In October, CAISO, ISO-NE, MISO, NYISO, PJM and SPP filed reports with FERC on how their system needs are changing in response to decarbonization and their shifting resource mixes (AD21-10). Last week, 19 groups and companies filed comments responding to the RTO/ISO reports.

Below is a summary of how the grid operators say they are working to ensure reliability and what the commenters think of their plans.

CAISO

CAISO told FERC its system needs are changing in response to the state’s 100% clean energy by 2045 mandate under Senate Bill 100.

“CAISO is actively engaged in addressing the evolving resource mix, an evolving market, and a growing recognition that regional coordination is necessary to enhance efficiency and reliability,” it said, adding that “weather patterns affected by climate change have created extreme conditions beyond those anticipated by current planning standards.”

One way CAISO is addressing its needs is with large amounts of battery storage to provide power during hot summer evenings after solar goes offline but air conditioning demand remains high. The ISO ordered rolling blackouts in August 2020, and had near misses in the summers of 2021 and 2022, under such conditions.

“The addition of lithium-ion storage capacity has been an extremely positive development,” CAISO said. As of October 2022, the ISO had about 4,300 MW of storage capacity available for dispatch; the California Public Utilities Commission, which is in charge of ordering procurement by the state’s three large investor-owned utilities, has called for 10,000 MW of additional storage by 2024.

Another way CAISO plans to deal with changes in the resource mix and load variability is through its proposed extended day-ahead market (EDAM) for its real-time Western Energy Imbalance Market.

“The EDAM will build upon the proven ability of the WEIM to increase regional coordination, support states’ policy goals and meet demand cost-effectively by supporting the rapidly evolving Western resource adequacy landscape,” CAISO said.

Managing its “unprecedented transition requires us to look very carefully at both the short and the long term,” CAISO said: “short term because we must maintain reliability during the transition to a carbon-free grid, and long term because we must make sound decisions now to help us reach that destination in the most reliable and cost-effective way.”

In February 2022, CAISO published its first 20-Year Transmission Outlook, “a long-term conceptual plan” of the transmission grid based on input from the CPUC and the California Energy Commission.

Its new 5-Year Strategic Plan focuses on what the organization must do in the short term to strengthen reliability during the transition.

To ensure resource adequacy, CAISO said it would rely on the Western Power Pool’s Western Resource Adequacy Program and California’s efforts to evolve its resource adequacy program through advanced computer modeling. “Together with its partners, the CAISO is actively working to develop a multiple-year roadmap that relies on its markets to provide reliable system operations in light of the changing nature of resources and load patterns throughout the West,” it said.

In comments filed last week, the American Petroleum Institute cited CAISO’s experience during strained conditions as a reason natural gas generators’ fast-ramping capability are needed. California continues to rely heavily on gas generation, especially at times when solar is unavailable.

“CAISO, which has the highest share of solar generation of the six ISO/RTOs, has already observed an increase in uncertainty around its net load forecasts,” API said.

“As the share of non-dispatchable resources grows, it can become difficult to guarantee that generation will be available when needed — particularly when resources with flexible attributes are either forced into retirement or not developed in the first place due to market, regulatory or legislative headwinds,” it said. “California faced such an issue in August 2020, when insufficient fast-ramping resources were available to compensate for the evening decline in solar generation and CAISO was forced to shed load on consecutive days. As former FERC Commissioner Tony Clark concluded in a recent opinion piece, ‘On-demand resources may not run as often in a renewables-heavy future, but the value of their ability to run when called upon will be critical.’”

CAISO monthly trend of historical day-ahead imbalances, which can exceed 6,000 MW, requiring large amounts of reserved capacity | CAISO

CAISO monthly trend of historical day-ahead imbalances, which can exceed 6,000 MW, requiring large amounts of reserved capacity | CAISO

Advanced Energy United (formerly Advanced Energy Economy) offered its thoughts last week on several parts of CAISO’s submission.

“CAISO predicts that ‘artificial intelligence and machine learning will play an increasingly important role as the energy industry continues its trend towards more complex and distributed systems,’” the group said. “Given the foundational role of software in supporting critical RTO/ISO functions, the commission should work to track RTO/ISO software needs and upgrades and look for ways to support expedited software upgrades and use of new and emerging tools and practices.”

