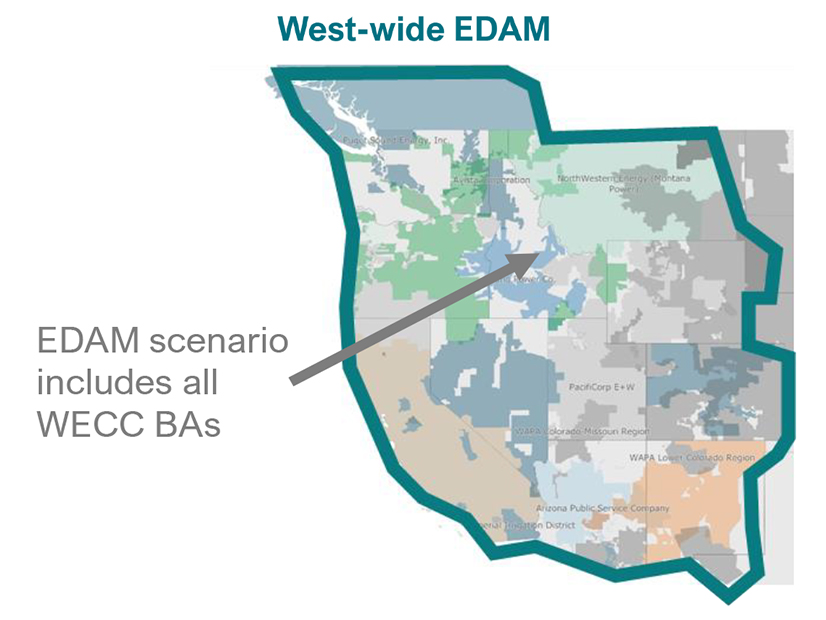

CAISO’s proposed extended day-ahead market (EDAM) for its Western Energy Imbalance Market could generate $1.2 billion a year in benefits, or 60% of the savings of a West-wide RTO, if it encompassed the entire U.S. portion of the Western Interconnection, a new study commissioned by CAISO found.

The report by Energy Strategies was similar to a study the consulting firm performed last year that found a single RTO covering the entire U.S. portion of the interconnection could save the region $2 billion a year in electricity costs in test-year 2030. The study was prepared for state energy offices in Colorado, Idaho, Montana and Utah with funding from the U.S. Department of Energy. (See Study Shows RTO Could Save West $2B Yearly by 2030.)

The firm’s EDAM study for CAISO built on that work. It examined operational savings obtained through more efficient dispatch and management of transmission capacity, lower operating reserve requirements, and the removal of transmission wheeling costs in the market footprint. It also looked at capacity reductions from regionally shared planning reserve requirements met through geographic diversity of generation resources and peak demand.

“The methodology and the underlying databases used to perform this assessment were consistent with those that my firm used to perform the state-led market study for a consortium of Western states,” Energy Strategies Principal Keegan Moyer said Friday in a meeting hosted by the Committee on Regional Electric Power Cooperation (CREPC). CREPC is seeking to play a larger role in Western market formation. (See CREPC Seeks to Become an OPSI for the West.)

The EDAM study differs from the state-led study because it dealt with a specific market proposal instead of a generic RTO framework, Moyer said.

“The framework that we assume here is really just based off of a sharing of resources, assuming planning reserve margins stay consistent, and we just begin to plan for a consolidated peak relative to individual peaks,” he said. “It’s really quite simple. It’s just a regional arbitrage of non-coincident peaks.

“There are, of course, other energy benefits that were not captured in this analysis,” he said. “So, for example, an EDAM could produce price signals that improve the efficiencies of transmission planning. That would be helpful to see a day-ahead price process to plan the transmission grid better, but that benefit isn’t captured here.

“Markets also tend to increase access to public-policy renewable resources,” Moyer said. “The reason for that is that you don’t have to wheel them across the system and/or you have different settlement points or different transaction options that are typically seen in SPP and MISO and help to increase that offtake optionality for those resources. So, it just provides better access to those low-cost wind regimes and solar regimes.”

The Western Energy Imbalance Market (WEIM) operates in real-time to share lower-cost and renewable resources among its participants, which now number 19. It has generated nearly $3 billion in benefits since it launched operations eight years ago. (See WEIM Benefits Top $500M, Near $3B Total.)

The fast-growing WEIM produced $739 million in savings for its 15 participants last year and $325 million in 2020 for its then-11 members. Energy Strategies said the EDAM would more than double the average of $525 in annual benefits from the past two years.

California would be the single largest beneficiary, with about $309 million in benefits in 2030, it said. All other Western states combined would save $886 million in 2030, including operational and capacity savings.

“An EDAM footprint across WECC causes California operational costs to decline by 6.2% from the status quo,” the firms said.

The operational-only benefits of the EDAM would equal 78% of the operational savings from a single all-encompassing Western RTO, as modeled in the state-led study, it said. Including capacity savings, the EDAM would achieve 60% of the benefits of a Western RTO.

The report bolstered CAISO’s sales pitch to Western entities to join the EDAM once it is approved.

CAISO fast-tracked the EDAM stakeholder initiative this year amid competition for Western market share by SPP, which is pursuing its own day-ahead Markets+ program and a Western RTO.

In a Nov. 14 meeting, CAISO presented its draft final proposal for EDAM with hopes of finalizing it next month and seeking approval from its Board of Governors and the WEIM Governing Body in February. (See CAISO Finalizing Plan for WEIM EDAM.)

“Some of the design is still in flux, but we’re kind of at the tail end of the design phase,” CAISO COO Mark Rothleder said at the start of Friday’s CREPC meeting. “Hopefully these additional data points, in terms of the value proposition of EDAM, help in the final stages of the process and really understanding its total value proposition.”