FERC on Friday approved MISO’s ability to abandon the only competitive transmission project it has ever assigned to its South region.

The commission’s order means the RTO can cancel its selected developer agreement with NextEra Energy Transmission (NEET) Midwest (NYSE: NEE) for the $115-million, 500-kV Hartburg-Sabine Junction project in East Texas. The grid operator recommended the project in 2017 (ER23-865).

MISO said that Texas’ 2019 right-of-first-refusal law prevented NEET Midwest from obtaining regulatory approval from the Texas Public Utility Commission to construct the project and meet a June 2023 in-service date. The grid operator said that after a fresh analysis of the project showed that it provided little value, it would not reassign the project to incumbent Entergy Texas. (See MISO Cancels Hartburg-Sabine Competitive Project.)

The project was intended to alleviate constraints in a load pocket straddling Texas and Louisiana.

NEET and the Southern Renewable Energy Association (SREA) attempted to save the project by lodging protests of the agreement’s cancellation with FERC. SREA has accused Entergy of strategically building generation near existing line routes to thwart projects that would open up Entergy’s service territory to outside generation supply. The nonprofit has said Entergy wants to preserve its load pockets. (See NextEra, SREA Protest Canceled MISO Project at FERC; SREA Criticizes Lack of MISO South Planning in FERC Tx Proceeding.)

SREA argued that MISO performed only a “limited” screening when it reexamined Hartburg-Sabine and did not conduct a more in-depth congestion analysis. The organization said the project could still be necessary to the MISO South system.

But the commission said MISO appropriately followed its tariff when it used schedule delays to trigger a project analysis and ultimately seek a dissolution of the developer agreement. FERC concluded it was “reasonable” for MISO to determine that NextEra was unable to complete the project.

“While NextEra and Southern Renewable disagree with MISO’s choice of outcome, we find that MISO appropriately exercised the discretion provided by its tariff in arriving at that outcome,” FERC said. “The issues NextEra and Southern Renewable raise do not provide a sufficient basis for us to find that MISO acted in a manner that is inconsistent with its tariff under the circumstances presented here.”

NEET maintained it was “optimistic” it could resume the project’s development following the 5th U.S. Circuit Court of Appeals ruling last year that Texas’ ROFR discriminates against nonincumbents in the portions of the state belonging to interstate transmission systems. Texas has since appealed the ruling to the Supreme Court. (See Texas Petitions SCOTUS to Review ROFR Ruling.)

“We disagree with NextEra’s argument that it is premature for MISO to find that NextEra is unable to complete Hartburg-Sabine given the status of Texas ROFR [l]aw litigation,” FERC said. “While it is true that the Fifth Circuit remanded the issue of the constitutionality of the Texas ROFR [l]aw under the Commerce Clause of the U.S. Constitution to the Western District, the Texas ROFR [l]aw is currently in effect.”

Entergy said it was appropriate for MISO to seek to terminate the developer agreement because the project can no longer deliver benefits.

In comments to FERC, Entergy said NextEra and SREA’s allegation that the utility is trying to stall outsider transmission projects or usurp those projects is untrue.

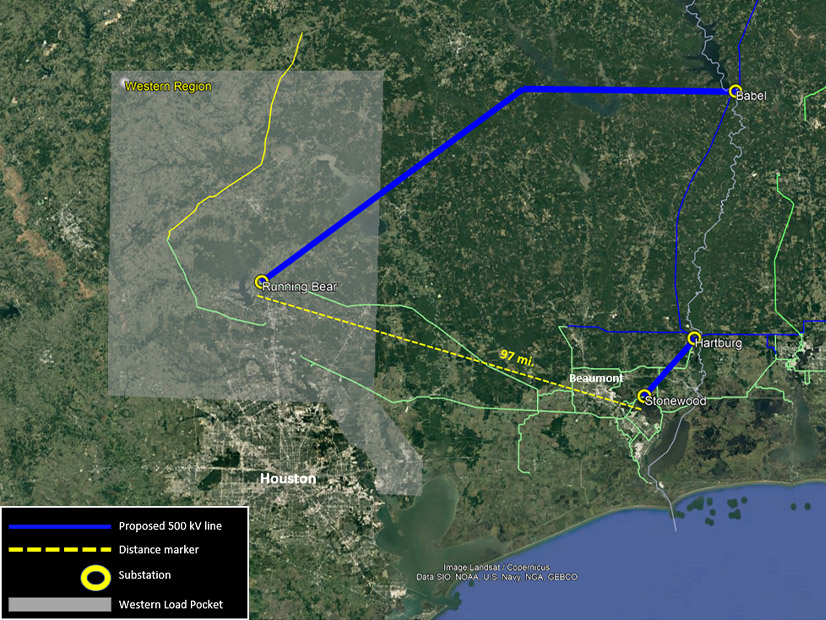

Entergy said its newly proposed, $1-billion Babel-Running Bear 500-kV project in East Texas is “completely different” from the Hartburg-Sabine project, counter to what NextEra alleged. Entergy gave notice to MISO that it intends to construct a substation and build a 150-mile 500-kV line to accommodate regional load growth and relieve the historically constrained Western Region load pocket. Unlike Hartburg-Sabine, a market efficiency project, the Babel-Running Bear project would be classified as a baseline reliability project and not be open to regional cost sharing.

The MISO stakeholder community has criticized Entergy for proposing billions of dollars of baseline reliability projects in the RTO’s South region in this year’s transmission-planning cycle. Stakeholders have pressed the grid operator to determine whether some of the projects could become more comprehensive, regionally allocated projects. (See Initial MTEP 23 Ignites Familiar Arguments over MISO South’s Reliability Spending.)

“Entergy believes that the transmission system should be planned and constructed to provide customers with reliable, reasonable cost electric service, including to accommodate the transition of a changing resource mix,” Entergy told FERC. “Among other things, transmission planning should consider generation solutions and local distribution facilities to ensure that the results of the planning process are efficient and will provide for a reliable grid.”