All the Albuquerque Public Schools (APS) system wanted to do was put some solar panels and storage at its largest high school, which has a huge campus and, at times, five-figure electricity bills. And APS had federal and state grants to help pay for the project.

But, according to Tony Sparks, APS’s HVAC and energy projects manager, the 850-kW solar system and accompanying battery storage have now been sitting at the school for close to a year, unable to connect to the distribution system, while school officials have struggled through a Kafkaesque interconnection process.

Beginning in September 2021, a yearlong initial review by APS’s local utility required biweekly meetings with the utility’s interconnection team and was followed by a series of requests for supplemental reviews, Sparks said Wednesday during a webinar on the bottlenecks that storage projects face at the distribution level.

“I didn’t know there were so many supplemental reviews available — technical and grid risk and modification,” he said. “They had a lot of names for them, but each time they would start a new one, they’d say, ‘OK, it’s going to take at least another 30 or 60 business days for this particular one.’ … And I have to say, we felt like we were getting a bit of a runaround.”

A meeting of all stakeholders last month finally resulted in a conditional approval, providing APS made specific upgrades to the distribution system, which, Sparks reported, have been delayed at least 20 weeks because of supply chain and labor issues. Beyond the extra expenses of the interconnection process and upgrades, the school system has lost a “couple hundred thousand dollars” in savings the solar and storage were expected to provide, he said.

“The challenges of this project on the interconnection side [could] greatly discourage development of this kind of project,” Sparks said. “If we didn’t have so much tenacity and enthusiasm, and so many people involved … I don’t think we would have remained in there.”

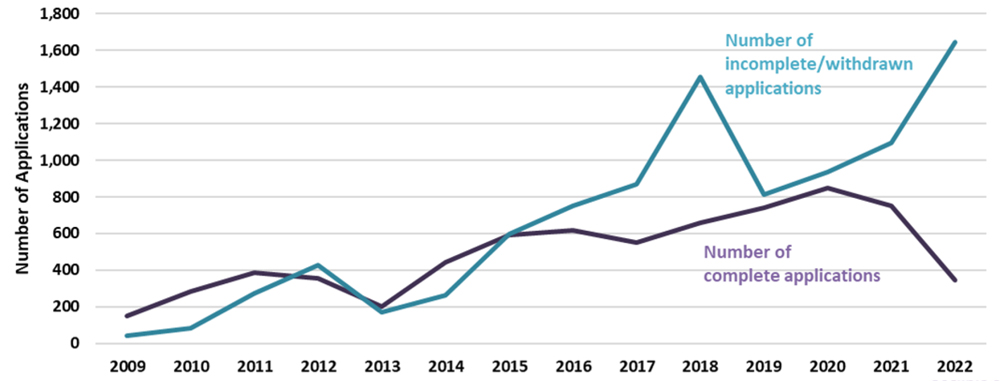

While overloaded queues for transmission interconnection have become a major focus for the electricity industry, regulators and policy makers, a new report from the Applied Economics Clinic and the Clean Energy Group shows that experiences like Albuquerque’s may also be the norm on local distribution networks across the country. In Massachusetts, for example, the report found more than 1,600 storage or solar and storage projects had either incomplete or withdrawn interconnection applications in 2022, versus fewer than 400 complete or approved.

Interconnection bottlenecks in Massachusetts last year resulted in more than 1,600 incomplete or withdrawn interconnection applications for solar and storage projects versus less than 400 complete or approved applications. | Applied Economics Clinic

Interconnection bottlenecks in Massachusetts last year resulted in more than 1,600 incomplete or withdrawn interconnection applications for solar and storage projects versus less than 400 complete or approved applications. | Applied Economics Clinic

The webinar, sponsored by the Clean Energy Group, dug into the reasons for such lopsided figures and explored potential solutions. Bottlenecks and other barriers are embedded in the interconnection process itself, said Chirag Lala, a researcher at Applied Economics, who worked on the report.

Key factors are a lack of system planning, the underlying, often mistaken assumptions many utilities make about storage, along with “cost causation,” that is, how the costs of system upgrades are allocated, Lala said.

The need for distribution upgrades is determined based on the “hosting capacity” of specific lines in a system — how much renewable generation or storage they can integrate — on a case-by-case basis as interconnection applications are filed. “It creates a system where nobody is planning ahead of time for distribution-level hosting capacity upgrades,” he said.

