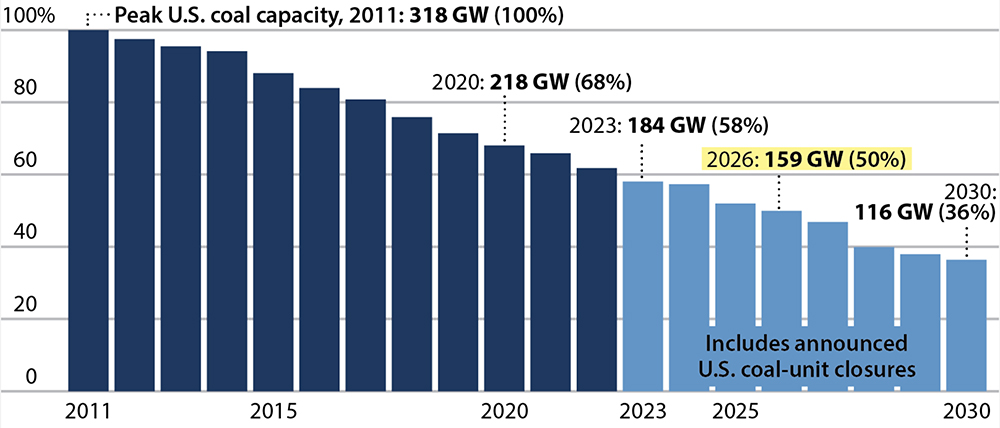

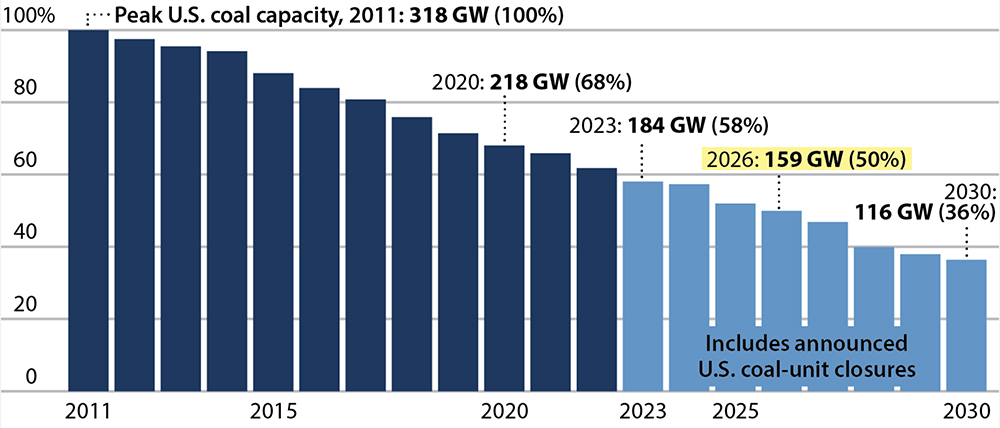

An energy market research group estimates that 159 GW of coal-fired power production will be online in the U.S. in 2026, down half from a peak of 318 GW in 2011.

By 2030, the Institute for Energy Economics and Financial Analysis report projects, the U.S. coal-fired fleet will be down to 116 GW, as gas, wind and solar power supplant it.

Fewer than 200 large units — those rated at 50 MW or more — now operating have not announced retirement dates, IEEFA said. The organization also noted an even steeper decline: Coal-fired plants now burn less than half as much coal and produce less than half as much electricity as they did in 2011.

Data were derived from internal IEEFA research, the U.S. Energy Information Administration, S&P Global and company reports.

IEEFA data analyst Seth Feaster, author of “U.S. on Track to Close Half of Coal Capacity by 2026,” said in a news release that the continuing trend does not bode well for the industry.

“This milestone is another clear sign of the ongoing and deep restructuring of the U.S. coal industry, as demand for the fuel continues to drop quickly,” he said. “It is likely to result in significant mine closures, layoffs, and falling tax and royalty payments in coal-producing states.”

IEEFA states that it takes a nonpartisan, evidence-based approach to its mission, which is to accelerate the transition to a diverse, sustainable and profitable energy economy. The 501(c)(3) nonprofit corporation lists multiple climate advocacy organizations among its financial supporters.

The Institute for Energy Economics and Financial Analysis projects a steady decline in U.S. coal-fired power generation. | Institute for Energy Economics and Financial Analysis

The Institute for Energy Economics and Financial Analysis projects a steady decline in U.S. coal-fired power generation. | Institute for Energy Economics and Financial Analysis

Its report speculates that coal power generation may decrease even more quickly than projected because of higher operation and maintenance costs for the remaining units, most of which went into service in the 1970s.

EPA in the last two months has taken multiple steps to tighten emissions regulators from coal-burning power plants; these are expected to prompt additional retirements. (See EPA Proposes Tougher MATS Regs on Coal Power Plants.)

The long-running effort to restrict and or reduce coal as a fuel in the U.S. has drawn criticism from the coal industry and its allies as a threat to energy security. But as federal and many state governments press to speed the transition from fossil fuels to emissions-free alternatives, some grid operators are voicing similar concerns. (See PJM Chief: Retirements Need to Slow down.)

The IEEFA report projects more than 80 GW of coal retirements from 2023 through 2030 and indicates 10.5 GW of the retired plants are expected to be converted to burn natural gas.

The pace of retirements will be steady over time, the report said, but not from year to year, as construction delays have ensued on renewable energy projects. For example, 11.8 GW of coal-fired capacity is currently announced for closure in 2023, less than 3 GW in 2024, 17 GW in 2025, roughly 10 GW in 2026 and 22 GW in 2027.

With the 2022 passage of the landmark Inflation Reduction Act, and its heavy emphasis on accelerating the energy transition and building a supply chain for it, the numbers could be in flux for a while.

The report noted that multiple factors in favor of coal in 2022 — soaring natural gas prices, high demand for power and the post-pandemic economic rebound — were counterbalanced by railroad delivery problems, a labor shortage and utility reluctance to increase coal use.

When coal’s use as a fuel for generating electricity in the U.S. peaked in 2011, it was responsible for 44% of power generation, EIA data cited in the report indicate. Based on current announcements and trends, coal’s power market share could decrease to 10% or less by 2030, IEEFA said.