RENSSELAER, N.Y. — Gas supplies to Eastern New York (ENY) could be limited during freezing weather in winter because of demand exceeding interstate pipeline capacity, resulting in a reliance on imported LNG from New England, NYISO’s Market Monitoring Unit told stakeholders last week.

Speaking to the Installed Capacity/Market Issues Working Group on Oct. 20, Potomac Economics’ Joseph Coscia said the findings suggest NYISO should adjust its resource adequacy models and capacity accreditations to reflect the gas limitations likely to occur in winter. Such constraints would force the ISO to rely on imported LNG from New England, he said, a region that itself relies on imported LNG during winter for reliability.

Coscia also said the ISO should discount emergency assistance from non-firm gas from out-of-state generators during the winter and consider the availability of oil-fired units with limited capacity to ensure grid reliability in the case of very cold days when heat demand peaks.

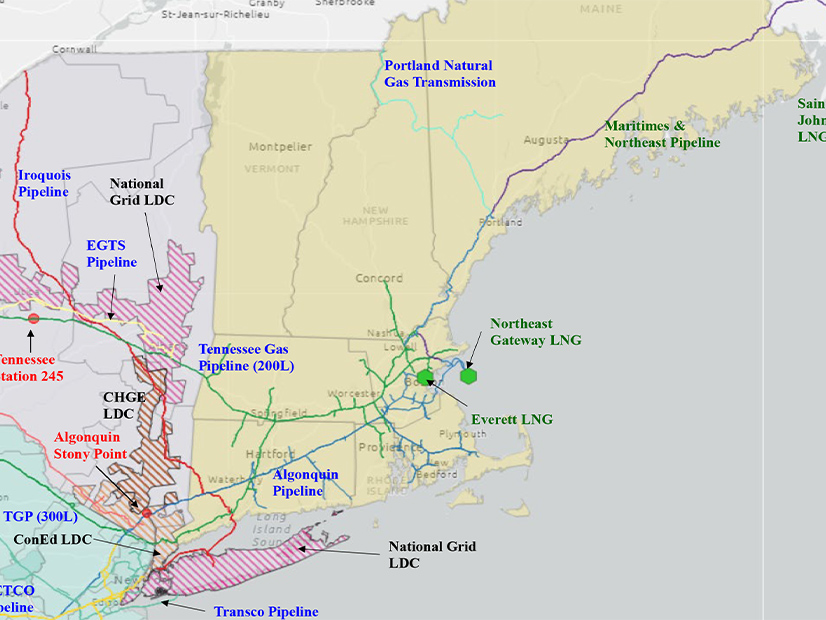

The analysis focused on the availability of gas to the greater region of ENY and New England because it is served by eight critical interstate pipelines, such as the Iroquois, Algonquin and TETCO pipelines; has greater constraints limiting total flows than the rest of New York; and local distribution companies have systems in the area that serve many of the consumers in the entire state.

LDC winter peak demand exceeds pipeline capability (2022) | Potomac Economics

LDC winter peak demand exceeds pipeline capability (2022) | Potomac Economics

LDCs secure supply to meet their “design days”: the estimated maximum retail gas demand based on the historically lowest temperatures. Peak winter demand for design days hovers above 10 million dekatherms/day. Potomac found that the estimated total import capability of the interstate pipelines, excluding LNG, was roughly 8 million dekatherms/day, which is both “far below the total design day demand of the local gas utilities” and “is even below the estimated peak demand of the coldest winter seen in the past five years.”

LNG and compressed natural gas is available, but these should be thought of as limited fuels because they are restricted to “either cargoes contracted in advance” or serve as “limited storage” for short periods of time.

The analysis found that “an increasing sense of tightness of the gas system in the region” had meant that LDCs in ENY have held “large amounts of firm pipeline capacity” and are increasingly “relying on holding rights to the firm transport capability in order to satisfy design day requirements.”

ENY and New England are heavily reliant on LNG storage and imports to meet peak regional supply demands. Potomac emphasized that LNG importers generally do not “provide speculative supply or short-notice cargoes to the region,” threatening ENY’s reliability during extreme winter storms.

Potomac recommended that the NYISO resource adequacy model “discount external assistance from New England” to avoid “counting on imports from a region affected by the same set of gas constraints affecting winter reliability.”

Mark Younger, president of Hudson Energy Economics, asked Coscia if Potomac had seen “other areas of New York indicating significant concern” around gas supplies.

Coscia replied that gas bottlenecks are “primarily at the borders of the ENY and NE region.” Though it is possible that “pockets of specific generators elsewhere in the state have difficulty accessing gas,” they are “less acute outside of the ENY region.”

One stakeholder questioned the relevance of the analysis, noting that “New York has a state policy pushing for the elimination of every molecule of gas” and that this problem might “vanish” as the state “continues to electrify the heating, building and generation sectors.”

Coscia responded that “even with aggressive implementation” of state climate or energy policies, downstate New York utilities are anticipating “core gas demands to grow” over the next couple of years, so even if residential heating demands decline quicker than expected, the MMU is “focusing on the system as it is today.”