“There is not [a state-level] entity … that is able to say, ‘We anticipate this much distributed energy resources will interconnect. We want to prepare for this much solar, this much storage, this much hybrid [solar and storage], and we should make these upgrades in advance,’ Lala said.

In addition, as developers are usually responsible for paying for system upgrades, “it means those who are responsible for managing the distribution grid don’t have a financial incentive to actually invest in hosting capacity more regularly,” he said.

Potential solutions include the use of online maps some utilities — such as Con Edison (NYSE:ED) and Green Mountain Power — are now providing for solar and storage developers to show where lines have adequate capacity for additional projects, and where they are already constrained.

Green Mountain Power’s hosting capacity map allows users to drill down to the substation and line level so developers can be sure a potential site includes the three-phase lines needed for solar and storage projects, said Kirk Shields, the utility’s director of development and risk management.

“It really helped the developers figure out where the best sites are going to be so that downstream, we run into fewer traps about upgrades or just not making [a project] feasible at all,” Shields said. “It’s not a cure-all for every problem, but it certainly has helped smooth out the upfront communication portion of the whole interconnection and build process.”

‘Worst-case’ Studies

Just how much storage is sitting in distribution-level interconnection queues is unknown, but the latest report on transmission queues from the Lawrence Berkeley National Laboratory found close to 700 GW of storage now waiting to connect to the bulk power grid.

Getting storage online at the distribution level can have multiple benefits for customers and utilities. For school systems like Albuquerque’s, a storage system linked to solar can charge up during off-peak hours, when power is cheap, and discharge during peak times, when power is expensive, which in turn can help trim demand charges.

The city’s Atrisco Heritage Academy High School, where the still-unconnected solar and storage are located, is a 65-acre, multibuilding campus. Summertime electric bills are often in excess of $50,000 per month, more than half of which are demand charges, Sparks said.

For utilities, storage can be used as flexible, peaking power that can defer or even replace the need for system upgrades.

But, Lala said, many utilities are still unfamiliar with how storage operates at the distribution level, which can result in unrealistic studies on interconnection and requests for potentially unnecessary and expensive system upgrades.

“A lot of interconnection processes … don’t define storage very well, or they insist on treating storage in the modeling as operating at the most extreme use cases,” he said. A utility “might say, ‘We want to model storage as if it will charge at peak times when everybody else is coming home and using electricity,’ even if the project applicants say, ‘We never would intend to charge storage around [those] times. We would want to discharge around them.’

“The interconnection processes just generally don’t account for either the technologies or logistical processes that might help in preventing that,” Lala said.

Schuyler Matteson, a senior adviser with the New York State Energy Research and Development Authority, described the tangled process storage developers face in his state, even with utility hosting capacity maps.

“The utilities still like to look at worst case scenarios because technically many of these projects are still uncontrolled; they’re not dispatchable in terms of utility ownership and operation,” Matteson said. “They are still doing two studies ― one worst-case scenario [for] charging, one worst case scenario [for] discharging.”

Further, while many New York utilities have tariffs and demand charges intended to send signals to encourage off-peak charging, Matteson said, “a lot of these interconnection studies are coming back with charging restrictions and discharging restrictions that don’t align with the same utility’s tariffs.”

For example, he said, an interconnection agreement could limit storage developers to charging during peak rather than off-peak hours, resulting in high demand charges. “So, there’s this conflict between real-time operational data that the utility has about usage on their system versus historical rates, and when they don’t align, you end up having this really high cost burden borne by the developers,” he said.

New York also has a “buy-back” demand charge that storage developers must pay for the power they discharge onto the grid during peak times when the power is needed, Matteson said. While the charge is a “historical anomaly” that could soon change ― a new rate proposal is before the New York Public Service Commission ― it can still be “as expensive as the value we’re paying [developers] for the peak power, which makes absolutely no sense at all,” Matteson said.

Flexible Interconnection

Cost causation is still another pitfall, as upgrades are generally paid for by the developer whose project is seen as tripping the need for system improvements or expansion, even if other projects will benefit, Lala said.

“It also creates an incentive then to jockey in the queue, or at least negotiate quite a bit over what those upgrades will be,” he said. “If you are in the queue, it actually matters whether you are first, second, third, fourth or fifth … because if somebody in front of you happens to make upgrades that are useful to your project, you will never be responsible for paying.”