Advanced Energy endorsed CAISO’s recommendation that the commission “continue to facilitate industry dialogue regarding the coordination between the transmission and distribution interface.”

“This is especially critical in light of the trend mentioned by multiple RTOs/ISOs toward increased electrification of transportation and heating; ensuring that these end uses can be leveraged as a grid resource rather than simply adding a new source of load for grid operators to balance will be essential to maintain affordability and reliability in light of shifting system needs.”

ISO-NE

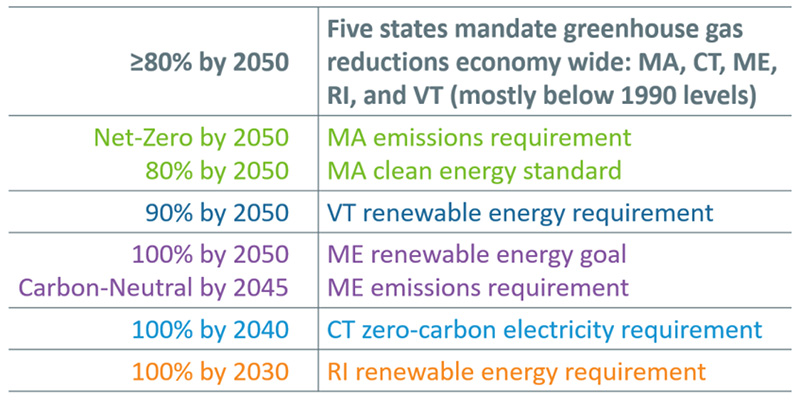

ISO-NE said it recognizes its energy systems are in the “early stages of a significant shift” caused by electrification and decarbonization goals in the six states of New England.

Among the changes that ISO-NE is preparing for are increasing winter peaks in the next five years, and the potential for a full-blown shift to a winter-peaking system in the next 10.

The grid operator said it expects to need “additional resource physical capabilities, ISO informational capabilities and markets’ capabilities to incent the former,” over those time frames.

ISO-NE cited what CEO Gordon van Welie has called the “four pillars” of New England’s energy future: clean energy, balancing resources, energy adequacy and transmission investment. It stopped short of making any specific asks of FERC, but called on the commission to remain flexible in its approach to overseeing RTOs.

New England’s emission reduction goals | ISO-NE

New England’s emission reduction goals | ISO-NE

“We look forward to continued efforts by the commission to remain responsive to the evolving resource mix and load profiles of individual RTO/ISO regions, and any related future market reforms that the evolving energy system may motivate,” the RTO said.

Four public power systems from Massachusetts, Connecticut, New Hampshire and Vermont called on FERC and ISO-NE to continue to focus on reliability, saying, “New England today is facing profound winter reliability issues that require swift action.”

Specifically, the groups wrote that FERC should mandate the use of competitive processes in transmission development, take a closer look at New England’s rules for fuel procurement and consider creating a regional energy reserve. They also urged a major revamp of ISO-NE’s capacity market, calling for a seasonal auction to replace the existing annual one.

They also said ISO-NE should look at new market products to incentivize building balancing resources and commit to undertaking cost-benefit analyses as it evaluates changes to market rules.

MISO

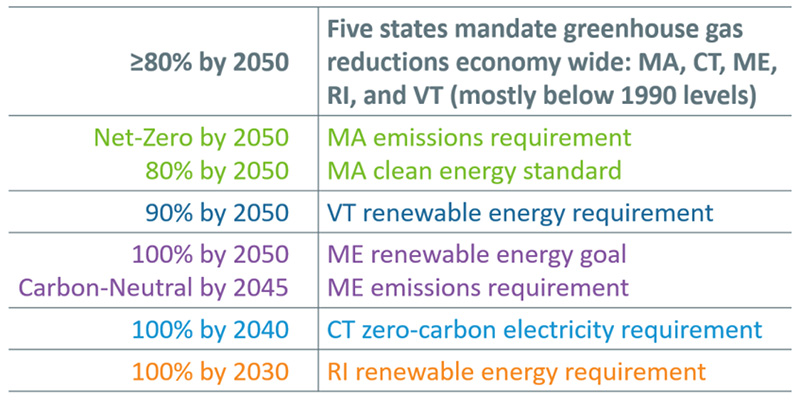

MISO said adapting its markets to reliably meet future system needs has been “core to MISO’s mission and vision” since it introduced its energy market in 2005.

