The term “green hydrogen” may be a misnomer under rules the U.S. Treasury Department is designing to determine the size of the federal production tax credit that a producer can claim using electrolysis.

It will come down to the amount of carbon dioxide and other greenhouse gases emitted to generate the electricity most companies will use to produce the hydrogen and whether they tried to net out those emissions with the purchase of renewable power. Even with the greenest method of production, that amount will depend on how green was the electricity used to power the technology.

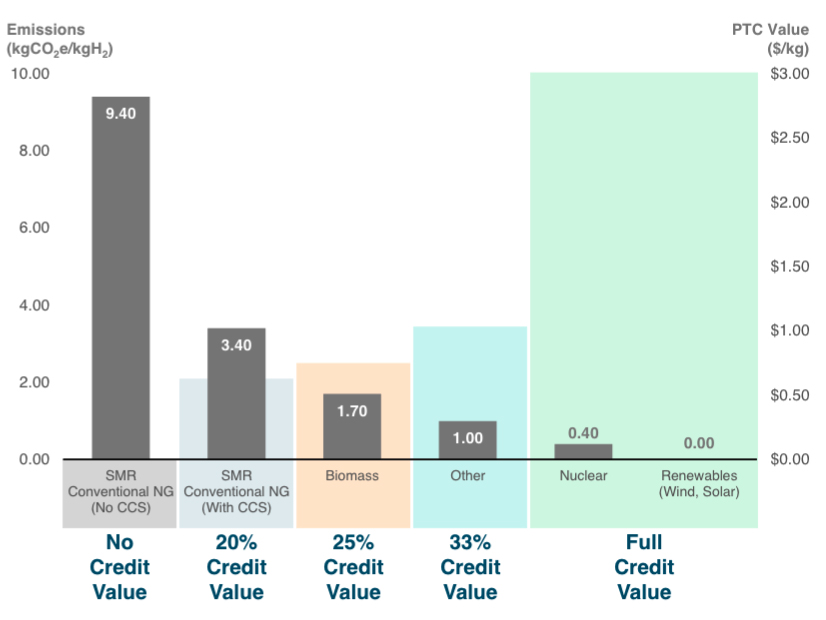

The argument is more than academic because the Treasury and the Department of Energy are expected to use the calculated level of GHG emissions across regional grids to determine the PTC. Billions of dollars are at stake.

A company will be able claim up to $3/kg of hydrogen produced with renewable or nuclear power, or as low as 60 cents/kg for hydrogen produced by steam reformation of methane, and then only if the resulting carbon dioxide is either sequestered or sold as an industrial gas.

Allison Nyholm, ACORE | E3/ACORE

Allison Nyholm, ACORE | E3/ACOREOne of complicating factors is whether to account for those new carbon emissions annually or on an hourly basis. Underlying assumptions are that clean grid power varies by region, by season and time of day. Electrolyzers will create a new, heavy load, likely causing power companies to run dirtier generation during times of peak demand.

In a report published last week, the American Council on Renewable Energy (ACORE) and energy consulting firm Energy and Environmental Economics (E3) argue that calculating emissions on an annual basis would likely lead to lower overall net carbon emissions and higher annual hydrogen production rates than calculating by the hour.

“An annual matching requirement, in which hydrogen producers would need to procure specified clean energy production to match their consumption on an annual basis, would allow electrolyzers to more cost-effectively operate at a higher capacity factor, reducing the cost of hydrogen production,” the report concludes.

The study found that calculating an electrolyzer company’s carbon emissions and efforts to offset them on an hourly basis could force electrolysis operations to shut down during times when the grid reaches peak demand, potentially driving up hydrogen prices.

Earlier studies by other organizations reached the opposite conclusion: that hourly accounting would lead to net-zero carbon in the atmosphere while still cutting the cost of hydrogen. The Treasury has not announced how it will address the issue. In addition to commissioning the study, ACORE has submitted comments to the department.

Arne Olson, E3 | E3/ACORE

Arne Olson, E3 | E3/ACORE“We began with three basic assumptions … that lowering the cost of hydrogen production is a fundamental goal to the tax incentives and should be considered in any analysis,” Allison Nyholm, vice president of policy and public affairs at ACORE, said at the start of a webinar last Wednesday to explain the findings of the report.

“Building out [hydrogen production] to scale requires considering the capital as well as energy costs for hydrogen production, and that … new clean energy development created through the Inflation Reduction Act … will result in lower greenhouse gas emissions, both independently and when combined with hydrogen production at scale,” she said. “Our assumption is that we’re looking at 500-MW electrolyzers that operates at 90% utilization rates. We account for capital costs.”

Noting that electrolyzers remain expensive, Nyholm said one of the objectives of the study was to provide an accurate picture of the cost of hydrogen production across regions and as well as clean energy use.

Arne Olson, senior partner at E3, said one of the underlying assumptions of the study is that “the relationship between supply and demand is purely contractual” across the grid, meaning the sources of power energizing the grid are indistinguishable.

Greg Gangelhoff, E3 | E3/ACORE

Greg Gangelhoff, E3 | E3/ACORE“Any new electric load, including hydrogen [production], is served with power from the grid, and all else [being] equal, that’s going to increase carbon emissions, because carbon-emitting sources will need to increase their production to supply that load,” he said.

The only exception would be an electrolyzer and a renewable power supplier both operating completely off-grid, he added.

Companies wishing to use clean power account for the carbon content of grid power they are using by contracting with a clean power producer to “inject” that power into the grid, he said. In other words, the relationship between the supplier and company using it is purely contractual, he added.

Figuring out how the electrolyzer industry would affect the grid over different parts of the nation involved modeling 40 markets on an hourly and seasonal basis.

“The reason for selecting these markets was ultimately to see the impact of electrolyzer operations in a widespread of market contexts,” said Greg Gangelhoff, an E3 analyst. “The benefit of … an annual matching approach, the electrolyzer can ramp down to avoid those highest-priced hours. And by avoiding those highest-priced hours, you are also avoiding some of the highest hourly marginal emission rates … giving you a kind of a double bang for your buck in terms of efficiency and reducing cost.”