During his first earnings conference call as CEO of Vistra (NYSE:VST), Jim Burke said Friday that he continues to remain confident in the company’s value proposition, even as it turned in a major second-quarter loss.

The Texas-based company reported a loss of nearly $1.4 billion in net income for the second quarter, driven by an increase in forward power prices requiring it to record mark-to-market hedging losses for GAAP purposes. The company had a $35 million profit for the same period a year ago.

Adjusted EBITDA from ongoing operations came in at $761 million during the quarter, down from $854 million a year ago. Vistra uses adjusted EBITDA as a performance measure, saying it believes that outside analysis of its business is improved by visibility into both net income prepared in accordance with GAAP and adjusted EBITDA.

“I continue to remain confident … because we intend to remain focused on the four key strategic priorities we initially defined in” 2021, Burke told financial analysts.

Vistra management said then it intends to “unlock … earnings power” through:

-

-

- its integrated business model of generation and retail that provides stability in volatile commodity markets;

- managing liquidity needs by supporting its hedging strategy;

- focusing on shareholder returns through an “upsized” $3.25 billion share repurchase program; and

- executing on its zero-carbon Vistra Zero initiative.

-

Burke said Vistra had bought back $1.6 billion of its shares, representing about 14.6% of outstanding shares as of last November, and that the board of directors has authorized buying back an additional $1.65 billion in shares before the year ends.

“Our confidence in our outlook is reinforced by the upsizing of the share repurchase program,” said Burke, who was named in March to succeed the retired Curt Morgan as CEO, effective Aug. 1. (See Burke to Succeed Morgan as Vistra’s CEO.)

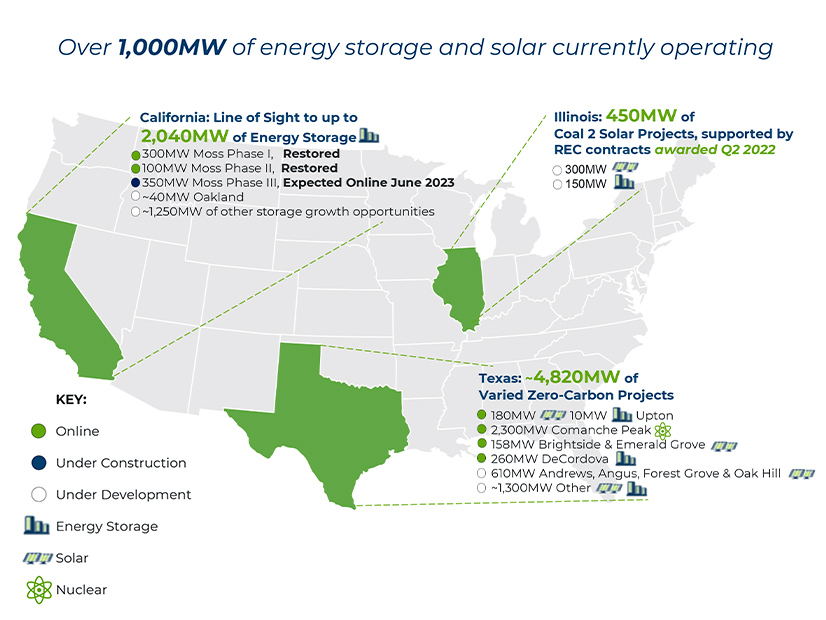

Vistra said it had brought online an additional 418 MW of capacity as part of its Vistra Zero program: the 260-MW DeCordova Energy Storage Facility, the 50-MW Brightside Solar Facility and the 108-MW Emerald Grove Solar Facility. Along with the 2,425-MW Comanche Peak nuclear plant, the projects bring Vistra Zero’s portfolio to nearly 3.3 GW, with plans to grow that to 7.3 GW by 2026.

Burke said Vistra is tracking ahead of its 60% greenhouse gas emissions-reduction target by 2030. “We anticipate Vistra Zero will more than replace the earnings of the retiring coal units,” he said.

The company also restored 98% of its 400-MW Moss Landing Energy Storage Facility in California, which has been shut down several times after battery overheating incidents. Burke said Vistra will eventually restore the world’s largest storage facility to full capacity.

Vistra shares dropped nearly 4% on Friday, closing down $1 at $24.62. Its stock closed at $24.74 on Monday.