The nuclear industry descended on D.C. last week to make the case for advanced reactors, both large and small, with some so small that they could be built at existing industrial sites to supply behind-the-meter dedicated power and heat.

On Monday, The Atlantic Council, working with the United States Nuclear Industry Council (USNIC), webcast an eight-hour live program featuring more than 30 speakers in a half-dozen discussion panels.f

And on Wednesday, the International Atomic Energy Agency began a three-day conference in D.C. focusing on the rebirth of nuclear energy in the U.S. and around the globe, in part as a reaction to Russia’s decision to cut natural gas exports to Europe and to address the plight of nearly 1 billion people globally who have no electricity, participants said. U.S Department of Energy leaders played prominent roles.

Once in a Lifetime Financial Boost from Federal Legislation

Beyond the situation created by Russia, which some participants at the events repeatedly called a “global energy crisis,” the passage of the Inflation Reduction Act (IRA) earlier this year as well as the Infrastructure Investment and Jobs Act (IIJA) in 2021 have galvanized U.S. nuclear proponents to look for ways to make nuclear power more competitive. It has also catapulted the reputation of the U.S. as a global leader in nuclear technologies.

The IRA will provide production tax credits to reactor owners, even to owners of existing reactors. The PTCs will be similar to what wind and solar have received for years. The zero-emission nuclear production tax credit provides up to $15/MWh — assuming labor and wage standards are met — from 2024 through 2032.

DOE in September stirred more interest in building advanced nuclear with the release of a study concluding that 157 sites of former coal-fired power plants would be suitable sites for nuclear plants. And because nuclear reactors are designed to run without interruption, giving them a high capacity factor, the nukes would not have to be as large as the original coal plants. The study also found that 237 operating coal plants could be considered for a nuclear replacement.

Existing nuclear plants are also getting new attention. The IIJA contained a provision that would create a $6 billion Civil Nuclear Credit Program, providing cash supplements to reactor owners who would otherwise be forced to shut down.

Awards have yet to be made but the first applications — totaling about $81 billion — are now under review.

8 Hours with the USNIC

The Atlantic Council’s multiple panel discussions began with a review of the renewed global interest in nuclear power, including interest from nations preferring to work with U.S companies and the U.S. government rather than state-owned enterprises connected to Russia or China.

The predominant focus was the rebirth of nuclear power as the best technology to address climate change while simultaneously providing national energy security.

“We have a renaissance in investment in the nuclear industry today, with record amounts of private capital being invested … about $4 billion last year,” said André Pienaar, CEO of C5 Capital, a venture capital firm with offices in London, Washington and Luxembourg.

C5 focuses on cybersecurity, space and nuclear energy. Investors are looking across “the whole spectrum of innovation, from small modular nuclear companies, all the way through to the promise of nuclear fusion,” Pienaar said.

The mention of fusion was a reference to U.S.-based developers of fusion reactors, which create energy by fusing helium atoms rather than splitting enriched uranium.

More immediately, Pienaar was referring to fission reactors of 300 MW and smaller, down to those as small as 50 MW, some using technology like the large traditional light water reactors now in commercial service, others designed around more exotic technologies with passive safety systems to make them “walk away safe.”

Small modular reactors (SMR) are factory-built, enabling the manufacturer to increase quality control while providing faster installation than traditional large reactors at a lower cost.

“The investments in SMRs are not limited to private capital,” Pienaar said, referring to NuScale Power (NYSE:SMR), an early developer of small modular reactor design. NuScale has been publicly traded since its merger last spring with Spring Valley Acquisition, a special purpose acquisition company created by banks, institutional funds and private investment groups.

“We’ve also seen significant cross-border investment. Constellation Energy invested in the Rolls Royce SMR consortium in the UK,” Pienaar said, adding that Cameco and Brookfield Renewable Partners this month purchased Westinghouse Electric in a deal valued at $7.87 billion.

Cameco (NYSE: CCJ) is a Canadian uranium mining company. Brookfield (NYSE: BEP) is a publicly traded limited partnership headquartered in Canada that owns hydroelectric, wind, solar and power storage facilities in North America as well as South America, Europe and Asia.

Westinghouse manufactures equipment for nuclear reactors operating around the globe and provides services to U.S. reactors as well.

Competition Among SMR Makers

At this point, NuScale appears to be ahead of competitors striving to market a working SMR. The Nuclear Regulatory Commission approved NuScale’s design in August, opening the door for the company to begin selling them rather than building demonstration projects.

