NYISO’s new long-term planning forecast is a major improvement but underestimates the role of merchant storage and increases the apparent need for transmission, according to the ISO’s Market Monitoring Unit (MMU).

Potomac Economics’ Joseph Coscia presented the MMU’s review of the System & Resource Outlook to the ISO’s Management Committee on Wednesday, before the committee recommended approval of the report to the Board of Directors. The ISO’s first 20-year economic planning forecast, the outlook predicts a need for more than 95 GW of new zero-emission resources by 2040, 20 GW within the next seven years, to meet New York’s goals under the Climate Leadership and Community Protection Act (CLCPA). (See NYISO 20-Year Forecast Highlights Generation, Tx Hurdles to Climate Goals.)

The MMU said the outlook incorporates “major enhancements” to previous economic planning studies and is “the most sophisticated forecast to date of how state policies will affect the NYISO system.” But the amount of generation that the outlook says is needed could be reduced with wider deployment of storage to reduce renewables’ curtailment, Coscia said in an interview.

While the outlook helps identify where new transmission could reduce congestion and make renewable energy more deliverable, the MMU said its analysis “sheds light on how NYISO’s wholesale markets can facilitate more efficient clean energy investments that reduce the need for regulated transmission investments.”

New Terms

Potomac’s analysis introduced three terms that it said would allow planners to compare the relative costs of renewable and storage resources and interconnection locations.

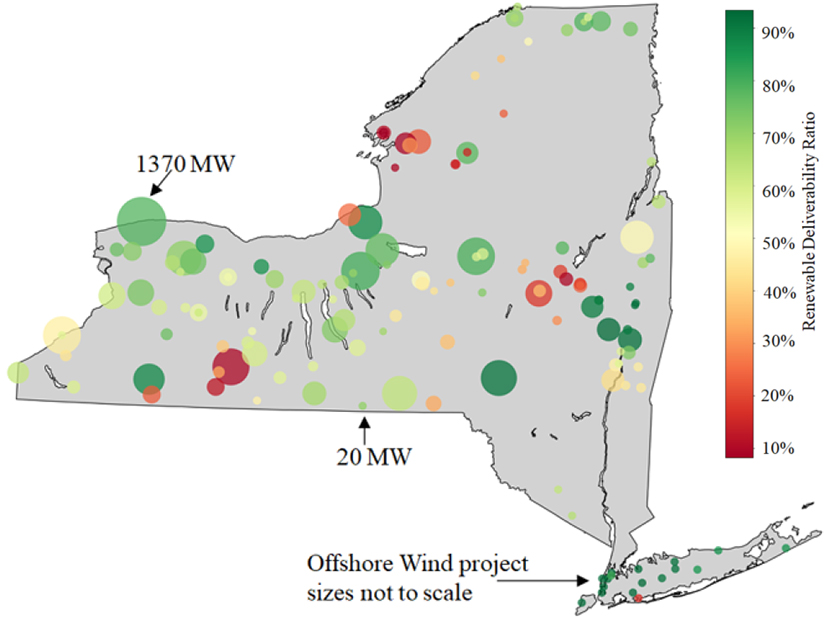

The “renewable deliverability ratio” is the share of an incremental resource’s output that would not cause curtailment of other resources. A wind project that can produce 3,200 MWh annually and loses 300 MWh to curtailments and causes other renewables to be curtailed by 500 MWh would have a ratio of 75% (2,400/3,200 MWh).

Closely related is the “renewable deliverability impact,” the megawatt-hours of renewable energy that an incremental megawatt of generation, storage or transmission capacity makes deliverable to load.

Those metrics affect the “implied net REC cost,” the average renewable energy credit (REC) payment a project would need to be economic, expressed in dollars per megawatt-hour of renewable energy that it can deliver without increasing curtailments of other resources.

Cannibalization

New renewables can be more costly than they appear because a resource receiving higher REC payments may run inefficiently and contribute to more congestion while other less costly resources are curtailed because they are receiving lower REC payments, Potomac said.

Owners of existing units who suffer this “cannibalization” — losing RECs because of increased curtailments caused by the new unit — will attempt to pass the costs to end users through higher REC prices.

As a result, Potomac said, policymakers should seek uniform pricing of clean energy to avoid undermining market efficiency.

“The value of storage and transmission projects may be distorted if the renewable energy curtailments they reduce are not valued consistently,” it said.

Incremental Storage

While new renewables can undermine existing resources by adding to congestion, storage reduces curtailments and lowers the amount of renewable capacity needed to meet New York’s goals, Potomac said. It said the outlook’s Scenario 2 case, which envisions high renewable penetration, underestimates storage with its assumption of 4.7 GW.

