ERCOT stakeholders this week arranged a pair of workshops as they continue to work with staff to provide bridging alternatives for a market redesign intended to preserve and attract thermal generation.

The Technical Advisory Committee scheduled workshops for March 31 and April 10 to further define market changes that could be made until a final construct is in place. ERCOT staff plans to share a strawman for the meetings and present a final recommendation during the second meeting.

Staff then plans to present their recommendation to the ISO’s Board of Directors on April 18. If approved, the recommendation would then be handed over to the Public Utility Commission.

The PUC in January recommended to state lawmakers that ERCOT adopt a performance credit mechanism (PCM) as a reliability addition to the ISO’s energy-only market, intended to address resource adequacy and operational flexibility challenges. The PCM would retroactively issue incentive payments to dispatchable — and primarily thermal — generation that meets performance criteria during the tightest grid periods.

The legislature has pushed back on the PCM and filed a package of bills that include building 10 GW of gas-fired generation to sit on the sidelines until load shed is imminent. (See Texas Senate Lays out Changes to ERCOT Market.)

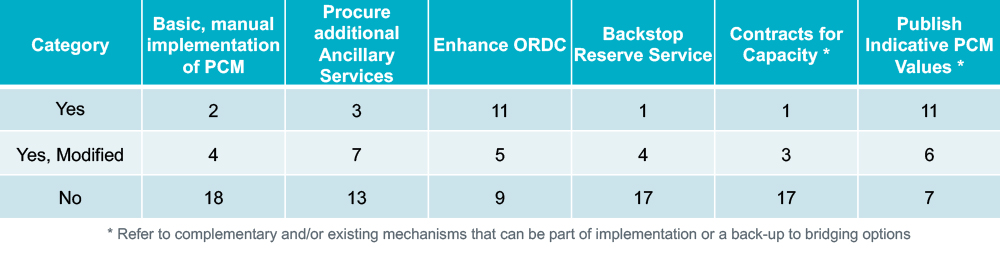

At the PUC’s direction, ERCOT staff has been soliciting input from stakeholders on a bridging mechanism until the final market design is developed. The options include a manually settled PCM, procuring more ancillary services, tweaking the operating reserve demand curve, and a backstop reliability service, previously offered by the PUC, to set aside capacity that is only dispatched during scarcity conditions.

Kenan Ögelman, ERCOT | ERCOT

Kenan Ögelman, ERCOT | ERCOTBy early this week, stakeholders had filed more than two dozen comments on bridging options, providing feedback and alternatives.

“At this point, I couldn’t tell you what our recommendations are going to be,” ERCOT’s Kenan Ögelman, vice president of commercial operations, told TAC during its meeting Tuesday. “We’re still kind of working through the comments and finalizing our position. You should know what we’re thinking by [April 10].”

Ögelman said staff’s summary of comments received so far indicate “some kind of a convergence” around changes to the operating reserve demand curve (ORDC) and an “indicative PCM value.”

“But the indicative PCM value on its own would not be a bridge solution, so we’re weighing that,” he said.

Credit Group’s Charter Approved

TAC approved a charter for its new Credit and Finance Sub Group (CFSG) that will replace the Credit Working Group (CWG). The new stakeholder group will be comprised of credit professionals responsible for ensuring that appropriate procedures are implemented to mitigate credit risk in ERCOT in a “fair and equitable” manner.

Austin Energy’s Brenden Sager, serving as the CFSG’s temporary chair, said the CWG’s original charter was used as a starting point. It will review ERCOT’s protocols on creditworthiness requirements or collateral calculations and provide recommendations to TAC. The group has yet to solicit members.

The CWG had reported to the board’s Finance and Audit Committee since 2004, but directors last year asked that they be briefed by ERCOT staff on market credit issues. TAC agreed to take on credit oversight responsibilities and consolidated the group with its Wholesale Market Subcommittee’s Market Credit Working Group. The latter group will be disbanded. (See “TAC Shares Changes with R&M,” ERCOT Board of Directors Briefs: Oct. 18, 2022.)

Aligning ISO with Infrastructure Protection Law

TAC’s combination ballot, approved by members 30-0, brings ERCOT into compliance with the state’s Lone Star Infrastructure Protection Act (LSIPA). The 2021 law prohibits businesses and government entities from entering into agreements that would grant direct or remote access to critical infrastructure, such as the Texas grid, with foreign companies from China, Iran, North Korea and Russia.

The ballot included a nodal protocol revision request (NPRR1155) that would amend a market participant’s eligibility criteria and make any entity that meets any of the LSIPA’s prohibited citizenship, ownership or headquarters criteria ineligible to register or maintain its market participant registration.

The combo ballot also included two other NPRRs, another binding document request (OBDRR) and a Load Profiling Guide revision (LPGRR). It additionally contains a second LPGRR, a revision to the Nodal Operating Guide (NOGRR) and related single changes to the commercial operations (COPMGRR), planning (PGRR), retail market (RMGRR) and settlement metering (SMOGRR) guides, resource registration glossary (RRGRR) and verifiable cost manual (VCMRR).

The ballot includes:

- NPRR1145: change the 15-minute level ERCOT-wide transmission loss factors (TLFs) in the settlement process from seasonal base case TLFs to state estimator-calculated TLFs in the energy management system and clarify non-opt-in entities’ deemed actual TLFs to remove behind-the-meter transmission losses.

- NPRR1157: require all revision requests be approved by the PUC before their implementation; add a credit review, Independent Market Monitor and ERCOT opinions, and the market impact statement to the board’s TAC report; and revise possible actions on RRs from “defer” to “table,” as currently captured in motions.

- COPMGRR049, LPGRR072, NOGRR248, PGRR104, RRGRR034, SMOGRR026 and VCMRR036: require all RRs be approved by the PUC before implementation; standardize all RRs considered by the ERCOT board; add IMM and ERCOT opinions, and the market impact statement to the TAC Report; and revise possible actions on RRs from “defer” to “table,” as currently captured in motions.

- LPGRR071: halve the required lead time from 120 to 60 days for an opt-in entity to provide ERCOT the monthly usage and demand values for its electric service identifiers (ESI IDs).

- OBDRR044: eliminate the weatherization-inspection fee’s sunset date and change its invoicing period from a quarterly to a semiannual basis.

- RMGRR173: requires all RRs be approved by the PUC before their implementation; standardize all RRs to be considered by the ERCOT board; add a credit review, IMM and ERCOT opinions, and the market impact statement to the board’s TAC report; and revises possible actions on RRs from “defer” to “table,” as currently captured in motions.