Criticism from the U.S. solar and clean technology sector was almost instantaneous on Friday after the Commerce Department issued a preliminary decision that could extend tariffs on solar cells and panels imported from 22 companies in Cambodia, Malaysia, Thailand and Vietnam.

According to a Commerce Department investigation — begun in February after a complaint from Auxin Solar, a U.S. manufacturer — those companies are using key components from China in a way that allows them to circumvent existing tariffs, called anti-dumping and countervailing duties (AD/CVD).

Four companies — New East Solar in Cambodia; Hanwha Q Cells and Jinko Solar Technology in Malaysia; and Boviet Solar Technology in Vietnam — were found not to be circumventing and are exempted from the duties. Other companies can avoid the tariffs through a certification process.

Abigail Ross Hopper, CEO of the Solar Energy Industries Association (SEIA), called the preliminary decision “a mistake we will have to deal with for the next several years.”

While “Commerce didn’t target all imports from the subject countries,” Hopper said, “this decision will strand billions of dollars’ worth of American clean energy investments and result in the significant loss of good-paying, American, clean energy jobs.”

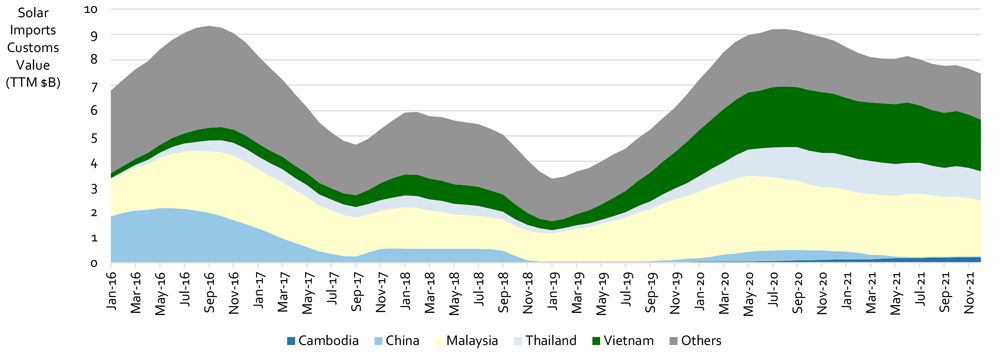

U.S. solar product imports by exporting nation. The Commerce Department preliminary decision could result in tariffs on these imports. | ClearView Energy Partners

U.S. solar product imports by exporting nation. The Commerce Department preliminary decision could result in tariffs on these imports. | ClearView Energy Partners

Following industry outcry about the investigation, President Biden ordered a two-year moratorium on AD/CVD on solar cells and panels from the four countries, which will end in June 2024. But, Hopper said, even that breathing space “is simply not enough time to establish manufacturing supply chains that will meet U.S. solar demand.”

Gregory Wetstone, CEO of the American Council on Renewable Energy, also called the decision “a major step backward.”

The preliminary decision “creates new challenges that threaten to undermine Biden administration efforts to address climate change and accelerate the clean energy transition,” Wetstone said. “The Commerce Department appears to be doubling down on constricting solar availability and imposing massive new red tape with certification requirements that could further chill the industry and thwart the administration’s clean energy objectives.”

Others, like JC Sandberg, interim CEO of the American Clean Power Association, argued that the tariffs would undercut efforts to build out a domestic supply chain for solar, including the tax credits for solar and other clean energy manufacturing in the Inflation Reduction Act.

“American solar companies are making critical 2024 procurement decisions now, and today’s decision casts greater uncertainty about the future of the solar industry in the U.S. that could lead to higher electricity bills,” Sandberg said.

Not all reactions were negative. Michael Stumo, CEO of the Coalition for a Prosperous America, a nonprofit focused on trade issues, welcomed the decision as “an important win for the rule of law” and criticized Biden’s tariff moratorium.

“At a time when American manufacturers are investing billions of dollars to boost domestic production as a result of the Inflation Reduction Act, it is unconscionable that the White House wants to continue to give Chinese manufacturers a pass for illegally violating U.S. trade law to the detriment of American companies and American workers,” Stumo said.

The Commerce Department will be verifying the information in the preliminary decision and accepting comments from industry stakeholders, according to a Friday press release. A final decision is now scheduled for May 1, 2023.

‘Minor or Insignificant’

The Commerce Department first slapped tariffs on Chinese solar panels in 2012, siding with U.S. solar companies that argued that Chinese companies, heavily subsidized by the Chinese government, were undercutting domestic manufacturers and dumping cheaper panels in the U.S. market. Tariffs — from 31 to 250% at the time — would level the playing field and spur the buildout of a domestic supply chain, they argued.

Ten years on, solar manufacturing has migrated to Cambodia, Malaysia, Thailand and Vietnam; the solar industry and federal government continue to fight over solar trade policy, and the U.S. still does not have a comprehensive domestic supply chain. In 2018, former President Donald Trump expanded the Chinese tariffs to the four Southeast Asian countries, where solar panels are manufactured using Chinese components. Biden decided in February to continue the tariffs, later adding the two-year moratorium.

Arguments for and against the current decision hinge on differing perceptions of the manufacturing processes occurring at solar companies in the four countries, the extent of Chinese involvement and the U.S. solar industry’s ability to build out a comprehensive domestic supply chain.

According to industry analysts ClearView Energy Partners, the preliminary decision reflects the Commerce Department’s “protectionist leanings.” The decision generally concludes “that the value of the merchandise produced in China before it was sent to the Southeast Asian nations represented a ‘significant portion of the total value’ of the final product exported to the U.S.,” ClearView said in a research note released Friday.

