California’s community choice aggregators expanded their long-term procurement of clean energy by 1,431 MW over the past year, a 14% increase that includes 119 MW of long-duration storage.

The new power purchase agreements bring the overall long-term procurement by the state’s CCAs to 11,258 MW, up from 9,827 MW in November 2021. The figures are included in an annual report released this month by the California Community Choice Association (CalCCA), an organization representing the state’s community choice electricity providers.

The 243 long-term contracts are for “new-build” resources, including solar, wind, geothermal, demand response, biogas and energy storage. The clean energy projects are spread across California, and some are in Arizona, New Mexico and Nevada.

“CCAs are procuring the diversity of resources that are needed for the state to achieve a 100% clean electricity system, with a focus on affordability, reliability and resilience,” CalCCA Executive Director Beth Vaughan said in a statement.

Vaughn said previously that the state’s CCAs “continue to drive a clean energy project-building boom throughout California and the West.”

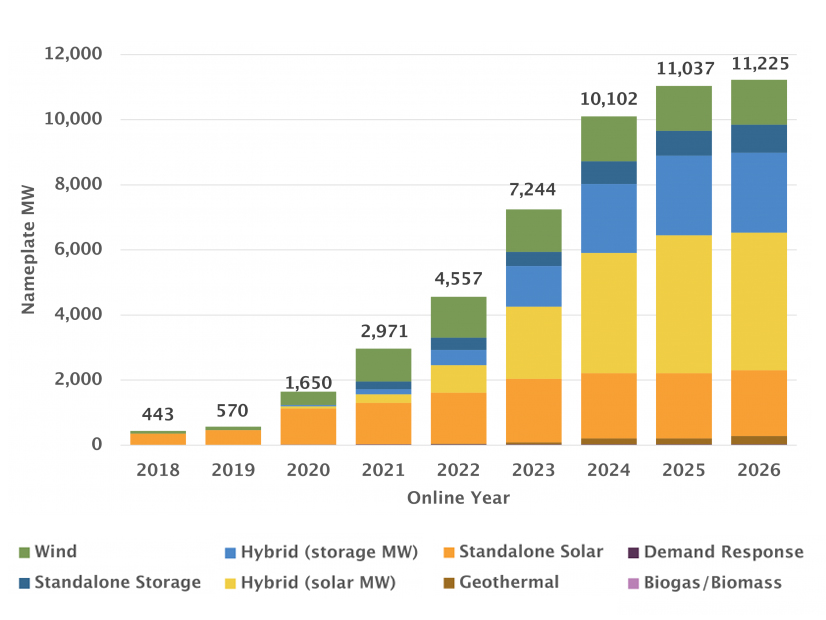

The purchase agreements, ranging in length from 10 to 25 years, are for power from newly built clean energy resources. More than 4,000 MW are in operation now and almost all the rest is expected to be online by 2026.

Solar paired with storage is the largest category of long-term clean energy procurement, contributing 4,232 MW to the total. Storage that accompanies solar is the second-largest category, providing 2,451 MW.

CCAs increasingly are turning to solar-plus-storage rather than standalone solar in solar energy contracts, according to CalCCA. The 2,016 MW of standalone solar energy procurement in this year’s report is a 71 MW decrease from last year’s figure.

Even with the reduction, standalone solar is the third largest clean energy procurement category for the CCAs, followed by wind, with 1,376 MW.

Long-duration Storage

The 119 MW of long-duration storage reported this year came from two contracts approved in early 2022 by California Community Power, a joint powers agency representing nine CCAs. One contract is with REV Renewables for 69 MW at the company’s Tumbleweed project in Kern County. The other is for 50 MW at Onward Energy’s Goal Line project in Escondido. The lithium-ion battery projects will have an eight-hour discharge duration.

Another addition to this year’s list was demand response, which accounted for 23 MW of the power purchases.

In addition, geothermal power procurement increased this year to 287 MW, up from 14 MW as of November 2021. In one of the agreements, announced in May, Fervo Energy will supply 40 MW of geothermal power to East Bay Community Energy from a project in Churchill County, Nevada.

In April, Ormat Technologies announced an agreement with Peninsula Clean Energy to buy 26 MW of energy from the company’s Heber 2 geothermal facility in Imperial Valley, California.

RPS Requirements

Community choice aggregators are nonprofit providers of energy within the territory of investor-owned utilities. Customers who choose to buy power from a CCA still receive transmission and distribution service from the IOU.

This year, CCAs served about a third of the load in the territories of the state’s three primary IOUs, CalCCA said. That figure is expected to increase to 36% in 2023.

And according to the California Public Utilities Commission, CCAs are playing “an increasingly significant role” in meeting state and local greenhouse gas reduction goals.

CalCCA said that the long-term contracts for clean energy are helping the CCAs meet requirements of the state’s renewables portfolio standard (RPS).

In 2021, CCAs achieved an RPS percentage of 50%, when considered in aggregate, the CPUC said in an annual RPS report released this month. That’s well above the 44% RPS requirement for the 2021-2024 compliance period.

“The CCAs’ generation has increased to keep pace with RPS requirements through 2023, even exceeding the 2023 forecasted target,” CPUC said in the report.

But current forecasts show online generation starting to drop in 2024 for 16 of the 25 CCAs, the report said. Considered in aggregate, the RPS percentage is projected to drop to 41% in 2024. CPUC said that’s due to expiring contracts and the launch of new CCAs that have little to no RPS procurement.

The RPS target grows to 60% in 2030, and most CCAs will need more renewable resources, CPUC said.

Another RPS requirement is that 65% of procurement should come from long-term contracts, considered to be 10 years or longer.

All the CCAs are expected to meet the long-term procurement requirement for the 2017-2020 compliance period, CPUC said. And most have met, or are close to meeting, the long-term procurement requirement for 2021-2024.