WEC Energy Group’s (NYSE: WEC) leadership last week plugged the billions they will spend on transforming their utility’s energy mix in a year-end earnings call.

WEC reported fourth quarter earnings Feb. 2 of $252.7 million ($0.80/share), compared to the $224.2 million ($0.71/share) it netted for the same period last year. The utility recorded year-end net income of $1.4 billion ($4.45/share), compared to the $1.3 billion ($4.11/share) over 2021.

WEC Energy Group Executive Chairman Gale Klappa told financial analysts that the company plans to spend $20.1 billion over the next five years, up from $17.7 billion it initially targeted in 2022. He said the spend, as outlined in an updated environmental and social governance progress plan, is the “largest five-year investment plan in our history.”

Klappa said management expects the plan to drive compound earnings growth of 6.5% to 7% per year through 2027.

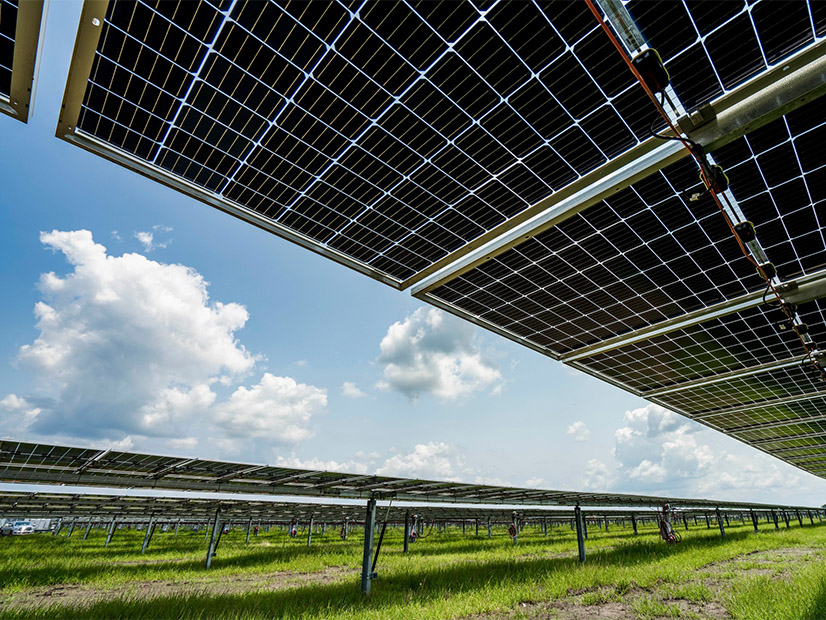

The plan will position WEC for “efficiency, sustainability and growth,” Klappa said. The plan includes more than $7.3 billion in new renewable investments in solar, wind and battery storage, a “major commitment to renewable projects” that is now a cornerstone of the utility, he said.

WEC announced last month it will acquire an 80% interest totaling $250 million for the first phase of the 250-MW Samson Solar Energy Center in northeast Texas.

WEC CEO Scott Lauber said the utility’s $160 million, 80-MW Red Barn wind farm in Wisconsin will come online in the next few months and its Badger Hollow II solar facility and the Paris Solar Battery Park in Wisconsin will likely go into service within the year, contingent on panel delivery.

Lauber noted that the Wisconsin Public Service Commission last year approved WEC’s purchase of the $451 million Darien Solar Energy Center. Its 225 MW of solar capacity and 68 MW of battery storage is expected online in 2024.

Laubner said the 300-MW Thunderhead Wind Farm in Nebraska is now in service; WEC has a $338 million, 80% stake in the project. He said he expects that the utility will finalize a $412 million, 90% interest in the 250-MW Sapphire Sky in Illinois in the coming weeks.

WEC plans to achieve carbon neutrality by 2050 and phase out coal use by 2030 so that it’s only a backup fuel.