Further, Commerce said, the processes for assembling and completing cells and panels in these countries were “minor and insignificant,” according to ClearView.

As outlined in the preliminary decision, Commerce based its findings on information gathered in response to questionnaires sent to companies in the four countries. Companies that did not provide the information requested on time and “failed to cooperate to the best of their abilities” were subject to an “adverse inference” that they were circumventing the AD/CVD tariffs.

But SEIA’s Hopper said Commerce had “elected to exceed its legal authority. As a basic fact, solar cell and module manufacturing greatly exceed the anticircumvention statute’s ‘minor or insignificant processing’ limitation.”

George Hershman, CEO of SOLV Energy, a utility-scale solar installer, also argued that the processes being penalized in the decision are the same as those the IRA seeks to incentivize. The preliminary decision is “inherently hypocritical” and “doesn’t pass the common sense test,” Hershman said.

“This ruling will further constrict a challenged supply chain and undercut our ability to fulfill the promise of the Inflation Reduction Act,” he said.

ClearView agreed the decision “could add to solar product trade risk.”

IRA tax incentives could “encourage domestic manufacturing, but our review of solar products demand and recently announced U.S. investments suggests the U.S. market is likely to remain partially reliant on imported solar modules and heavy reliant on overseas solar supply chains after the AD/CVD might take effect,” ClearView said.

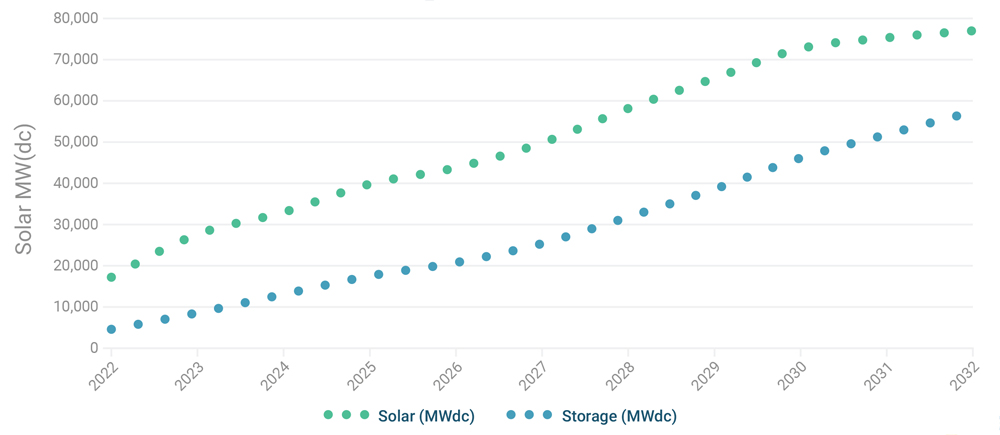

New solar installations in the U.S. hit 18.9 GW in 2021, ClearView said, and the U.S. Energy Information Administration expects that number to more than double, to 39.7 GW in 2023.

Exceptions

In a report released in August, SEIA predicted that building out a full domestic supply chain for all solar components, from polysilicon wafers to inverters, could take five years or longer. The group is targeting a U.S. supply chain capable of producing 50 GW of “domestic solar manufacturing capacity” by 2030.

SEIA projects the U.S. can build out key domestic supply chains for solar by 2027. | SEIA

SEIA projects the U.S. can build out key domestic supply chains for solar by 2027. | SEIA

According to the report, “the United States currently has no domestic solar ingot, wafer or cell manufacturing capacity and only modest capacity to produce solar modules, inverters and trackers. … Practical timelines for siting, permitting, constructing and commissioning new factories [will] influence how quickly domestic manufacturing can scale.”

Ingots are blocks of polysilicon, which are then sliced into the superthin “wafers” that go into the solar cells used to produce panels. According to industry analyst Bernreuter, seven of the top 10 polysilicon producers in the world are Chinese companies.

But another industry analyst, who requested anonymity because he is not authorized to speak publicly, said that the details of the decision provide a range of loopholes for companies to avoid the tariffs once Biden’s moratorium expires.

First, the exclusion of Hanwha and Jinko, both major U.S. suppliers, provides some certainty for the industry, he said.

The decision also excludes solar cells and panels made with wafers not specifically produced in China, even if the silicon ingots they are sliced off of are. “That means that all the … production [of wafers] that is online and coming online in Southeast Asia can be made into cells that are not subject to duties,” he said.

Another big loophole is the exclusion for cells and panels where four of six key components — silver paste, aluminum frames, glass, backsheets, ethylene vinyl acetate (EVA) sheets and junction boxes — are not made in China. Silver paste is a conductive material used to improve electricity production in solar panels, and EVA sheets are used to “encapsulate” and protect solar cells in panels.

“If you have four of the six … made outside of China, no duties. That’s not going to be hard to comply with,” the analyst said. “You can make aluminum frames anywhere; you can make glass a lot of places; backsheets, EVA; there’s no reason you have to make this stuff in China. … And then suddenly — boom — all of those modules aren’t subject to duties.

“This was a much better decision for the industry than people may realize,” he said. “The fine print here is really positive for us to continue to have module supply for the next few years.”

But, the analyst cautioned, building out a U.S. supply chain, especially for ingots and wafers, will face challenges. Setting up the new factories will be capital intensive, “and you need somebody who’s got the know-how to do them,” he said. “That ingot and wafer knowledge is now concentrated in Asia, so you have the same problem.”