The grid operator cited its plan to use a seasonal accreditation of capacity, the opening of its markets to electric storage and the 2021 rollout of its short-term reserve product. It also said its long-range transmission portfolios and its ongoing market platform replacement are meant to keep the system nimble.

MISO also cited analyses such as its “Markets of the Future” report and annual regional resource assessment as ways to keep close tabs on its evolving resource mix and anticipate what new market products might be needed.

Policy drivers are accelerating the fleet transition and associated risks, MISO says. | MISO

Policy drivers are accelerating the fleet transition and associated risks, MISO says. | MISO

The RTO said it considers market pricing “a powerful signal” to attracting resources. In its “ideal state,” it said, it would remove the requirement that it must declare an emergency to access its load-modifying and other “emergency only” resources and be able to commit and dispatch them “through more regular market operations.”

MISO has begun discussions with stakeholders on how to appropriately value and maintain resources that supply beneficial system attributes. It has defined six system reliability attributes as necessary, including resource availability, the ability to deliver long-duration energy at a high output, rapid start-up times, providing voltage stability, ramp-up capability and fuel certainty. (See MISO Considers Resource Attributes as Thermal Output Falls.)

NYISO

NYISO said it is simultaneously responding to more frequent extreme weather and higher temperatures caused by climate change and the renewable requirements of the Climate Leadership and Community Protection Act (CLCPA). Reaching the CLCPA’s targets — 70% renewable electricity by 2030; 100% emissions-free electricity by 2040 — “will require unprecedented levels of investment in both new supply and transmission resources.”

The ISO’s 2020 Climate Change Impact and Resilience Study said it could be facing one-hour ramp requirements of more than 10,000 MW and a six-hour ramp of more than 25,000 MW by winter 2040. In 2021, in contrast, the ISO’s maximum one-hour ramp was 1,800 MW, and the largest ramp was 8,800 MW.

NYISO said it faces uncertainties including “weather, net load forecasts, actual available energy from intermittent wind and solar resources, available energy from limited-energy resources, reduced availability of traditional flexible generation resources and higher probabilities that weather, or other factors, lead to correlated supply and transmission issues.” In July 2019, it experienced a 36-hour period when the state’s wind resources produced only 4% of their maximum output.

The ISO identified six time frames in which it must balance the variance in intermittent resources, ranging from six seconds (for regulation service) to decades — the time horizon over which investments in resources able to provide balancing will be made.

Progress toward New York’s “70 x 30” mandate | NYISO

Progress toward New York’s “70 x 30” mandate | NYISO

NYISO told FERC its energy and ancillary services markets are “working efficiently,” citing its operating reserve demand curves, which were changed in 2021, and stakeholders’ recent approval of its constraint-specific transmission shortage pricing project. The latter project is intended to help its market software redispatch suppliers to alleviate transmission constraints and identify locations where new resources could provide the greatest benefits.

“The upcoming balancing intermittency project and the initiative to review real-time market features to enhance incentives to follow NYISO instructions directly respond to expected ramping and flexibility needs,” it said. The real-time project will consider lengthening the look-ahead capabilities of the ISO’s real-time commitment and real-time dispatch software.

It acknowledged that the low marginal costs of renewables will require changes to the markets to balance intermittency and improve price formation.

“Determining the quantity and location of operating reserves more dynamically will be instrumental in preparing the markets for the new grid risks as the resource mix evolves.”

Simultaneously co-optimizing energy and ancillary services requirements will increase revenues in those markets, the ISO said. “Absent ancillary services market changes or other wholesale energy market changes to improve incentives for flexible resource availability, market signals to retain and invest in flexible, controllable resources may not be sufficient.”

