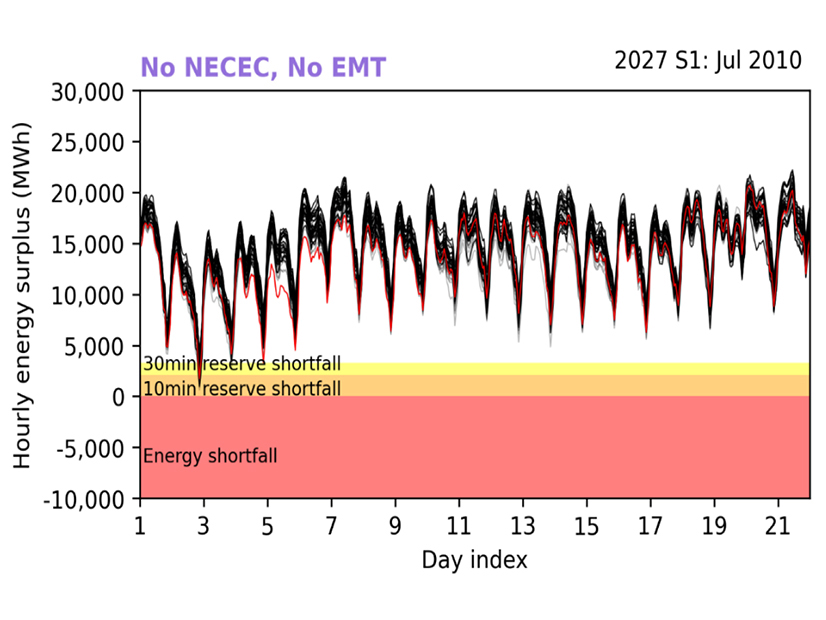

No energy shortfall is anticipated for the summer of 2027, ISO-NE told the NEPOOL Reliability and Transmission committees on Wednesday, adding that some reserve shortfall appeared in just one of the worst-case scenarios modeled.

The results are part of ISO-NE’s ongoing study with the Electric Power Research Institute looking at how extreme weather affects grid reliability, taking into account how climate change is projected to affect the probability and magnitude of extreme weather. The RTO noted that the expected growth of utility-scale and behind-the-meter solar, offshore wind and storage all contributed to minimizing reliability risks.

While results indicated the New England Clean Energy Connect transmission line would help reduce reserve shortfall in the worst case studied, the RTO found the presence of the Everett Marine Terminal (EMT) did not significantly impact the reserve shortfall.

“Results with and without EMT are similar, as there is minimal depletion of stored fuels in any cases,” said Stephen George of ISO-NE, adding the reserve shortfall seen in the study was manageable. “Cases where reserve shortfalls occur are representative of capacity deficiency conditions, which are managed through ISO’s Operating Procedure No. 4 (OP-4), Actions During a Capacity Deficiency.”

Aaron Patterson of The NorthBridge Group, representing Constellation Energy, the owner of both EMT and the Mystic Generating Station, EMT’s main customer, criticized how the winter iteration of the study modeled the availability of LNG with and without EMT. (See Limited Exposure to Supply Shortfall for ISO-NE During Extreme Weather.)

“The results of the ISO-NE/EPRI study with respect to the impact of EMT retirement are not credible,” Patterson said. “The assumption that the retirement of EMT would have no impact on regional LNG stocks over the course of a winter event is not supported by any data or analysis, and a review of history and the demonstrated capabilities of EMT compared to other facilities suggest that it is not accurate.”

Patterson said the ISO-NE assumption that the loss of Everett wouldn’t significantly affect the amount of LNG available to the region “drives the general conclusion of the study with respect to EMT that retirement of EMT has no material impact on regional electric reliability during extreme winter events.”

While ISO-NE’s modeling assumed the two other LNG facilities servicing the region would be able to make up for the loss of EMT, Constellation argued this assumption is overly optimistic.

Patterson said Everett historically has had an LNG inventory of 6 Bcf during the coldest 21-day periods of the past five years, equating to almost 60% of the available LNG projected by ISO-NE’s 2027 modeling.

“Given this outsize contribution from EMT, the unsupported assumption that the other two facilities would be able to effectively more than double their assumed contribution to LNG stocks without EMT is not credible,” Patterson said.

ISO-NE argued that the LNG assumptions used in the study are reasonable, noting they ran the winter analysis with a range of LNG inventories, including a low LNG scenario that reduced the starting inventory by 3 Bcf (from 6.5 to 3.5 Bcf total).

The study’s results for the winter of 2032 likely will be shared at the Reliability Committee meeting in August, while the summer 2032 results likely will be available in September, ISO-NE said.

Increased Regional Network Service Costs

David Burnham of Eversource told the committees the projected regional network service (RNS) costs for the next five years likely will increase annually by approximately $10 per kW-year. RNS costs are projected to reach $196 per kW-year by 2028, compared to $141.6 expected for 2023.

RNS costs are the costs of transmission service paid by transmission customers in New England. For 2023, asset condition projects made up more than $570 million of the $1.3 billion in total projected regional costs, while regional system plan projects are expected to cost more than $540 million. In 2024, asset condition costs are expected to increase to $890 million, while system plan projects are anticipated to cost more than $300 million, with total costs nearing $1.4 billion.

Eversource Project Costs Rise

Eversource presented to the committees about a series of ongoing projects, including a group of projects in the Greater Boston area, which have ballooned in cost to $921 million, compared to the original 2017 estimate of $572 million.

The utility company cited unanticipated underground interferences, work hour restrictions, soil management and groundwater treatment costs, and material costs as the drivers of the increase.

Eversource also presented on a series of projects in Eastern Connecticut, including upgrades at several substations and rebuilds of multiple 115-kV lines. The company requested a total transmission cost allocation of nearly $200 million, with the final components of the projects to be active by fall of this year.