Stakeholders at the NYISO Transmission Planning Advisory Subcommittee and Electric System Planning Working Group (TPAS/ESPWG) meeting Friday learned how the ISO assessed the seven transmission projects chosen from the Public Policy Transmission Need (PPTN) solicitation for Long Island.

The solicitation was issued in August 2020 after assessments showed that Long Island’s existing transmission system was not capable of exporting offshore wind power to the rest of New York at levels exceeding its native load. NYISO identified seven viable transmission projects out of 19 submissions that the ISO found could expand Long Island’s export capabilities by unclogging constraints across the island. (See “Long Island PPTN Report,” NYISO Previews Plan to Expedite Interconnection Queue.)

NYISO presented cost cap assessment results, projected performance and production costs, and potential economic benefits for the projects.

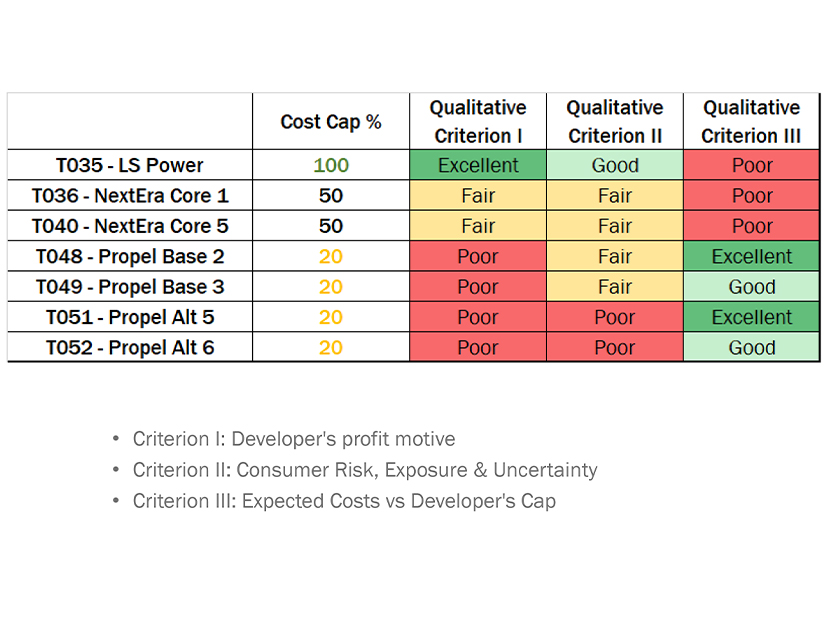

The ISO used three criteria to assess developers’ proposed project cost cap, which is the amount of money they can recover from customers for the construction and operation of their transmission project: developers’ profit motive, consumer risk exposure and uncertainty, and the expected project cost versus the developer’s cost cap.

Respectively, these criteria evaluate how well developers incentivize their projects to contain costs via their proposed cost cap; how effectively the cost cap protects consumers from cost overruns; and how divergent the developer’s cost cap is from one estimated by SECO, an independent market research consultancy.

Summary of Long Island OSW project cost estimates and economic benefits | NYISO

Summary of Long Island OSW project cost estimates and economic benefits | NYISO

For the first and second criteria, the results indicated that projects with hard caps — meaning little to no recovery of expenses incurred above the cap — were assessed better than those with soft caps, meaning incurred costs above the cap are shared between investors and customers. This means hard-capped projects tend to have lower risk profiles.

Conversely, results for the third criterion show projects with hard caps tended to have significantly different proposed costs than those estimated by SECO, while soft-cap projects were closer.

According to NYISO, the qualitative results should not be read as weighted scores indicating whether one transmission project scores higher or lower than another, as each criterion is not a “smoking gun,” but instead should be considered collectively to “give a global perspective that holistically” identifies how each project can best fit New York’s needs.

In its review of project impacts, NYISO also found potentially immense economic, environmental and grid reliability benefits over the next two decades. The projects could reduce future consumer costs, generate production savings across New York and enable up to $3 billion in avoided upstate solar capacity capital costs.

The ISO compared the potential production cost savings and avoided costs from building out either upstate solar or Long Island dispatchable emission-free resources (DEFRs) to the buildout costs projected by the developer and SECO.

