FERC issued explanations for denying rehearing requests in several cases in the past week. Requests to rehear FERC orders are automatically deemed denied “by operation of law” unless the commission acts within 30 days. The orders below elaborate on why the commission declined to reconsider its prior orders.

MISO

NextEra Request for Rehearing of Canceled MISO Competitive Project

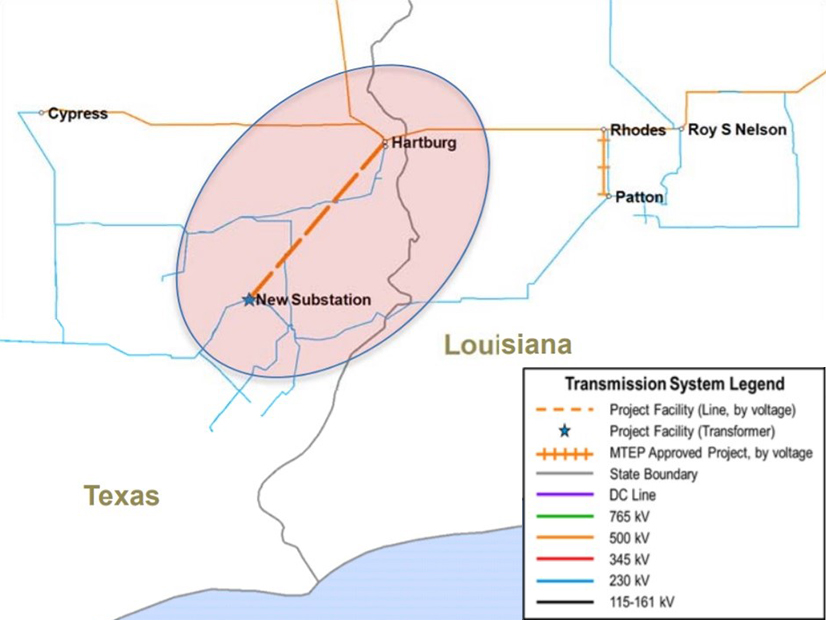

NextEra Energy asked the commission in April to stay its order terminating the only competitive regional transmission project in MISO. (See NextEra Asks for Rehearing of Canceled Competitive Project.) The commission’s March order allowed MISO to abandon the $115 million, 500-kV Hartburg-Sabine Junction project in East Texas. The RTO approved the project in 2017 but determined last year that the project’s benefits had evaporated due to recent generation additions in the region.

The commission reiterated its conclusion that MISO followed its tariff in the matter and said it disagreed with NextEra that no other parties would be harmed by granting the requested stay. “As the commission explained in the termination order, ‘the mounting delay in commencing construction’ of Hartburg-Sabine resulted in economic uncertainty for MISO stakeholders due to the modeling of a project that will not be built, which will eventually create reliability concerns,” FERC said. “Even if the threat of reliability issues was not concern enough, MISO asserts that requiring it to reinstate Hartburg-Sabine into its generator interconnection models would cause queue delays for a number of generator interconnection customers. In light of these findings, we find that granting the stay would harm third parties.”

Eliminating Schedule 2 Reactive Power Charges

Vistra, Invenergy and others sought rehearing on the commission’s January order approving MISO transmission owners’ request to eliminate Schedule 2 charges for reactive power within the standard power factor range. Opponents said FERC failed to consider the effects of eliminating reactive power compensation on the MISO markets, particularly regarding independent power producers’ reliance on such compensation.

In approving the MISO TOs’ proposal, FERC cited its policy “that the provision of reactive power within the standard power factor range is … an obligation of the interconnecting generator and good utility practice.” In its July 12 order, the commission rejected the challenges “as collateral attacks on that longstanding policy.”

Commissioner James Danly, who dissented from the January order, repeated his opposition, saying the MISO TOs failed to overcome “the record’s substantial unrebutted evidence of the rate impacts this proposal would have on generators not affiliated with the MISO TOs.”

PJM

PJM Interconnection Queue Procedures

Petitioners challenged the commission’s Nov. 29, 2022, order accepting PJM’s proposal to transition from a serial first-come, first-served queue process to a first-ready, first-served clustered cycle approach. (See FERC Approves PJM Plan to Speed Interconnection Queue.)

Lee County Generating Station complained that the commission failed to address arguments that the rule changes were unfair to existing generators making long-term firm transmission service requests. In its July 6 order, FERC acknowledged that the transition from a serial approach to a cluster approach “may present delays for existing customers that had previously been avoidable due to PJM’s pre-existing practice of removing from the interconnection process and advancing firm transmission service requests that did not contribute to the need for network upgrades.” But it said the generator “has not demonstrated that PJM’s proposal is unduly discriminatory.”

