Data centers have been a major business in Northern Virginia for decades, but a recent acceleration in their growth has policymakers working to make sure their high demand for electricity continues to be met reliably.

“Data Center Alley,” near Dulles Airport outside of D.C., is home to the largest concentration of data centers in the world, easily outpacing Silicon Valley, according to the Loudon County Department of Economic Development.

Northern Virginia has ties to the earliest days of the internet, from when the Defense Department’s Advanced Research Projects Agency (ARPA) set up ARPANET in the 1960s, Steven Gonzalez Monserrate said in an interview with RTO Insider. Gonzalez Monserrate has worked in the industry and is pursuing a doctorate in the Massachusetts Institute of Technology’s History, Anthropology, and Science, Technology and Society (HASTS) program on data centers’ impact on the environment.

“There’s another reason for it, which is national security,” Gonzalez Monserrate said. “So, a lot of the data centers in Data Center Alley are government-related as well.”

The cheap power from Dominion Energy (NYSE:D) has also led many data centers to plop down in its footprint. Data centers generally tend to cluster around each other because it minimizes the latency in internet connections, Gonzalez Monserrate said.

“People who play video games, for instance, or people who are doing trading on Wall Street, they need very low latency in the milliseconds to have a satisfactory experience,” he added. “And so, the closer that your data center is to you the one that you’re accessing and routing information, the lower the latency.”

The importance of lower latency is driving additional construction of new data centers, as are new trends on the internet such as the “metaverse,” Gonzalez Monserrate said.

The Virginia Department of Environmental Quality is taking comments on a proposal that would allow the 300 facilities in Northern Virginia to use their on-site diesel backup generation more often from March through July in case the transmission grid is too overloaded to send them power.

Dominion is accelerating several transmission projects to alleviate constraints around Data Center Alley, which makes up 20% of the utility’s overall demand and is the only major source of load growth there.

“This includes several reconductoring projects, substation expansions and two new 500/230-kV lines,” spokesman Aaron Ruby said in a statement. “The first of the projects will be completed in late June and will help alleviate the constraints.”

DEQ’s proposal, which cannot go into effect until after it has taken written comments from interested parties and held a public hearing late this month, was issued out of an abundance of caution, and the issues will not impact service to residential or small business customers in the area, he added.

Individual data centers can have demand of up to 100 MW. Gonzalez Monserrate said that most of that power is used to run the servers of the cloud or to provide cooling for them. Cooling is often around 40% of the demand for more efficient facilities, though it can be higher than that, he said.

PJM has approved $627.62 million worth of transmission upgrades around Data Center Alley to avoid reliability violations observed in 2024 and 2025, which Dominion will build by 2025. Both houses of Virginia’s General Assembly have unanimously voted out bills, Senate Bill 1541 and House Bill 2482, that call on the State Corporation Commission to approve those upgrades within 270 days.

But load growth from new data centers has outpaced even those new lines, with PJM explaining it was opening a third window to the 2022 Regional Transmission Expansion Plan to deal with expanded data center demand expected through 2028.

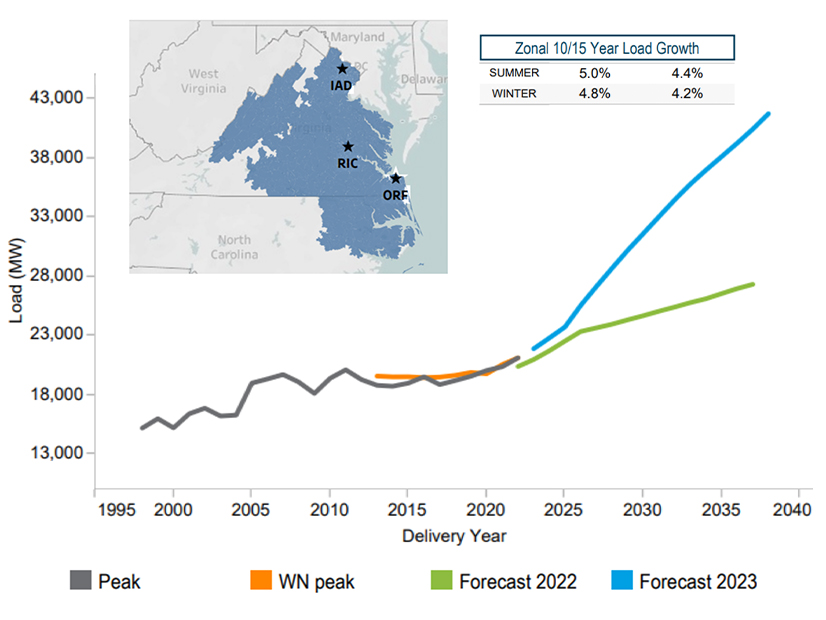

PJM’s 2023 Load Forecast Report showed Dominion’s peak load growing at a rate of 5% per year over the next decade. The rest of the RTO is expected to grow by just 0.8% per year, with some regions seeing demand drop over the decade. In a presentation to the Transmission Expansion Advisory Committee in January, PJM said that its summer peak prediction for 2022 was off by 732 MW as Dominion had peak demand of 21,156 MW. That is expected to grow to 35,789 MW by 2033.

“This growth primarily driven by data center loads, which have been increasing at an unprecedented rate and will require significant new capital investment,” Dominion CEO Robert Blue said on the firm’s earnings call Wednesday. (See related story, Dominion Energy Sees Loss in Q4; Earnings Fall for 2022.)

Adding more transmission projects to the 2022 plan will ensure that the infrastructure is available before the demand shows up, PJM Director of System Planning Dave Souder told RTO Insider at the TEAC meeting Tuesday. The rate of load growth driven by the industry is fairly new, and it is starting to impact other regions.

“Until recently, it has been atypical; however, there has been a significant data center load growth in the Dulles Airport area,” Souder said.

The biggest internet companies in the world all have data centers in Northern Virginia, including Amazon, which is a major player industry through its Amazon Web Services subsidiary. The tech giant also picked nearby Arlington as its second headquarters in 2018, and in January it announced it would build another $35 billion worth of data centers in the state by 2040, which was welcomed by Gov. Glenn Youngkin (R).

“Virginia will continue to encourage the development of this new generation of data center campuses across multiple regions of the commonwealth,” Youngkin said. “These areas offer robust utility infrastructure, lower costs, great livability and highly educated workforces, and will benefit from the associated economic development and increased tax base, assisting the schools and providing services to the community.”

While the major players in the industry have committed to efficiency and renewable energy to meet their data centers’ demands, Gonzalez Monserrate cautioned that some in the industry were not focused on such efforts at all.

“It’s important to note that most data centers out there are not Google, or Amazon, or these giant facilities with a lot of capital; many of them are actually really poorly resourced or poorly run, or in aging facilities that don’t have the resources to be energy efficient,” he added.

Devin Leith-Yessian contributed to this article from Valley Forge, Pa.