies. Solar cells, whether thin film or crystalline photovoltaic, will be able to claim credits of 4 cents/W, while panels will be eligible for credits of 7 cents. At present, the capacity for individual rooftop panels is about 350 to 375 W.

Industry advocates who lobbied for a transmission investment tax credit will be disappointed, according to ACORE, but it does provide:

- $2 billion in direct loans for construction and modification of transmission deemed in the national interest;

- $760 million in grants for permitting and siting and for economic development in communities with transmission builds; and

- $100 million for modeling and analysis.