NERC staff called the organization’s 2022-2023 Winter Reliability Assessment, issued on Thursday, a “serious warning” that highlighted the possibility of “bigger problems” compared to last winter in several regions, with extreme weather once again posing a major risk to grid reliability.

“When we look at events over the last several years, it’s really clear that the bulk power system is impacted by extreme weather more than it’s ever been,” said John Moura, NERC’s director of reliability assessment and system analysis, in a media call on Thursday. “And so, as we transition our system rapidly, it’s vitally important that we’re planning and operating a bulk power system that is resilient to … the extreme weather we’re seeing, which includes both generation and transmission solutions.”

The regions where NERC identified potential for insufficient electricity supplies during peak winter conditions are MISO; ERCOT; Alberta; the Maritimes region, which contain parts of Canada and the U.S.; and SERC-East, which includes North and South Carolina. In addition, the assessment marked New England as at risk of constraints to the natural gas transportation infrastructure during cold weather, which could lead to outages of gas-fueled generation sources.

Demand Rising as Capacity Falls

NERC’s winter assessments are released each year and cover the months of December through February, based on demand and generation availability forecasts provided by regional entities, utilities and other stakeholders. In Thursday’s call Mark Olson, NERC’s manager for reliability assessments, emphasized that “almost all areas are well prepared for … average winter years” and observed that some regions do, in fact, appear to be in a better position than they were last year.

For example, the WECC-Western Power Pool assessment area had a lower risk of supply shortfall based on its improved hydropower outlook from last year, while SPP was assessed at lower risk because of added natural gas and wind generation since last winter.

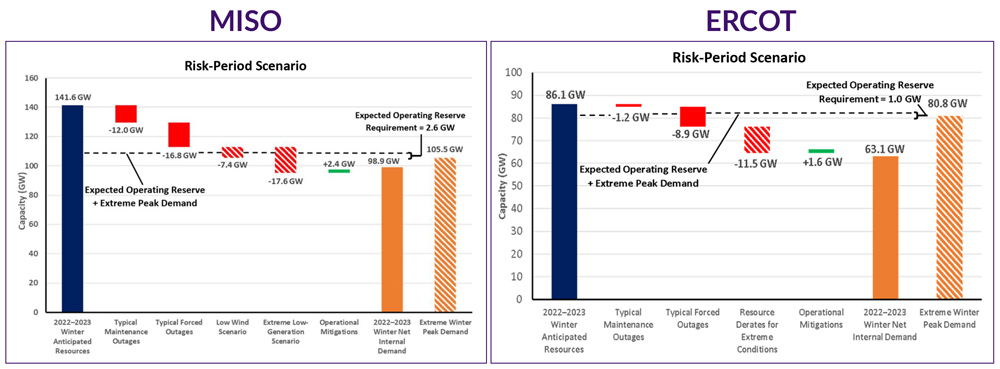

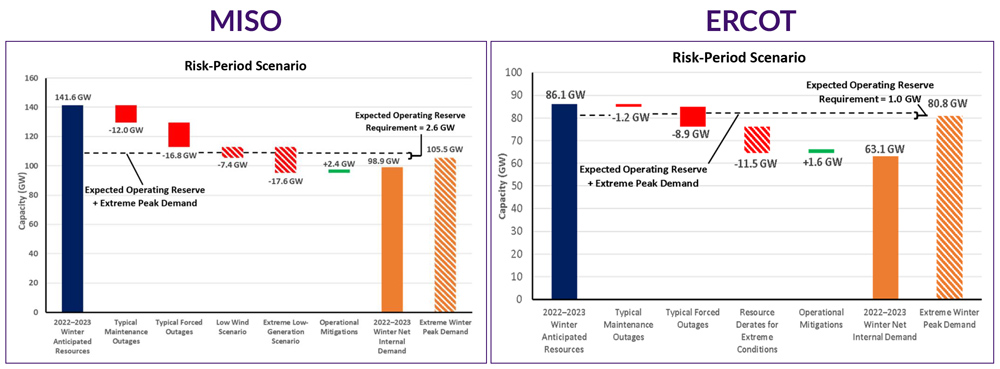

However, for a significant fraction of the North American electric grid, questions exist about the ability to maintain needed levels of service in the face of extreme conditions that might affect the functioning of generators while driving up demand for electricity for heating. ERCOT faces the biggest potential shortfall, with NERC calculating that under the region’s projected reserve margin could fall as much as 21% below demand in the most severe scenario.

No other region approaches ERCOT’s assessed risk: The closest is the Maritimes — comprising the Canadian provinces of New Brunswick, Nova Scotia and Prince Edward Island; and Northern Maine, which is not part of ISO-NE — which has a potential 8.6% shortfall. MISO could come short by as much as 7.6%, while Alberta, which is in WECC’s footprint, has a potential 1.1% deficit.

John Moura, NERC | NERC

John Moura, NERC | NERCOne reason the possible shortfall in Texas is so high, Olson said, is that unlike other regions, ERCOT has “very little transfers that can come help in the event that they do [have] energy emergencies.” Demand in Texas is also very sensitive to cold weather because of electric heating demand, which “significantly uses more electricity” as the temperature drops.

On the other hand, Olson pointed out that ERCOT has implemented a number of improvements to cold weather performance since the winter storms of February 2021 that “also should improve the fuel availability to the natural gas-fired generators.” Moura added that while NERC only assesses the readiness of the bulk electric system, he was “sure” that those responsible for regulating the natural gas supply “have made strides” in preparing their system.

For MISO, reserve margins have fallen by more than 5% since last winter, largely because of more than 4.2 GW in nuclear and coal-fired generation retirements. While 2.25 GW of demand response and wind generation with nameplate capacity of 3.2 GW have been added, Olson reminded listeners that the inherent uncertainty around the weather impacts the availability of these resources.

“If wind comes in below projections … that can drive whether there is an energy emergency or not in MISO,” Olson said. “If it’s low, it’s more likely to have emergencies, and if it’s high, it can alleviate some of those concerns.”

Coordination Recommended

NERC’s assessment includes several recommendations to utilities to lower the risk of energy shortfalls this winter. The first is for balancing authorities and reliability coordinators to work with generator owners to ensure adequate fuel supplies both for normal and extreme conditions; this includes filling storage capacity, preparing fuel delivery systems, and coordinating with fuel providers to make sure additional fuel can be secured when needed. GOs should keep BAs and RCs apprised of their fuel levels and readiness as well, while RCs and BAs should actively monitor fuel adequacy and be prepared to step in with “proactive steps” to assist if needed.

The ERO also said policymakers at the state and provincial levels should be aware of energy risks for the winter season as well, and delay generation retirements if they are likely to negatively impact reliability. State regulators can also support environmental and transportation waivers requested by grid operators (GOPs) in the event of cold weather, in addition to issuing public appeals for electricity and gas conservation.

Finally, the assessment recommends that grid operators, GOs and GOPs implement the mitigations in NERC’s recent Level 2 alert related to cold weather preparations, as well as any additional recommended winterization steps for their facilities.