ARLINGTON, Va. ― Infocast’s two-day Hydrogen Hubs Summit last week was intended to focus on the $8 billion in federal funding for clean hydrogen hubs ― officially dubbed “H2hubs” ― authorized in the Infrastructure Investment and Jobs Act (IIJA) and the multiple value streams they can create.

However, that was largely overshadowed by the production tax credit (PTC) for green hydrogen — up to $3/kg — in the Inflation Reduction Act (IRA), as speaker after speaker hailed the incentive as a “game changer.”

The result of hard lobbying by the industry, the PTC is “the single most important thing that we could have done and will do moving forward,” said Erin Lane, vice president for public affairs at Plug Power, a green hydrogen production and storage company. “It’s not just driving costs down here in the United States, but the rest of the world is watching, and they’re going to follow suit.”

The PTC “makes the U.S. the No. 1 place to build [hydrogen] production projects in the world, both from a country risk and economic perspective,” said Alejandro Perellón, investment director for the Americas at Hy24, an investment firm focused solely on hydrogen. “It’s going to be tough for other geographies to compete with that. … Capital is going to flow to the U.S.”

The conference drew about 240 business leaders, federal, state and local government officials, and researchers and nonprofit representatives, most of them with hydrogen projects at some stage of planning or development.

As defined in the IIJA, an H2hub is “a network of clean hydrogen producers, potential clean hydrogen consumers and connective infrastructure located in close proximity.”

The U.S. Department of Energy provided an overview of the program in a Notice of Intent released in June, and according to its website, the official funding announcement is scheduled for the coming weeks. (See DOE Hydrogen HUB Funding Program Announced.)

The demonstration hubs that may soon be receiving IIJA funds are not at commercial scale, noted Todd Shrader, deputy director for project management at DOE’s Office of Clean Energy Demonstrations, which will oversee the program.

Now less than a year old, the office is “trying to identify the risks and mitigate them where we can and then leverage, of course, private partnerships across all these efforts to move this into commercialization,” Shrader said. “The Notice of Intent indicated six to 10 hubs, but we see our mission as, yeah, we’ll help build the first six to 10, but how does our mission translate into plant 10 to 100? What can we do to de-risk that and move forward with the mission or move forward with transformation of the economy itself?”

Building Supply, Creating Demand

A July analysis from the Center for Strategic and International Studies (CSIS) found 22 hub proposals in the works, most of them coming from public-private partnerships.

Laura Luce, CEO of Hy Stor Energy, said her company has 80,000 acres for a Gulf Coast hub that could eventually produce green hydrogen from electrolyzers powered with solar or other renewables. The hydrogen will then be stored in multiple underground salt caverns ― Mississippi has more than 50 of them ― and sent out to a range of potential end users located in the area.

The goal is “to bring manufacturing and some of those products and services that need expansion ― [such as] steel, ammonia and fertilizer ― into our location, so that we can have this kind of circular economy and be very dependent on each other,” Luce told the audience at.

Laura Luce, Hy Stor Energy | © RTO Insider LLC

Laura Luce, Hy Stor Energy | © RTO Insider LLCHy Stor’s first small project, including a 1-MW electrolyzer, will be completely off-grid so the company can ensure customers are getting 100% carbon-free hydrogen, Luce said. Hy Stor has already permitted four salt caverns, the first of which will be able to store 70,000 metric tons of hydrogen, she said.

“By having multiple caverns and by having adequate compression, we can start cycling them,” Luce said. “We’ve designed our caverns so they can recycle 12 times a year as demand increases, so you really get a tremendous amount of leverage on that initial investment.”

The company hopes to have the first electrolyzer up and running by 2023 or 2024, she said.

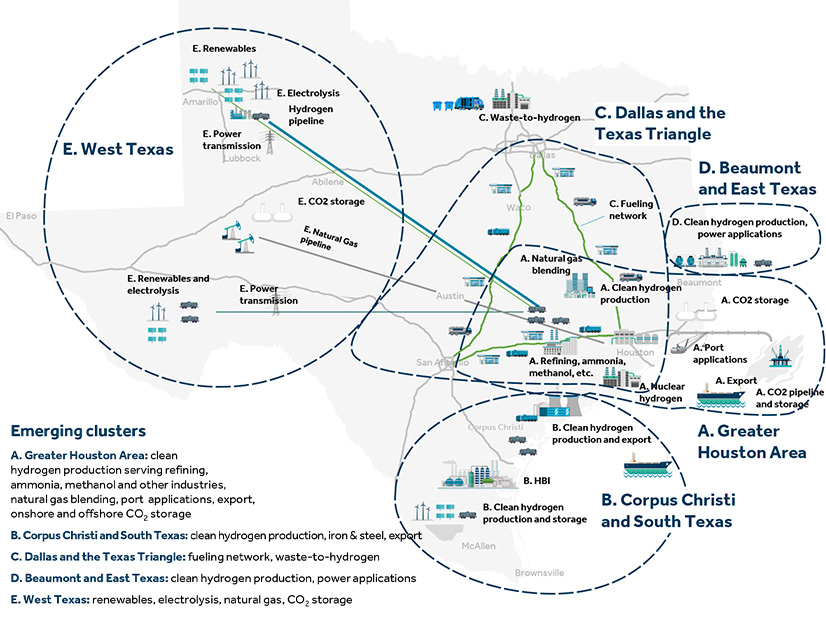

Another example, although not on the CSIS list, is the Center for Houston’s Future’s vision for a network of clean hydrogen hubs across Texas, which already has well developed infrastructure, both pipelines and storage, for hydrogen produced from natural gas. Speaking at the summit, Brett Perlman, the center’s president and CEO, detailed the state’s other selling points, including “lots of expertise in hydrogen and using hydrogen, a concentration of academic and industry-driven innovation … [and] a welcoming environment for infrastructure development.”