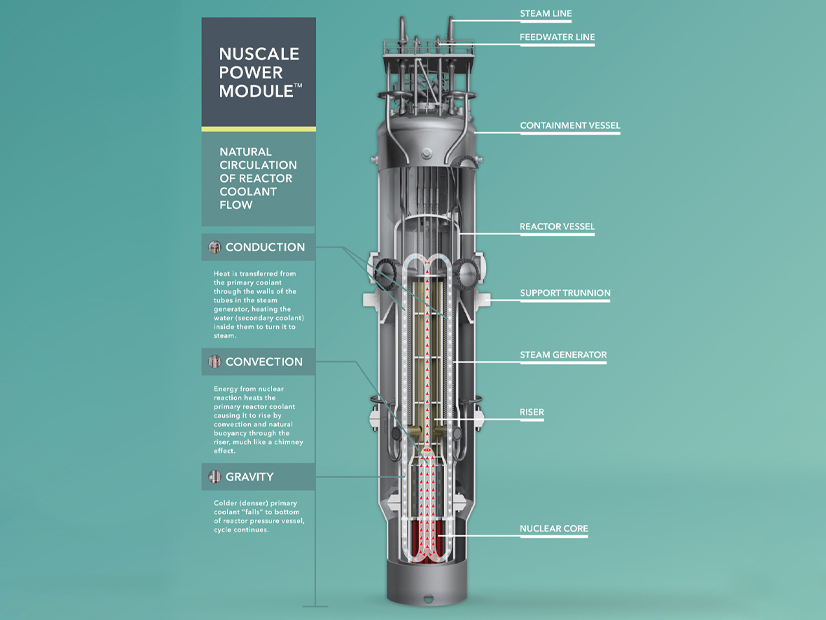

Founded in 2007, NuScale designed a self-contained 77 MW pressurized water reactor. Up to 12 of these factory-built “modules” can then be configured in a “multi-module” container and operated from a single control room.

X-energy, a Maryland company that has designed a gas-cooled high temperature SMR, is aiming at providing reactors that the company says cannot meltdown to private industry in need of reliable power and on-site heat. The company’s basic reactor, the Xe-100, is rated at only 80 MW but can be “scaled” into a four-pack, 320-MW power plant. X-energy won a $1.1 billion matching grant through the IIJA.

Marcy Sanderson, a nuclear engineer and vice president at X-energy, said the reactor operates at a little over 1,000 degrees F. Today’s conventional reactors operate at roughly 550 degrees (boiling water reactors) to 600 degrees F (pressurized water reactors).

Rather than fuel rods as in conventional reactors, the Xe-100 uses “pebbles,” small balls of extra-enriched uranium., an arrangement that allows the reactor to “ramp” up and down, something conventional reactors are not good at doing.

“The inherent characteristic of our design is exceptionally well-suited to what we consider an … opportunity right now, trying to take meaningful, tangible steps to decarbonize heavy industry, support the carbon challenge, support the climate crisis that we all know is in front of us,” Sanderson said.

Because the fuel “has been hailed as the safest fuel on earth, we can talk about doing something like siting a nuclear power station next to a chemical facility,” she said.

The facility in question is owned by Dow Chemical.

Dow and X-energy have announced a preliminary agreement to install an Xe-100 at one of Dow’s Gulf Coast facilities to provide heat and power, said Kreshka Young, a Dow business director, in another panel.

“We’re looking for high-temperature, high-pressure steam to support our heat needs at our sites. And by high temperature I mean in pretty much all cases [temperatures] greater than 500 Celsius [932 F], and then it goes up from there.”

Young said Dow is also looking for reliability.

“For steam, we’re really relying on our on-site generation, whether that’s from a gas turbine, from a boiler, or in this case from a reactor. Whatever the source of that steam, it must be reliable,” she said.

“And when I mean reliability, I don’t mean the 95% reliability. When we say reliability for steam, we need 99.995% reliability,” she said. “We need a backup, and then maybe even a backup to a backup. The modularity of X-energy’s design … combined with the steam temperatures that it can reach made it one of the technologies we thought would be a really good fit for us.”

Dow additionally has emissions reductions goals, she said.

“We’ve already reduced our carbon emissions since 2005 by 15%. We have a goal to reduce them another 15% by the end of this decade, and to be net zero by 2050.”

Globally, the company currently produces about 7 GW equivalent of power and steam for use at its manufacturing sites, with any excess sold to the market. “That’s produced with over 50 gas turbines and gas-fired boilers. That energy production is about 50% to 55% of Dow’s total carbon emissions,” Young said.

Another SMR competitor is TerraPower, an engineering company founded in 2008 by Bill Gates specifically to design advanced nuclear reactors. Company CEO Marcia Burkey also argued in another panel discussion that investors have decided nuclear energy has a role to play.

“There is a growing recognition that nuclear power must be part of the mix. It’s a small footprint. It’s a very dense energy form. It certainly addresses energy independence, and that’s a growing concern and preoccupation, not just of providers [of generated power] but of investors.”