Another source of uncertainty is behind-the-meter solar PV. The ISO forecasts that 6,000 MW of BTM solar nameplate capacity will be installed by 2024, rising to 10,000 MW by 2030.

The ISO and its stakeholders are considering additional changes, including the implementation of reserve requirements within constrained load pockets; additional availability incentives for suppliers on Long Island; five-minute transaction scheduling; and separating up and down regulation service.

In response to Commissioner Mark Christie’s question on whether LMPs remain the best way to run energy and capacity markets, the ISO attached to its filing a report by economists Scott Harvey, of FTI Consulting, and William Hogan, of the Harvard Kennedy School.

Harvey and Hogan rejected those who question whether LMPs still make sense in a world of low-marginal-cost variable resources. “The critical role for LMP was true in the past, is true today, and will be true and more important with the anticipated changing resources mix,” they wrote.

PJM

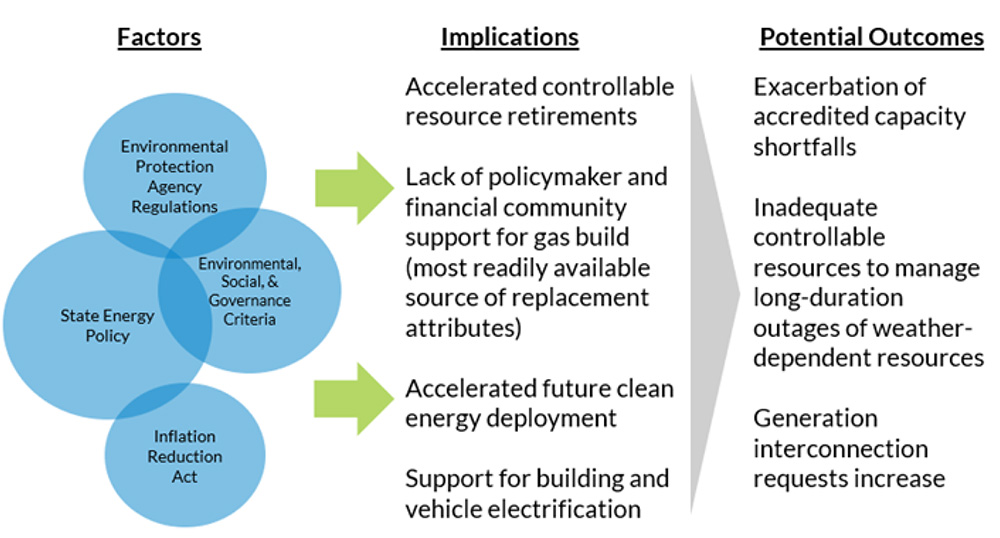

PJM aims to meet the challenges presented by growing renewable penetration and electrification by expanding its energy and ancillary services market to include pricing of flexibility attributes. In its report to the commission, the RTO said many of the characteristics of dispatchable generation will be crucial through the clean energy transition — such as the ability to ramp, cycling capability, quick start times and low minimum run times.

“A significant challenge PJM faces over the next five to 10 years is the disorderly retirement of resources that provide needed ancillary services,” the RTO said. “The limitations in how these resources are priced today could well add to the premature and disorderly retirement of these needed resources that are not priced accurately in today’s markets.”

While the RTO believes it has adequate flexibility in the near term, it said it must create defined values for attributes as quickly as possible to incentivize generation owners to keep their facilities online.

“The value in addressing this issue now is that prices for this additional flexibility will rise slowly as the fleet transitions and send early price signals on the increasing value of flexibility. This is critical to avoiding the disorderly retirement of resources,” PJM wrote.

