The New England States Committee on Electricity (NESCOE) pressed transmission owners Thursday to increase the transparency of their asset condition projects and incorporate them into ISO-NE’s planning process.

In a presentation to the Planning Advisory Committee (PAC), NESCOE also called for more information on spending plans and assumptions used in estimating project costs. NESCOE also suggested the RTO create guidelines around right-sizing transmission projects and integrating asset condition project planning into the RTO’s regional planning process.

Thursday’s discussion came in response to NESCOE’s Feb. 8 memo to the New England Transmission Owners (NETOs), which called for maximizing the use of the region’s transmission, saying that “modernizing planning processes and protecting system reliability will be fundamental in the transition to the clean energy future.”

Asset condition projects are undertaken by transmission owners to maintain transmission infrastructure that is aged or damaged. While ISO-NE directs the regional transmission planning process for transmission reliability projects, asset condition projects are not included in this process and are therefore subject to less scrutiny from other stakeholders.

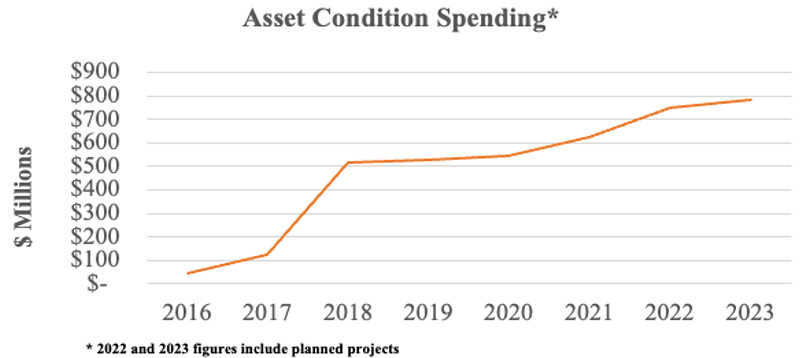

NESCOE has previously highlighted how costs associated with asset condition projects have been trending upward in recent years, with over $3 billion in projects currently proposed, planned or under construction. Asset condition project costs are eventually passed on to ratepayers.

“The process by which asset condition projects are developed by NETOs, reviewed by ISO-NE, states and the public, approved for rate recovery, and considered in overall transmission system needs and planning is antiquated and ultimately, inadequate,” NESCOE wrote in its February request to reassess the planning process. “It is the right time to implement planning process improvements to protect consumers from excessive costs and to maximize the use of all transmission assets by moving Asset Condition Projects from the current siloed, notice-based method into meaningful and holistic transmission system planning.”

In a memo sent to participants prior to the PAC meeting on behalf of consumer advocate members of NEPOOL, Synapse Energy Economics argued that the current process risks putting unnecessary burdens on ratepayers.

Asset condition spending since 2016 | NESCOE

Asset condition spending since 2016 | NESCOE

“Asset condition spending now constitutes the majority of new regional transmission investments and is projected to continue increasing,” Synapse wrote. “Ratepayers ultimately bear the costs for asset condition projects, but unlike other investments that have cost reviews built into approval processes, there is little to no meaningful check on the prudency of asset condition spending.”

NESCOE wrote in its February memo that modernizing planning procedures is also important in anticipation of increased reliance on clean energy technologies in the energy transition.

“The question of whether and to what extent to ‘right-size’ transmission to account for broader potential needs will arise more often in the future as the region considers transmission expansion to account for clean energy resources and state decarbonization requirements,” NESCOE wrote.

In its March 2 response to NESCOE’s memo, the New England Transmission Owners expressed their support for a review of the planning process while emphasizing their commitment to reliability and transparency. “Specifically, we agree that there is an opportunity to better integrate asset condition planning with longer-term planning for transmission to meet future system needs,” they wrote.

At the PAC meeting, NESCOE asked for feedback from stakeholders to be submitted to pacmatters@iso-ne.com by June 2.

Asset Condition Projects

Also at the PAC meeting, National Grid and Eversource outlined their plans to spend a total of $492.4 million on infrastructure updates and repairs, while New Hampshire Transmission detailed a projected $14 million cost increase for its Browns River capacitor bank station.

- New Hampshire Transmission, a subsidiary of NextEra Energy, said that the cost estimate for the capacitor bank station it is building near the Seabrook nuclear plant in Southern New Hampshire has more than doubled, increasing from $8.9 million to $22.9 million. The company said that most of the projected increase — $10.9 million — is because of additions to the scope of the project, with an additional $3.1 million increase resulting from rising costs, including changes in commodity prices.

- National Grid projects that the relocation of its substation in Adams, Mass., will cost $133.5 million, with an expected in-service date of early 2030. The current substation is located in a wetland area along Hoosic River and is frequently subject to flooding events. The proposed new location is at a higher elevation next to a mobile home neighborhood in North Adams.

- Eversource expects to spend a cumulative $358.9 million on a series of transmission infrastructure rebuilds and replacements in New Hampshire. In Northern New Hampshire, the company would replace wood structures with new steel structures and install optical ground wire on 115-kV lines B112, Q195 and U199, with respective in-service dates of late 2024, late 2026 and mid-year 2026. The company would also replace wood structures with steel structures and replace 49 circuit miles of shield wire with optical ground wire on 115-kV and 345-kV lines in Southeastern New Hampshire, with in-service dates ranging from late 2023 to early 2024.