Dominion Energy (NYSE:D) on Friday said warm weather in the first quarter of this year led to lower operating earnings of 99 cents/share, compared to $1.18 a year earlier.

Despite the mild winter weather, Dominion CEO Robert Blue said the firm was in a good position given projected demand growth and the new Virginia law on regulations, providing it with certainty to make needed investments going forward. (See Virginia Legislature Passes Utility Regulation Bills Backed by Dominion.)

“With nearly unanimous bipartisan support, the legislation provides the certainty we need to fund and execute critical energy investments in support of the commonwealth’s robust electric demand growth, long-term energy security and reliability, leading decarbonization goals and impressive economic growth,” Blue said on a conference call with analysts.

Blue said the new law will lead to lower customer bills through the elimination of $350 million in riders and the securitization of fuel costs, cutting the average residential customer’s bill by about 10%, which positions the company’s Virginia utility about 21% below the national average.

“The law prescribes certain regulatory parameters for use in rate-setting for the next few years and establishes an authorized ROE of 9.7%, up from 9.35% currently,” said Blue.

The new law compliments previous legislation — such as the Virginia Clean Economy Act, which set up decarbonization goals for the utility in midcentury — to create a regulated utility framework that balances customer benefits, regulatory oversight and Dominion’s need for capital to invest in its system for decades to come, he added.

“That stability and certainty is especially critical now, as we ramp into the very substantial and growing multidecade utility investment required to address resiliency and decarbonization public policy goals,” said Blue.

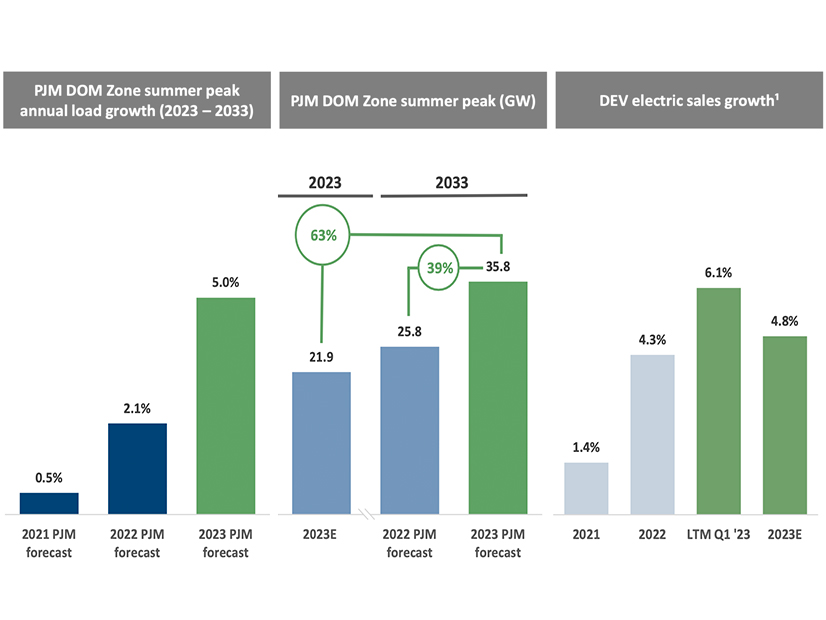

The decarbonization policy comes on top of fast load growth in Dominion’s system, which is dominated by data centers in Northern Virginia. PJM’s load forecast for Dominion’s territory this year calls for 5% growth, compared to 2.1% last year, and the RTO is projecting a 2033 peak demand of 35.8 GW, a 39% increase over last year’s projection of 25.8 GW.

“This isn’t hypothetical growth. It’s demand we’re seeing and investing to serve every day,” Blue said.

Dominion is working on a business review, but the exact plans are still being worked out. Blue and other executives offered no real details beyond their schedule. The firm plans to discuss the review at an investor day in the third quarter.

While the firm said recent developments in Virginia set it up for future success, exactly who will be helping to implement the new law is still unclear because the State Corporation Commission is down just one member.

Former commissioners have been stepping in to help vote out orders as needed, and the commission has been able to issue several orders on Dominion cases recently, including approving a transmission line needed to serve growing load from data centers and the company’s request to procure 800 MW of solar and storage. (See Virginia SCC Approves 800 MW of Renewables for Dominion.)

The Virginia Constitution gives legislators the right to appoint new members to the SCC, though if they are out of session, then the governor can make temporary appointments, Blue said.

“If you look just at where we’ve been in Virginia: We’ve got low rates; we’ve got strong reliability; we’ve got a clear mandate from policymakers for energy security within an energy transition,” Blue said. “And as our [integrated resource plan] indicates, we’ve got very strong load growth. So, we’re sitting in a very good spot moving forward in the Virginia regulatory process.”