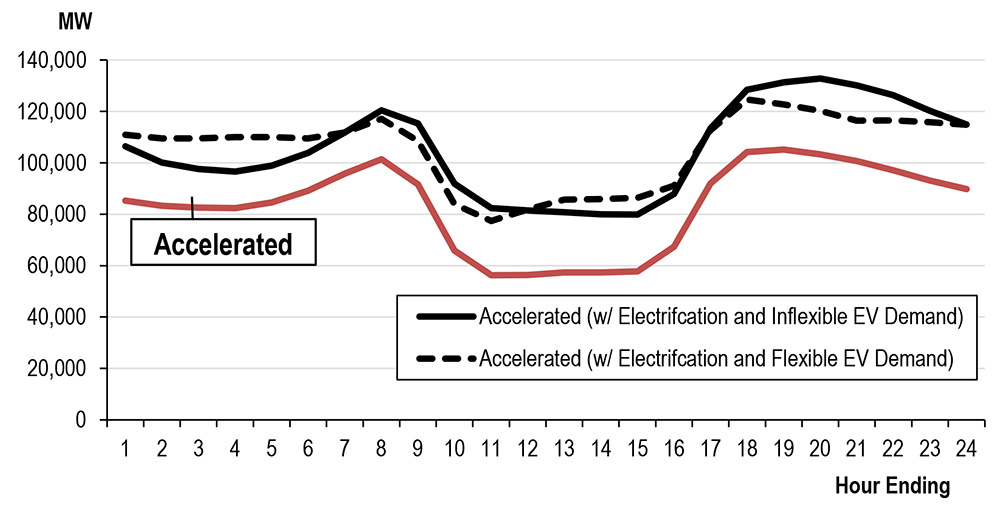

Winter load shape with electrification | PJM

Winter load shape with electrification | PJM

The RTO urged the commission not to take a “passive stance.”

“A policy statement outlining the commission’s expectations would help to focus RTOs and their stakeholders on these issues at a time when there are countless issues that could distract from their development,” it said. “Moreover, such a policy statement, if adopted on a bipartisan basis, could ensure a level of continuity in the commission’s direction that would further incent the industry to move proactively.”

PJM’s Independent Market Monitor argued that the RTO’s core market design elements already provide the flexibility it will need going into the future. It said the focus should be on removing existing barriers rather than creating new market products.

“Creating new ancillary services products and repeatedly revising the existing ones is a distraction from identifying opportunities to improve dispatch tools and enhancing basic market rules to unlock existing resource flexibility,” the Monitor wrote in response to PJM’s filing.

Current market rules often allow resources to avoid defining their flexible operating parameters outside of instances where they fail the market power test, or during weather alerts and emergencies, the Monitor said. For example, combined cycle units have the physical capability to be dispatched on and off for morning and afternoon peaks, and typically do not offer their start and down time parameters on their price schedules.

The IMM also said “inferior capacity resources” that are exempted from must-offer rules — namely intermittent generation, storage and demand response — are undermining the reliability offered by PJM’s capacity market.

The PJM Industrial Customer Coalition said that the RTO must ensure that load is not responsible for resources that cannot meet their obligations.

“Currently, load is fully responsible for the payments associated with the reserve products in PJM. If certain resources are not able to meet their reserve obligations due to the intermittency of those resources or for other reasons, those resources should bear an appropriate cost; the full risk and costs should not be borne directly by consumers,” the coalition wrote.

The ICC also argued that all generation types carry some physical flexibility and that they should be required to offer that capability to grid operators. Those resources that cannot provide a range for its flexibility or fail to follow dispatch instructions should be obligated to purchase flexibility from other resources or their respective RTO, it said.

“Resources that cannot provide desired flexibility and dispatchability attributes should appear more costly and less desirable than resources that can provide the desired attributes. As a result, the mantra of ‘reliability through markets’ would continue to be fostered through proper investment signals,” it wrote.

The PJM Power Providers Group (P3) noted that the RTO is forecasting strong load growth as thermal resources are scheduled to retire. It argued that the renewable resources expected to go online are not a “megawatt-for-megawatt” replacement for those going offline, particularly as risk moves to the evening hours.

To address the reliability challenges expected in the future, P3 said that an overhaul of the capacity market is necessary to undo “myopic regulatory decisions from the commission, illogical proposals from the RTO” and delays in running auctions. P3 said the current market is unsustainable, with resources exposed to nonperformance charges during extreme weather, no ability to independently evaluate risk and no protection from buyer market power.

