NYISO stakeholders urged transmission upgrades upstate, downstate and along the Pennsylvania border during the ISO’s 60-day comment period for its 2022-2023 Public Policy Transmission Planning Process.

NYISO submitted 17 sets of recommendations to the state Public Service Commission on Nov. 7 (22-02192/22-E-0633). The filing triggers a review by the PSC, which will identify the public policy transmission needs (PPTN) it wants the ISO to pursue.

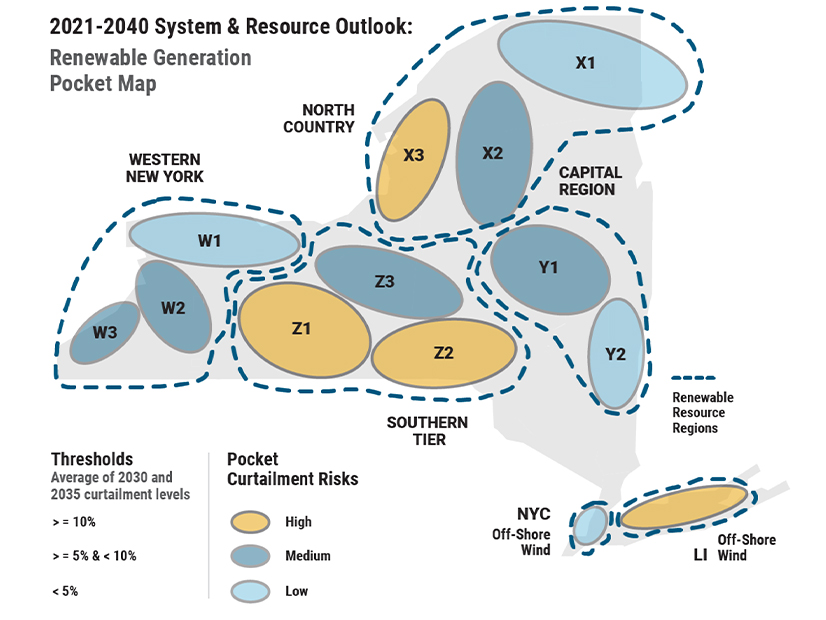

The Alliance for Clean Energy New York and the New York Offshore Wind Alliance identified three geographic areas flagged by the ISO in its 2021-2040 System & Resource Outlook as potential constraints: downstate because of the amount of planned offshore wind generation; the Pennsylvania border region; and the state’s North Country, where the existing network is expected to limit the availability of renewable energy resources. (See NYISO 20-Year Forecast Highlights Generation, Tx Hurdles to Climate Goals.)

Offshore Wind

The ISO is currently reviewing proposals it received in response to the PSC’s March 2019 declaration of a need for transmission to ensure the output of offshore wind facilities interconnected with Long Island are deliverable to the rest of the state (Case 20-E-0497).

The PSC’s order directed the ISO to add at least one bulk transmission intertie cable to increase the export capability of the Long Island Power Authority (LIPA)-Con Edison interface that connects Zone K (Long Island) to Zones I (Westchester) and J (New York City) to ensure at least 3,000 MW of offshore wind is deliverable from Long Island to the rest of the state. The PSC also ordered upgrades to associated local transmission facilities to accommodate offshore export capability.

Several stakeholders, including PSEG Long Island (NYSE:PEG), said the current Long Island PPTN may not be sufficient for future offshore wind projects.

National Grid Ventures (NYSE:NGG) said the state should provide for transmission of at least 20 GW of offshore wind by 2050, as contemplated in the Climate Action Council’s Draft Scoping Plan. At present, state law mandates only 9 GW of offshore wind by 2035.

Con Edison Transmission (NYSE:ED) made a case for a single coordinated transmission infrastructure for the multiple projects to be built off the New York coast, citing the risk, limitations and expense of siting multiple radial lines. Con Edison has proposed such a solution, the Brooklyn Clean Energy Hub, and repeatedly pointed that out in its comment letter to NYISO. Other developers have identified possibilities similar to the Brooklyn hub concept. (See Stakeholders Question Feasibility, Costs of Con Ed OSW Substation.)

Ørsted (OTC: DNNGY), which has been awarded 1,060 MW of wind projects off the New York coast, urged that proposals for transmission of offshore wind be evaluated for flexibility for future expansion and resilience to extreme weather.

Other Needs

Avangrid Networks (NYSE:AGR) said its analysis showed the planned upgrades of the bulk transmission system may not be sufficient in two ways: pathways for carrying power from upstate to downstate and transfer capacity between load zones in upstate.

The Climate & Environmental Justice Office of New York City flagged the need for additional transmission capacity into the city and the need to plan it soon, given that such projects can take a decade or more to build.

HQ Energy Services U.S. urged that a public policy need be identified for dispatchable, emission-free resources. The company is a subsidiary of Hydro-Quebec, which could sell hydropower in New York state via new transmission projects, or — if New York state should ever develop a surplus of clean energy — reverse the current and store that excess power in its network of reservoirs.

Invenergy recommended significant transmission investment in the Southern Tier — the Pennsylvania border region — where there is significant potential for wind and solar power development but where NYISO identified significant transmission constraints.

New York Transco, which is owned by subsidiaries of National Grid, Con Edison, Avangrid and CH Energy Group, urged improvements to eliminate constraints in the three regions flagged by NYISO. It also suggested improvements in western New York at the Dysinger East and West Central interfaces.

The New York Power Authority flagged a need to modernize the existing transmission system in the Albany region, to increase flexibility and transmission capability between upstate and downstate.

Rise Light & Power said the Champlain Hudson Power Express and Clean Path NY transmission projects may not meet the needs for additional power in New York City, and a solicitation should be issued for an additional line from upstate New York to New York City.

Transource Energy and Transource New York urged the PSC to direct NYISO to include advanced transmission technologies in its viability and sufficiency assessment of proposed solutions. It made a pitch for Breakthrough Overhead Line Design, which was developed by Transource parent American Electric Power (Nasdaq: AEP). Transource said BOLD offers “reduced inductance and impedance [and] increased transfer capability.”

2019 Order

In its 2019 order directing the ISO to pursue upgrades for Long Island’s offshore wind, the PSC declined to endorse any other PPTNs, saying further consideration of the Power Grid Study by PSC staff and the New York State Energy Research and Development Authority was needed first.

The staff’s “Initial Report on the New York Power Grid Study” in January 2021 found that a new 345-kV tie-line across the Long Island to New York City interface could provide benefits, including reduced OSW curtailments.