As noted by stakeholders during the meeting, DEFRs do not exist at scale, but they represent a significant element of New York’s strategy for achieving its energy goals.

The results show that a project’s magnitude of savings and its benefits are closely correlated to the amount by which it increases Long Island’s import capability and reduces energy curtailment.

The ISO is targeting the TPAS/ESPWG meeting this Thursday to present and review the draft report. It will spend the rest of the month seeking stakeholder advisory votes on the report.

Queue Window Comments

Also at Friday’s TPAS/ESPWG meeting, NYISO shared stakeholder feedback and comments on its interconnection queue proposal, which emphasized stakeholders’ continued apprehension.

NYISO and stakeholders have been debating the proposed overhaul of the interconnection process, and the recent feedback highlighted both developers’ concerns about the lack of transparency on implementation and transmission owners’ calls for greater scrutiny on the requirements for projects seeking interconnection. (See NYISO Stakeholders Debate Proposed Interconnection Queue Overhaul.)

This debate was best captured during a discussion about the overlapping nature of projects in a queue window between Anne Reynolds, executive director of the Alliance for Clean Energy, and Doreen Saia, an attorney with Greenberg Traurig.

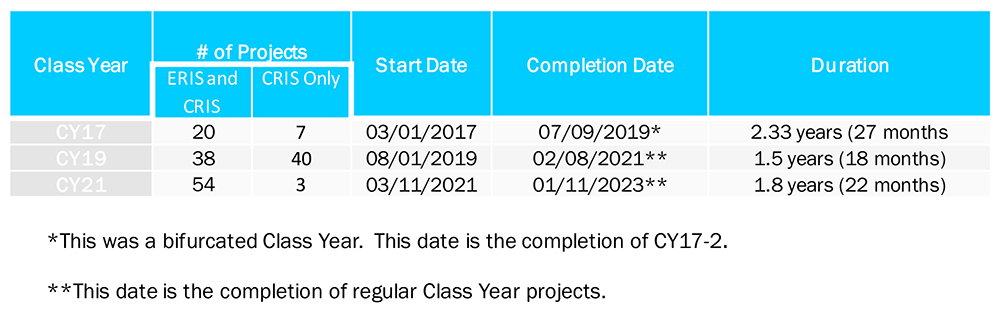

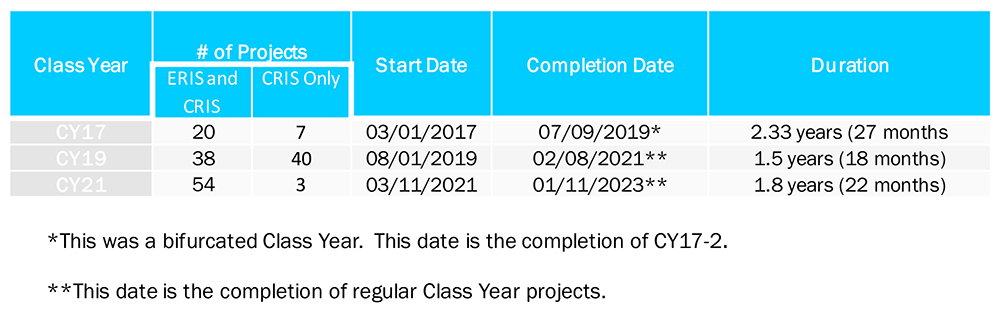

Historical statistics on NYISO’s class year interconnection study | NYISO

Historical statistics on NYISO’s class year interconnection study | NYISO

Reynolds asked why some TOs appeared opposed to overlapping clusters of projects, saying, “This is somewhat fundamental to [NYISO’s] redesign proposal.”

Saia responded that they were not outright opposed to overlapping projects but thought it was important “to stay open with how we address concerns identified.”

“This whole effort feels like that old joke about, how do you eat an elephant? A bite at a time. And we have this enormous elephant in front of us, and we are trying to figure out how to digest it while also trying to turn it into a different kind of elephant,” she said.

Anthony Abate, lead energy market adviser with the New York Power Authority, concurred. “We’re eager to get into the details,” but “we are looking at the next number of months and saying, ‘Holy moly, there’s still a lot of details that need to be figured out.’”

NYISO will return to the TPAS later this quarter after refining its proposal based on solicited feedback and begin vetting tariff revisions.