SPP

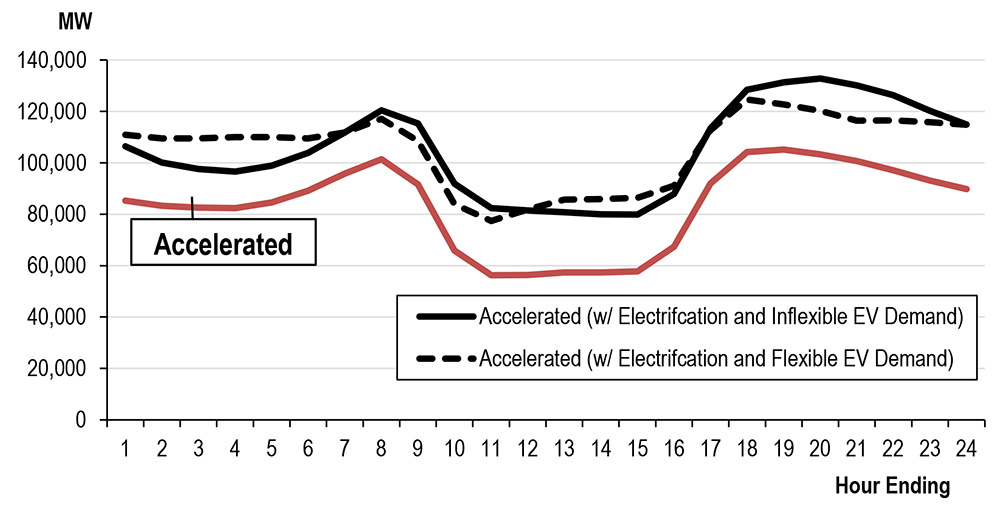

SPP’s report documented the RTO’s response to the rapid growth in wind energy and its increasing peak demand.

The RTO’s 33 GW of installed and registered wind power capacity represents 29% of its total capacity and 38% of its total energy. It also has seen a continued drop in coal generation, although rising natural gas prices allowed its usage to rebound in 2021.

Because of rising high temperatures, the RTO said, its coincident instantaneous peak demand has risen more than 7% in two years, from 49,569 MW in 2020 to 53,243 MW in July 2022.

Share of SPP’s real-time, annual generation by technology type | SPP

Share of SPP’s real-time, annual generation by technology type | SPP

It also reported increasing uncertainty in load forecasting because of demand response and behind-the-meter generation. “SPP receives load forecasts from its members that inform SPP’s own load forecasts, and these load forecasts may be performed differently,” it said.

It has also seen increased generation variability, which it manages through reliability unit commitment studies and manual operator commitments and its new ramp capability product.

“SPP’s primary source of uncertainty comes from generation, not from load,” it said. “With the balance between available flexibility and system variability expected to tighten in the future, efficient methods to assist in providing the needed flexibility with the available generation fleet will become increasingly important to economical and reliable operations.”

The RTO said its requirement is for resources that are “visible, forecastable and responsively dispatchable.”

It recently revised its balancing authority emergency operating plan to incorporate information on generators’ on-site fuel and the ability of the BA to allow resources to take actions to conserve fuel. The RTO is also tracking plant retirements based on owners’ plans instead of making assumptions based on plants’ age.

SPP said it will need more information from its 550 distribution utilities as additional resources interconnect on distribution lines.

Another concern is the increasing complexity of the system, which is making it more difficult for software to clear, solve and post the results of SPP’s market in a timely fashion.

“The SPP market clearing engine has to optimize an extensive mathematical model (greater than 1,000 resources, large amounts of transmission constraints over a large footprint, granular modeling),” it said. “The potential addition of thousands of distributed energy resources, storage, greenhouse gas logic and continued variable energy resource growth could require adjustments to how SPP clears the market.”

SPP said it has an increased need for visibility of resources. “This means knowing where resources are on the system and forecasting their output. Visibility concerns arise with increasing numbers of distributed energy resources and behind-the-meter generation. This generation may not be registered in SPP’s markets and may be accounted for differently in the load forecasts of distribution utilities connected to the transmission system operated by SPP,” it said.

“Another potential problem with resource visibility is the potential for mobile storage resources (both plug-in vehicle and commercial-size truck bed storage) within SPP’s footprint. This possibility may be more likely as new electric charging stations along interstate highways come online.”

