Changes meant to bolster CAISO’s day-ahead market and a planned day-ahead extension of its Western Energy Imbalance Market won approval from the ISO’s Board of the Governors and the market’s Governing Body on Wednesday.

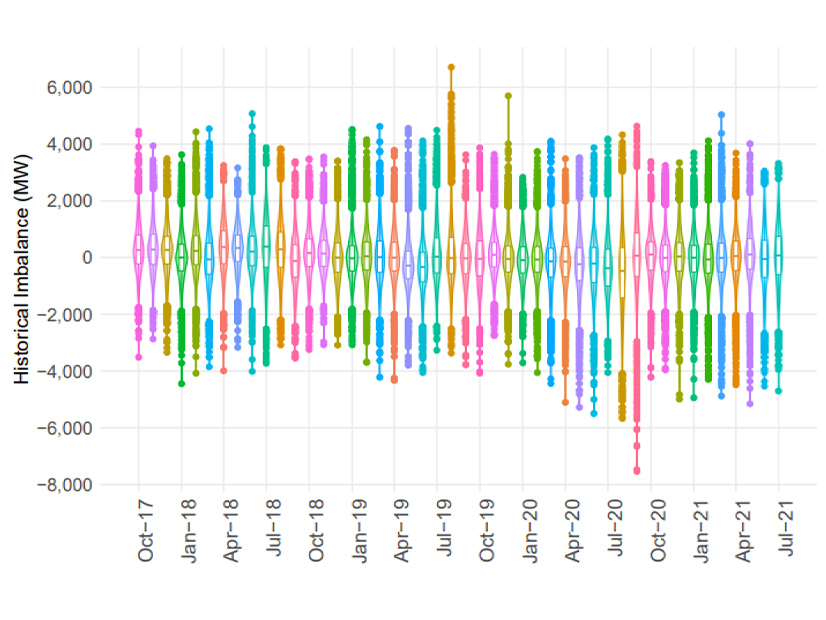

The new day-ahead market enhancements will introduce an imbalance reserve product meant to deal with increasing uncertainty in the net-load forecast between day-ahead and real-time markets, driven largely by the proliferation of weather-dependent solar and wind generation in the West.

“This proposal is intended to give the ISO better tools to be able to handle the growing challenges involved in managing the electrical grid, specifically around growing uncertainty and variability,” Becky Robinson, CAISO’s principal economist, said at the board and Governing Body’s joint meeting Wednesday.

“It is the latest in a series of steps to devise market products and tools to procure and incentivize flexibility, which is increasingly needed and more valuable because of the increasing quantities of weather-dependent renewable generation,” Robinson said. “This is a trend [facing] ISOs and RTOs across the country, and it is an important incremental step on top of our existing flexible-ramp product in the real-time market.”

The imbalance reserve product is designed to procure flexible reserves to cover supply-and-demand differences between the day-ahead forecast and real-time conditions.

For the WEIM’s proposed extended day-ahead market (EDAM), the imbalance reserve product is “essential … as it best ensures EDAM entities, including the ISO, can benefit from the footprint-wide diversity in the day-ahead market’s optimization,” CAISO’s revised final proposal states.

The interstate WEIM, currently a real-time-only market, includes 79% of load in the Western Interconnection. CAISO is hoping many real-time participants also sign up for EDAM.

Robinson said the imbalance reserve product is especially important for the EDAM because it will ensure there are sufficient offers into the real-time market to “address system needs that may well turn out to exceed day-ahead energy awards.”

It will increase reliability and economic benefits for EDAM participants and increase confidence in the market, she said.

The enhancements are also meant to improve the residual unit commitment process, CAISO said.

To address uncertainty between day-ahead forecasts and real-time supply, “market operators have historically taken manual actions outside of the market framework to procure additional capacity in the day-ahead time frame,” the proposal states. “Specifically, grid operators increase the demand forecast used in the day-ahead market’s residual unit commitment process.”

That can distort price signals and mask the value of more flexible resources, Robinson said.

Introducing imbalance reserves in the day-ahead time frame will “greatly decrease the need for grid operator adjustments to the demand forecast used in the residual unit commitment process, creating a more efficient and effective market outcome,” the proposal states.

The enhancements were developed in a stakeholder process that began in 2019 and involved 17 stakeholder meetings and four straw proposals. CAISO had expected to bring the proposal to the CAISO and WEIM boards in February but extended the stakeholder process to May to discuss alternative approaches.

One result was the decision to continue refining the effort with recommendations from a working group of stakeholders as more is learned about its real-world effects.

Commenters were consistent in their message that this is a new product, still in development, and with a number of unknowns, said Jan Schori, vice chair of the CAISO board.

“The bottom-line message I came away with is this that we do need to get on with this; get the software in development; get going on the design and start testing it,” Schori said before Wednesday’s unanimous vote, adding, “I think we’re at a point where it is logical to make that decision today.” But she asked CAISO management to regularly update the two boards on the project’s progress.

CAISO CEO Elliot Mainzer responded, “You have my absolute commitment on that.”