Texas also has a wealth of renewable wind and solar projects in the western part of the state. “We want to build this as a broad-based ecosystem,” Perlman said.

According to a report from the center, a Houston hub would produce hydrogen for applications in the fossil fuel industry — refining, natural gas blending and port operations ― while a Corpus Christi hub would focus on hydrogen for use in iron and steel manufacturing. A Dallas hub would specialize in waste-to-hydrogen production, while Beaumont would be a center for hydrogen used for power generation.

The goal is for Texas to produce about 21 MMT of clean hydrogen per year, half for domestic consumption and half for export, Perlman said. Beyond applying for IIJA funding, the next step is focusing on “demand aggregation and demand creation,” he said.

“The idea [is to] engage with demand creation, getting early adopters who are interested in driving demand either domestically or internationally to come to the table,” Perlman said. “We believe that will have a knock-on effect in the next set of supply projects.”

A Clean Hydrogen Standard

By contrast, Dominion Energy, Virginia’s largest investor-owned utility, sees hydrogen as playing a more modest role in its plans to decarbonize its power generation in the state by 2045, as required by state law. While the utility is working on the permitting and construction of a 2.6-GW offshore wind project, it has not signed on to any proposal for an IIJA-funded H2hub.

Dominion is investing in renewable natural gas and looking at blending hydrogen with natural gas as a means to reduce emissions, said Rizwan James, manager for combustion fleet turbine engineering. So far, it has completed one pilot project in Utah, which tested blending 5% hydrogen with natural gas, and is waiting for approval of a second, similar pilot in North Carolina, James said.

Around 240 industry, nonprofit and government officials attended the Hydrogen Hubs Summit. | © RTO Insider LLC

Around 240 industry, nonprofit and government officials attended the Hydrogen Hubs Summit. | © RTO Insider LLC

Opposition to hydrogen from some clean energy and environmental groups is rooted in such applications, which are seen as a “greenwashing” strategy to prolong the use of fossil fuels. They are skeptical of the IIJA’s requirement that its funding must go to clean hydrogen hubs that are technologically diverse in both their feedstocks and end uses. While at least one hub will produce hydrogen from renewable energy, one will use fossil fuels and one nuclear, according to DOE’s notice.

Similarly, one hub must demonstrate the use of clean hydrogen for power generation, one for industrial applications, one for residential and commercial heating, and one for transportation. The initial round of funding will include grants of up to $10 million for producing a detailed hub plan over the next 12 to 18 months and will require the federal dollars to be matched 50/50 with private or other public funding.

The law also requires DOE to establish a clean hydrogen standard, Shrader said, which is already looming as a major challenge for applicants and their hubs ― and a point of intense industry debate — as the IIJA and IRA set different benchmarks.

The IIJA defines clean hydrogen as producing no more than 2 kg of carbon dioxide per kilogram of hydrogen at the point of production, with a possible re-evaluation of that standard after five years. But to qualify for the IRA’s $3/kg tax credit, the maximum is 0.45 kg of CO2 per kilogram of hydrogen.

Lesser credits are available for higher concentrations, beginning at $1/kg for a CO2 intensity of up to 1.5 kg and bottoming out at 60 cents for 2.5 to 4 kg.

While all H2hubs will have to meet the IIJA’s 2-kg carbon-intensity standard, the NOI states, “DOE intends to also evaluate full lifecycle emissions for each application and will give preference to applications that reduce GHG emissions across the full project lifecycle, inclusive of hydrogen production, compared to current industry standards.”

While potential applicants are already asking if and how the standards might be reconciled, Janet Anderson, senior technology and policy adviser for the Clean Hydrogen Future Coalition, said that finding common ground may not be possible.

“They’re not related,” Anderson said during a panel on the second day of the summit. “I don’t really know how they can be reconciled.”

Compared to DOE’s “full lifecycle analysis,” the IRA “states that the lifecycle analysis will end at the point of production or, if you will, go well-to-gate,” she said. “Significant indirect emissions” must also be included, she said, but “everybody working on hubs would like to see a lot more certainty about what’s going to happen with this,” as the Treasury Department and Internal Revenue Service hash out rules and guidance.

Nima Simon, grid fuel and power supervisor at industry analyst ICF, said her clients are raising questions about whether indirect emissions will include Scope 3 emissions: those generated in a company’s supply chain that it cannot control, such as from waste generated by suppliers or their employees’ business travel.

Both Anderson and Simon also stressed that hydrogen technology, carbon intensity definitions and carbon accounting methods will change over time. “This isn’t going to happen in 60 days. It’s going to take some time,” Anderson said.

“There might be a public comments period,” Simon said. “It’s still very early stages; there is maybe some room for conversation.”