“Renewables have not caused any new problems but have only highlighted the shortcoming of the market,” SPP’s Market Monitoring Unit said in its comments last week.

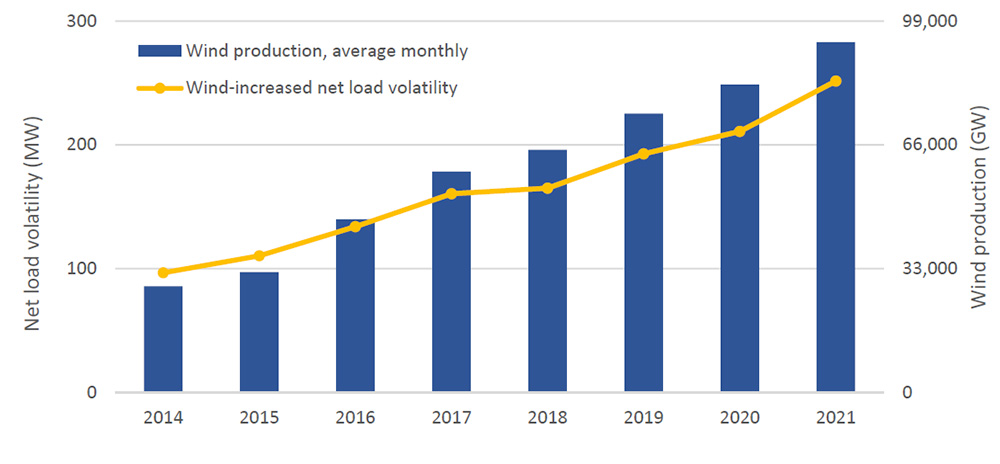

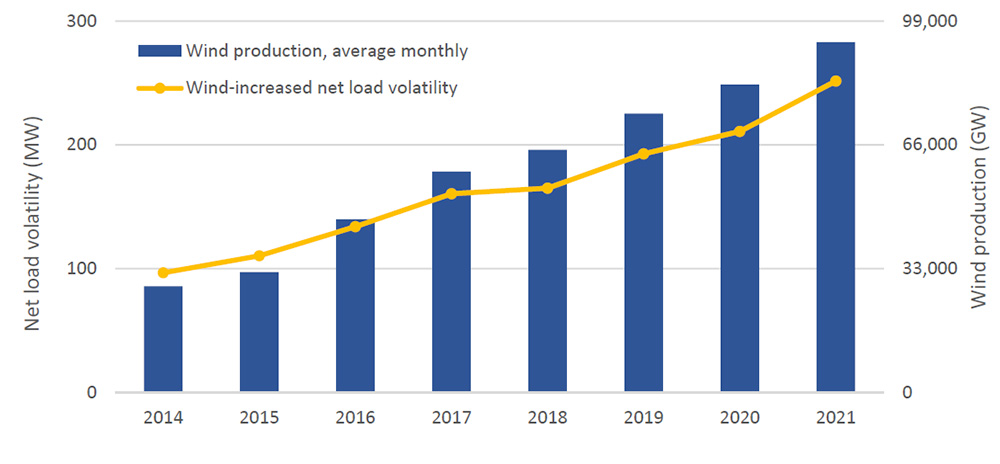

Net load volatility increases with wind production. | SPP

Net load volatility increases with wind production. | SPP

The MMU said the RTO needs to construct its rules with an eye to “flexibility, dependability, availability, resiliency and quality.”

“These attributes must be defined and incentivized, or they may not be provided in the future,” the MMU said.

The MMU noted that wind’s market share has nearly tripled from 2014 to 2021 to about 35% of total annual generation. Compounding the challenges, in about half of all real-time intervals, wind production moves in the opposite direction of load, it said.

“Although almost all weather-dependent renewables are dispatchable in the down direction, they were expected to follow dispatch instructions in less than 7% of resource intervals, compared to about 80% for non-renewables.

“When not following a dispatch instruction, weather-dependent renewable output varies irrespective of price, causing a need for rampable capacity separate from load.”

Almost 36% of capacity in SPP is more than 40 years old, most of it gas and coal.