“When storage resources charge to relieve curtailment of renewable resources that earn REC payments, the value of the REC is passed through to the storage owner via negative prices,” the MMU said.

The implied net REC costs for land-based wind, offshore wind and solar are likely to increase between 2030 and 2035. But Potomac says net prices for four-hour storage will drop, because of its ability to increase renewables’ deliverability and take advantage of higher price volatility.

Additional storage beyond the 4.7 GW would be economic based on market prices at locations where frequent curtailments and negative pricing provide substantial revenues for batteries that charge to reduce the curtailments, Potomac said.

Implied net REC costs for land-based wind (LBW), offshore wind (OSW) and solar (PV) are likely to increase between 2030 and 2035 while four-hour storage will drop, making it “very cost-effective,” according to NYISO’s Market Monitoring Unit. The MMU defines implied net REC costs as the net cost of incremental renewable energy deliveries from an investment in generation, storage, or transmission. | Potomac Economics

Implied net REC costs for land-based wind (LBW), offshore wind (OSW) and solar (PV) are likely to increase between 2030 and 2035 while four-hour storage will drop, making it “very cost-effective,” according to NYISO’s Market Monitoring Unit. The MMU defines implied net REC costs as the net cost of incremental renewable energy deliveries from an investment in generation, storage, or transmission. | Potomac Economics

The MMU identified 32 such locations in 2030, projecting storage’s median cost there at $24/MWh. With the median cost dropping to a projected $6/MWh by 2035, that would rise to 107 locations — more than half of the total nodes modeled by the ISO.

“This suggests that the amount of storage in the outlook is inefficiently low in 2035,” the MMU said.

Storage is most economic in upstate areas with low renewable deliverability ratios and least economic in New York City (Zone J) where offshore wind is expected to have higher deliverability ratios.

The outlook models assumed the location of new renewables based on projects in the current interconnection queue and did not fully consider whether the resulting mix of locations is economic or whether a different mix would be more attractive to developers, Potomac said.

“This approach is reasonable given the NYISO’s limited information but runs the risk of relying too heavily on the current queue,” it said, noting that the outlook’s capacity expansion model does not capture congestion and prices at the nodal level.

Recommendations for Future Outlook Modeling

Potomac recommended that NYISO perform an optimized production cost model sensitivity case with new renewables relocated to more deliverable sites and add options for two-, six- and eight-hour storage in its capacity expansion model, which is currently limited to four-hour storage.

“Longer-duration storage resources have higher capacity value and might cost-effectively provide peaking capacity in the long term while reducing curtailment of renewables,” the MMU said.

The low renewable deliverability ratios at many locations in 2035 suggest that changing the location of renewable resources would reduce curtailments and increase deliverability, Potomac said.

It cited the study’s projection that wind generation at the 115-kV Bennett line in Zone C will increase from 239 MW in 2030, with a 56% deliverability ratio, to 771 MW by 2035, with deliverability falling to 10%. “Many other locations across the upstate region have much better renewable deliverability ratios, indicating that it might be more efficient for some of the 771 MW of wind capacity modeled at Bennett 115 kV to be built elsewhere,” Potomac said.

It acknowledged that factors such as land availability, permitting considerations and site-specific costs can cause developers to pursue projects at congested locations and that locations with high deliverability may be inaccessible or more costly.

The MMU also said the ISO’s transmission planners should estimate the implied net REC cost of regulated transmission projects and compare them to alternatives including merchant battery storage and renewables.

Planners should “exercise caution when evaluating benefits of transmission projects whose value is strongly linked to uncertain long-term generator siting decisions,” it said. Transmission projects designed to clear constraints are more likely to be economic if selected in areas where renewables have a high probability of entering service or “superior land availability, resource potential or special cost advantages.”

“Ultimately, planners should promote regulated transmission investment only when it is cost effective, since inefficient transmission investment tends to crowd out more cost-effective investments in generation and storage,” Potomac said.

The MMU also raised questions about the outlook’s modeling assumptions, saying it “relied on forecasts derived from currently known assumptions, which are unlikely to accurately predict how economics and policy will shape the long-term NYISO resource mix.”

For example, it noted that the outlook’s Scenario 2 case forecast no additional utility-scale solar until after 2030. But as the ISO was completing the outlook, the New York State Energy Research and Development Authority announced in June it had contracted for 2.4 GW in additional solar. “This suggests either that a large number of projects with state REC awards are not economic and will not enter service, or that the outlook underestimated future solar development compared to wind,” Potomac said.

Potomac’s Coscia praised NYISO’s efforts, telling the Management Committee that the outlook includes “a lot of really key improvements.” But he said planners should press for more improvements. “For studies of this magnitude, it’s always an iterative process from one to the next,” he said.