Hecate Energy, a Chicago-based renewable power developer and operator, challenged FERC’s acceptance of a $5 million cap on network upgrades for projects seeking to interconnect through PJM’s expedited process, saying it was arbitrary. “Despite Hecate’s disagreement with PJM’s observation that new service requests associated with network upgrades at or below the $5 million threshold are ‘fairly straightforward’ and that ‘the majority of new service requests do not proceed when they are assigned network upgrade costs … in excess of $5 million,’ Hecate provides no contrary evidence,” FERC said.

PJM Order 2222 Compliance

FERC defended its March approval of PJM’s Order 2222 compliance filing after rejecting rehearing requests by the Ohio and Pennsylvania public utility commissions, Advanced Energy United (AEU) and the Solar Energy Industries Association (SEIA) (ER22-962-003).

FERC responded to the Ohio and Pennsylvania commissions’ jurisdictional concerns by saying its order does not give PJM authority over disputes with state laws but found the RTO’s proposal “unreasonably restricts” a DER aggregator’s use of PJM’s dispute resolution procedures.

AEU and SEIA argued that the proposal’s provisions to prevent double counting of energy and capacity would prevent net energy metering programs from participating in PJM’s markets, pointing to narrower language from NYISO and ISO-NE. FERC said it was granting RTOs flexibility in their double-counting restrictions and that PJM’s proposal is sufficiently narrowly designed.

Commissioner Mark Christie concurred with the July 11 order, reiterating his dissent in Order 2222-A over jurisdictional concerns. “This fundamental issue raised by these two state commissions has, of course, been among the daunting practical challenges of implementing Order No. 2222 from the beginning because that order egregiously invaded the long-time authorities of the states and other relevant electric retail regulatory authorities (RERRAs) to regulate retail rates,” Christie wrote. “We are also beginning to see some of the other consequences, including the costs that consumers will now be forced to bear towards implementing Order No. 2222.”

PUERTO RICO

APPA Request for Rehearing or Clarification re: Alternative Transmission Inc.

The American Public Power Association sought rehearing or clarification of FERC’s March 16 order granting Alternative Transmission Inc.’s petition for a declaratory order regarding the jurisdictional consequences of a proposal to build one or more HVDC undersea transmission lines connecting Puerto Rico to the mainland. The commission said the interconnection proposed by ATI would result in Puerto Rico’s utilities becoming subject to the commission’s jurisdiction unless an exemption were granted under Section 201(b)(2) of the Federal Power Act. (See FERC Weighs in on Jurisdictional Questions over Puerto Rico Project.)

APPA responded that because Puerto Rico is considered a state under the FPA, “a utility owned by the government of Puerto Rico would not be a public utility as defined in the FPA.” Thus, the Puerto Rico Electric Power Authority would be considered a “municipality,” which is excluded from the definition of “public utility,” APPA said.

In its July 10 order, FERC said that whether a particular utility in Puerto Rico would be considered a public utility as a result of ATI’s proposed interconnection would be dependent on the company’s specific characteristics. “For example, if an electric or transmitting utility in Puerto Rico qualifies as a municipality under section 3(7) of the FPA, then that utility would not become subject to the commission’s jurisdiction as a public utility under section 201(e) of the FPA as a result of the interconnection proposed by ATI, although such utility would be subject to the commission’s jurisdiction under other provisions of the FPA, including, but not limited to, Section 215 of the FPA,” which created the Electric Reliability Organization to develop mandatory reliability standards.

SPP

City of Nixa, Mo., Annual Transmission Revenue Requirement

Numerous parties challenged FERC’s February order approving SPP’s proposal to include the annual transmission revenue requirement (ATRR) for the city of Nixa, Mo., (owned by GridLiance High Plains) in transmission pricing Zone 10. The commission said it was consistent with cost causation principles. (See “Order on GridLiance ATRR,” FERC Grants Rehearing of SPP Capacity Accreditation Proposal.)

The order was challenged by several municipal utilities in Arkansas and Missouri and a group of SPP transmission owners, including Evergy and American Electric Power’s Public Service Company of Oklahoma and Southwestern Electric Power Co., which said the commission should have focused on the non-Nixa transmission customers in evaluating the impacts of including the Nixa assets in Zone 10.

In its July 5 order, the commission said the challengers’ arguments “focusing on the extent to which they derive benefits specifically from the Nixa assets are inconsistent with SPP’s zonal rate design.”

Empire District Electric Co. Generation Replacement Under SPP Rules

Empire District Electric challenged the commission’s March 29 order denying its request for a tariff waiver to allow Empire to replace its Riverton Unit 10, a 16.3-MW simple cycle facility damaged in a fire Feb. 8, 2021. The commission ruled that Empire’s waiver request was retroactive and prohibited by the filed rate doctrine because the company failed to file the waiver request within the one-year deadline in SPP’s replacement rule.

In its July 12 order, FERC rejected Empire’s contention that its request was “prospective” because SPP could modify its generator replacement process in the future. “Whether SPP will revise [its tariff] in the future is not only speculative, but … also irrelevant, given that Empire is requesting that the commission provide retroactive relief to excuse Empire’s failure to submit a generating facility replacement request by the Feb. 8, 2022, tariff deadline,” the commission said.