Vistra (NYSE: VST) said Monday it will buy Energy Harbor and combine the two firms’ nuclear plants, renewable facilities and retail businesses into a new subsidiary called “Vistra Vision.”

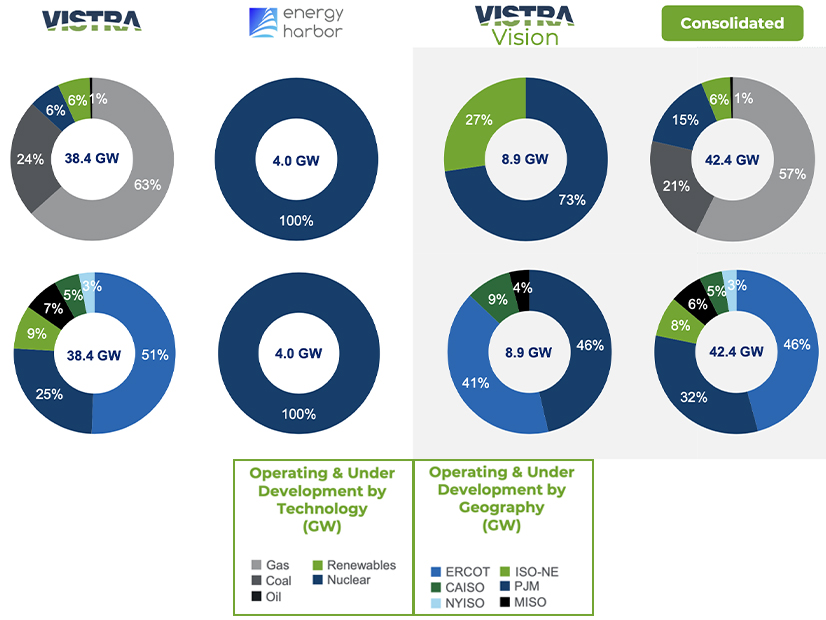

Vistra is paying $3 billion and assuming $430 million in debt, while Energy Harbor’s two biggest shareholders, Nuveen and Avenue Capital, will continue to own 15% of Vistra Vision. Vistra’s fossil assets, which total 24,000 MW of natural gas units and 8,400 MW of coal, will be in a separate subsidiary called “Vistra Tradition.” The deal needs to be approved by the Department of Justice, FERC and the Nuclear Regulatory Commission; Vistra expects it will close later this year.

“Through this creative transaction we will combine Vistra’s nuclear, retail, renewables and battery storage assets with Energy Harbor’s nuclear and retail assets to create one of the largest clean energy businesses in the country,” Vistra CEO Jim Burke said on a conference call with analysts.

Energy Harbor, which was spun off from FirstEnergy (NYSE:FE), owns three nuclear plants in Ohio and Pennsylvania and has a competitive retail power business serving 1 million customers in PJM and MISO. That will be matched with Vistra’s Comanche Peak nuclear plant in Texas, its renewable and storage projects around the country, and its retail business in Texas and other states.

Vistra Vision will have a about 7,800 MW zero-carbon generation, about 5 million retail customers and access to a pipeline of 1,100 MW of additional renewables projects. It would be the second largest operator of nuclear plants in the country with six reactors across its four plants.

With the country navigating a transition to cleaner energy, nuclear provides the unique capability of being both carbon free and available around the clock to serve demand, Burke said.

“The nuclear production tax credit provides significant downside protection while maintaining the ability to capture upside through market volatility and … hedging forward,” Burke said.

The federal PTC for nuclear, part of last year’s Inflation Reduction Act, will effectively give the firm’s four nuclear reactors an earnings floor. It provides revenue support when a nuclear plant’s “gross receipts” are below $43.75/MWh and can contribute up to $15/MWh when gross receipts drop to $25/MWh.

Power prices were much higher when Vistra first considered the deal last summer because of spiking natural gas, but Burke said his firm is doubtful that prices can go much lower and does not expect cheap natural gas, or resulting power prices, to stick around long.

“Our returns on our PTC case are not that much further below the returns that we actually modeled for this,” Burke said. “And we think we’re modeling closer to the downside of the opportunity with still a lot of upside opportunity, depending on how gas and power … behave from this point forward.”

While Vistra Tradition would be home to the firm’s fossil assets, Burke said that Vistra Vision would use its generation to firm up supplies for retail customers as needed.

Keeping the traditional generation around also gives the firm a larger scale, which could help it invest in new technologies as they become viable, he said.

“We’ve got some opportunities with sites to do things with future nuclear technologies, potentially even at existing coal sites and sites that we’re retiring,” Burke said.

The firm’s coal plants are eventually going to retire, but Burke expects the natural gas generators will be needed for a long time to come.

Separating the two businesses gives investors and customers more visibility into the clean energy assets that Vistra has, Burke said, conceding that it might eventually make sense to split the two businesses completely.

“But right now, these are both scaled businesses with some interdependencies, and so I think we’re going to focus on running this in an integrated fashion for a while,” he added.