This allocation of costs can also create incentives for utilities “to be extra, extra cautious in terms of the system impact modeling that they do in order to determine hosting capacity upgrades,” Lala said. “If they’re extra cautious and demand more upgrades, that will also raise interconnection costs.”

The Advanced Economics report recommends “reforming cost allocation so that you incorporate more stakeholders than just the project … applying for interconnection,” he said. Developers applying for interconnection in a cluster can help spread costs, providing they can agree on the individual allocations. If not, and “somebody leaves the group partway through the interconnection process, which can and does happen, then you may have to start the interconnection process all over again” Lala said.

Another possibility is that “a single entity can pay for interconnection-related grid upgrades up-front and be reimbursed by other stakeholders post-upgrade,” the report says. For example, a utility could “pay for grid upgrades for smaller-sized projects in the interconnection queue and be reimbursed by customers with larger projects using a one-time pro-rated fee,” he said.

Advanced system planning and pushing for utilities to treat storage “as much as possible based on how [it] will actually operate or function in practice” will also be needed, as well as advanced technologies such “smart inverters” that can help regulate when a storage project charges and discharges.

“Rather than assuming a DER system will export its full nameplate rating, the export capacity (which is equivalent to the nameplate rating or a lower amount when using an acceptable means of control) should be considered and evaluated for its impacts,” the report says.

Smart inverters and distributed energy resource management systems (DERMS) form the core of still another option for improving solar and storage interconnection at the distribution level — “flexible interconnection,” in which utilities have the ability to curtail or discharge power from a specific project.

The approach is widely used in the United Kingdom, where it is a “business as usual” solution for allowing interconnection while avoiding costly distribution system upgrades, said Robert MacDonald, executive vice president for U.K. sales at Smarter Grid Solutions, speaking at a U.S. Department of Energy webinar on Thursday.

The company provides advanced DERMS systems that can optimize distributed energy resource (DER) “hosting capacity by taking advantage of the latent grid capacity that’s inherent within our network,” MacDonald said.

In other words, utilities tend to make conservative estimates of hosting capacity, which can open opportunities for the flexible use of intermittent DERs.

“Rather than take conservative assumptions to the assignation of grid capacity to new DER sites, based on static, worst-case conditions, what we’re trying to do here is, in real-time, reflect that real-time capacity that’s available on the network,” he said. “But, in times where that real-time grid capacity isn’t available to generators with flexible interconnection, then we have the curtailment.”

Static interconnection (left) versus flexible interconnection with DERMS, which allows increased integration of distributed energy resources, like storage. | EPRI

Static interconnection (left) versus flexible interconnection with DERMS, which allows increased integration of distributed energy resources, like storage. | EPRI

U.K utilities use flexible interconnection as an interim method for getting new DERS, such as solar and storage, interconnected, but in some cases, it becomes a longer-term, permanent solution, MacDonald said. Two demonstration projects in upstate New York, both owned by Avangrid, have been using Smarter Grid’s DERMS to flexibly interconnect solar projects for about a year and a half, he said.

Zachary Caruso, lead analyst for programs and projects at Avangrid, said the projects were part of New York’s Reforming the Energy Vision initiative, aimed at spurring innovation and new investment in the state. The 2 MW Robinson solar project, located in Champlain, was sitting in an interconnection queue, waiting for system upgrades, Caruso recalled.

Recognizing the potential to defer the upgrades, “we sort of walked it right out of the queue, and the developer was on board, and we moved forward with it,” he said.

The second project was a 15 MW installation spread over three sites in Spencerport, a suburb of Rochester, where the nearest substation did not have adequate capacity. Again, the projects were flexibly interconnected without costly upgrades, Caruso said.

The projects operate on both “static capacity,” when the power they can put on the grid is limited, and flexible capacity, when they can increase output based on the time of day and time of year, Caruso said. The amount of curtailment necessary at both projects has been minimal, he said.

While both Avangrid projects are solar, flexible interconnection can also be used with standalone storage or hybrid solar and storage, said Karyn Boenker of the Pacific Northwest National Laboratory, who moderated the DOE webinar. Such projects would have to use “a grid-support, utility-interactive inverter with compliant certifications,” such as UL 1741 SA, an advanced inverter safety standard, Boenker said.

Avangrid has not deployed any other flexible interconnection projects, Caruso said, but the utility sees it as “another tool in our toolbox. … It’s not the be-all and end-all [that] will solve all of the DER interconnection issues that are out there, [it’s] just that we’ve seen on some substations that there is value.”