The U.S. Energy Information Administration on Wednesday reported that domestic use of natural gas reached a six-year January low this year.

Domestic consumption in February 2023 was the lowest in five years for that month. As a result, EIA said in its Short-Term Energy Outlook, natural gas inventories at the end of March were 19% higher than the average over the preceding five years.

Use of natural gas is widely targeted for gradual reduction in a planned transition to renewable energy sources, but the reduced use this past winter was attributed to mild weather and the resulting decrease in demand for it as a heating fuel in the residential and commercial sectors.

This varied by region. Natural gas accounts for 70% of space-heating fuel in the Midwest Census Region and 52% in the Northeast Census Region, for example. Residential and commercial gas consumption was down 16% and 22% in those two regions, respectively, from the January-February average in the preceding five years.

But in the West Census Region, one of the coldest winters in years caused gas consumption to surge in the electric power sector more than in the residential and commercial sectors: 33% more gas was burned in January and February than the average over the preceding five years, EIA said.

The U.S. is the world’s largest producer of natural gas and more recently became the largest exporter of its liquid form. EIA projects continued year-over-year growth of LNG exports in 2023 and 2024.

Meanwhile, EIA said Tuesday that it expects continued and long-term growth in U.S. production of “associated natural gas” — gas that is extracted from oil formations.

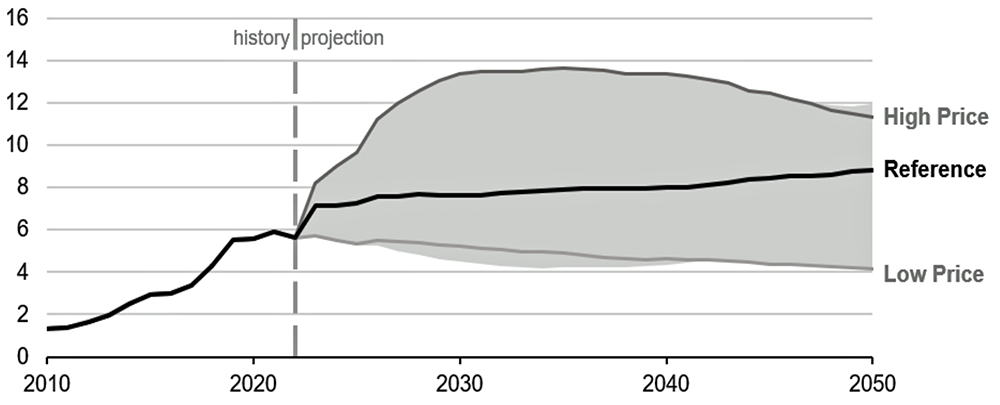

U.S. natural gas production (Tcf) is expected to increase through 2050. | EIA

U.S. natural gas production (Tcf) is expected to increase through 2050. | EIA

Associated natural gas historically was a footnote, accounting for only about 6% of domestic supply as recently as 2010. But in its Annual Energy Outlook, EIA is projecting it will account for approximately 20% of total U.S. natural gas production through 2050.

EIA bases its prediction on three trends:

- rising oil prices that will support increased production from nontraditional or unconventional oil formations that contain significant amounts of natural gas;

- the tendency of these unconventional oil wells to produce a higher ratio of natural gas to oil as they age; and

- increasingly favorable economics for associated natural gas resources, in part because of official policies such as the Inflation Reduction Act’s penalties for venting and flaring methane.