TerraPower is planning to build a 345-MW advanced reactor in partnership with GE Hitachi on the site of a Wyoming coal-fired power plant scheduled to shut down. The reactor will be cooled by liquid sodium rather than pressurized water as in traditional large commercial reactors, enabling it to run at lower pressures.

The reactor power plant will include a molten salt storage system, allowing operators to store the heat from the reactor core rather than use it immediately to make electricity as conventional reactors now do.

Burkey said her company has raised funds globally in anticipation of building small advanced reactors around the world. She said the company had recently spent time with potential investors in a drive to raise $750 million in new private capital.

“I would say that strategics [strategic industries] were very interested because they could see the potential to bring into their operations a carbon-free source that helps them meet their own goals, and [to] participate in the supply chain and help us to accomplish our goals. I would say private equity was very interested,” she added.

Another speaker also mentioned that the interest in small U.S.-designed reactors is international.

Rick Springman, senior vice president at SMR, a maker of SMRs and now a division of the privately held Holtec International Company, said overseas clients are interested in the company’s technology and are calling to ask whether Holtec can manufacture an SMR with a design that meets specific regulations in their countries. He said operating regulations should be at least “harmonized” as the demand for SMRs continues to grow.

“I think harmonization is a key and needs to be connected to financing. Because if you take a U.S. technology with the U.S. regulation and you go abroad and you change it, you’re going to end up with a different plant, period. If you apply different codes and standards you’re going to end up with a different plant.”

In another panel discussion, Rafal Kasprow, CEO of Orlen-Synthos Green Energy, a joint venture in Poland of Synthos Green Energy and PKN Orlen, the largest multi-energy company in central Europe, said his company is a good example of private capital and the international nuclear renaissance.

Earlier this month his company signed a master services agreement with Laurentis Energy Partners, a Canadian company with European operations, to build and deploy a fleet of SMRs designed by GE Hitachi. The small reactors are rated at 300 MW and designed with passive safety systems, making them less likely to suffer catastrophic failures. Kasprow said U.S.-designed nuclear technology is in high demand.

“I think that there’s a recognition now of the geopolitical risks associated with doing business with Russia or China,” Kasprow said, adding that demonstrating the economics of nuclear energy is no longer a problem.

“People are calling every day, from meat-packing companies, from chemical businesses and other businesses, asking ‘Do you have SMRs? Can you deliver? We will pay cash,’” he said.

Bridge to Bankability

Whatever the advantages that nuclear offers, the new SMR technology is competing with numerous other technologies, all hungry for investor — and tax — dollars in what has become a rush away from conventional fuels.

In a one-on-one interview with the Atlantic Council’s Landon Derentz, Jigar Shah, head of DOE’s Loan Program Office, provided a frank evaluation of the hectic activity his office now faces from U.S. companies and entrepreneurial groups competing for the billions of dollars in tax credits, production credits, loan guarantees and matching grants across a broad spectrum of energy technologies, including nuclear.

The function of the loan office, making loans to companies involved in promising technologies but risky market penetration is often described as building a “bridge to bankability” in the sense that if these companies can achieve full market acceptance they will qualify for conventional financial banking.

“We’re building a lot of bridges these days here in the United States. I think when you look at sectors that are actually at scale today, solar wind, EVs, lithium-ion battery storage, you’re looking at a minimum of $100 billion in private sector capital before they [can achieve] real market acceptance from the commercial banking sector,” Shah said.

“There are lots of technologies that are in different phases of getting support — hydrogen, carbon sequestration and storage, nuclear and others — that are coming to the Loan Programs Office,” Shah said. “There’s some rhyme or reason but not a lot. It’s not based on the readiness of technology.

“It’s based on who’s promoting the technology, who that CEO is and their ability to raise capital right in the marketplace, some of which comes from their previous roles and experience and some of which comes from who their sponsors are and where that support is coming from.”

“But how does that translate into brass tacks when industry wants to approach you?” Derentz asked. “What do you need from them to articulate that because each company is bringing its particular interest. Do you need a comprehensive view? Do you need a consortium view or viewpoint? What is the most helpful for approaching the loan office?”

Shah responded: “A supply chain investment doesn’t work unless they’re supplying something to somebody. Right? If they have one order for something, and then they come into the Loan Programs Office for a loan, I’m saying, ‘Who would you supply next? Who would be two, three and four?’

“I think nuclear is one of the hardest conversations because of this private sector-led, government-enabled approach that we have here in the U.S. The U.S. has a challenge around figuring out who goes first. And I do think that the Department of Energy can play, and is playing today, a critical role in facilitating those conversations.”