BALTIMORE — With major new projects coming online starting this year, the offshore wind industry is turning to longer-term goals of rolling out more than 100 GW of capacity and setting up the associated supply chains, speakers said Wednesday at the Business Network for Offshore Wind’s International Partnering Forum (IPF) Conference.

The conference marked the 10th anniversary for BNOW, as the conference has grown from occupying a small conference room to filling the Baltimore Convention Center, CEO Liz Burdock said.

“Together, we have grown the U.S. offshore wind industry,” Burdock said. “We’ve taken it from legislation to demonstration and this year to commercialization.”

The federal Inflation Reduction Act passed last year includes direct subsidies for offshore wind, but also seeks to grow new markets for OSW, such as hydrogen. Passage of the law makes it impossible to accurately forecast the industry’s eventual size, Burdock said, but the Biden administration has a goal of 110 GW by 2050, and states are starting to step up their own goals, which amount to about 77 GW.

Maryland Gov. Wes Moore (D) announced a new, more aggressive target for the technology than his predecessor, who had set a goal of 1.6 GW.

“Once the Bureau of Ocean Energy Management approves the new lease areas for our state, Maryland will aim to produce 8.5 GW of power through offshore wind,” Moore said. “And let’s be clear, that’s enough energy to power nearly 3 million homes.”

Other states either have raised — or are planning to raise — their targets for offshore wind, with New Jersey last year announcing a new 11-GW target, and New York considering raising its 9-GW goal to 16 to 19 GW.

Moore hopes that expanding Maryland’s goal will attract new industrial jobs to Baltimore, which used to be a major producer of steel.

“The steel we made in Baltimore helped win two world wars,” Moore said. “The steel we made in Baltimore helped stand up the tallest buildings in the world. The steel we made both helped create tens of thousands of jobs and millions of dollars of wealth.”

Demand dropped off in the later 20th century and the mills shut down, but now offshore developer US Wind is planning to lease 100 acres where an old steel mill stood as it builds out the resources needed for its planned offshore wind farms. Other firms are setting up shop in the state to further the industry as well.

“Maryland steel led the American economy in the 20th century,” Moore said. “I want Maryland wind to lead the American economy in the 21st century.”

Moore said he ordered the Maryland Energy Administration to focus on delivering grants to companies that make up key links along the offshore wind supply chain. Increasing the high-paying jobs associated with the industry can change lives and lead to generational prosperity, he said.

“That’s why I am deeply serious when I say that Maryland will lead in offshore wind,” Moore said. “I mean that. I am deeply serious. When I say that we have the real estate, the brainpower, the assets and the agenda to get it done, I mean that.”

Job Opportunity

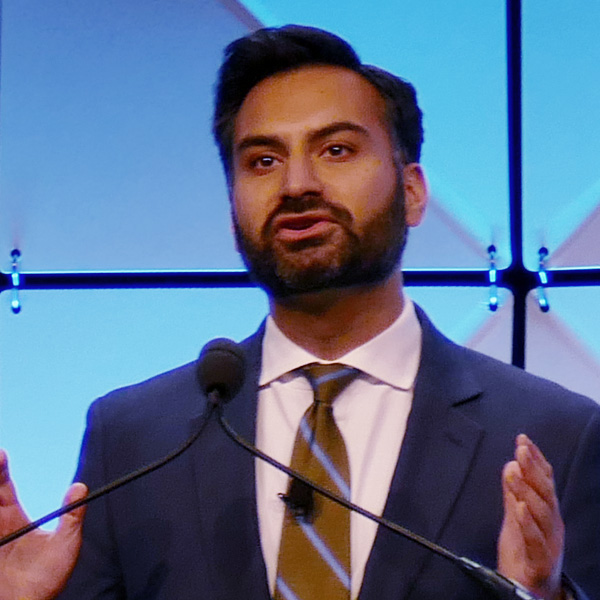

White House National Climate Adviser Ali Zaidi | © RTO Insider LLC

White House National Climate Adviser Ali Zaidi | © RTO Insider LLC

President Biden in 2021 set a goal of building 30 GW of offshore wind by 2030, which many at the time thought was ambitious, White House National Climate Adviser Ali Zaidi said. But that target can be reached, and the industry could even go well beyond it, he said.

“And the reason is because this is not just an opportunity for electricity,” Zaidi said. “It’s an opportunity to create good-paying jobs across manufacturing, and shipbuilding and port operations — construction jobs, operations jobs and more as we build a brighter, more sustainable and fairer future for all of us all across the United States.”

Offshore wind investments tripled last year, totaling $10 billion, with 46 states having some piece of the supply chain for offshore wind, he added.

“Through the Inflation Reduction Act, the president has delivered game-changing support for building clean energy components here in the United States of America,” Zaidi said. “We’re working to swiftly implement the manufacturing tax credit to support U.S. production of offshore wind components, like blades and nacelles and towers and foundations.”

New York’s 9-GW target for offshore wind is just the start, said New York State Energy Research and Development Authority CEO Doreen Harris.

“New York certainly has some of the most aggressive and ambitious climate and clean energy objectives in the nation, and … talk about something we need more of: we need more offshore wind,” she added.

While New York and other states want to attract the same kind of jobs that Gov. Moore does, Harris said states could also benefit from working together to develop regional hubs for with their neighbors.

Setting ambitious, long-term goals is a big help for the industry because those, in turn, will attract the kind of supply chain investments needed to produce jobs and create the wind farms themselves, US Wind CEO Jeff Grybowski said.

“We know that we won’t be able to do it on our own here in the U.S. The supply chain is paying attention — a lot of attention — to U.S. projects,” he said. “The state policy goals are critically important to that because this industry needs the long-term vision.”

The policy support from states and the federal government has coalesced to the point where real investments are being made by global suppliers feeding domestic developers, he added.

The domestic industry will have to initially rely on foreign supply chains because the expertise in offshore wind is in Europe, although that will have to change over time.

“The global supply chain is not big enough to service the rest of the world, never mind throwing in the U.S. requirements as well,” said Tony Appleton, director of offshore wind for engineering firm Burns & McDonnell. “So, it’s very important the U.S. develops its own supply chain.”

On top of that, Americans will eventually get “pretty annoyed” about supporting European jobs in the supply chain through their electric bills, so developing domestic capacity will be more politically sustainable, he added.