The D.C. Circuit Court of Appeals on Friday upheld a FERC decision suspending the application of PJM’s transmission constraint penalty factor (TCPF) after it led to spiking prices that could not be addressed on Virginia’s Northern Neck Peninsula (22-1090).

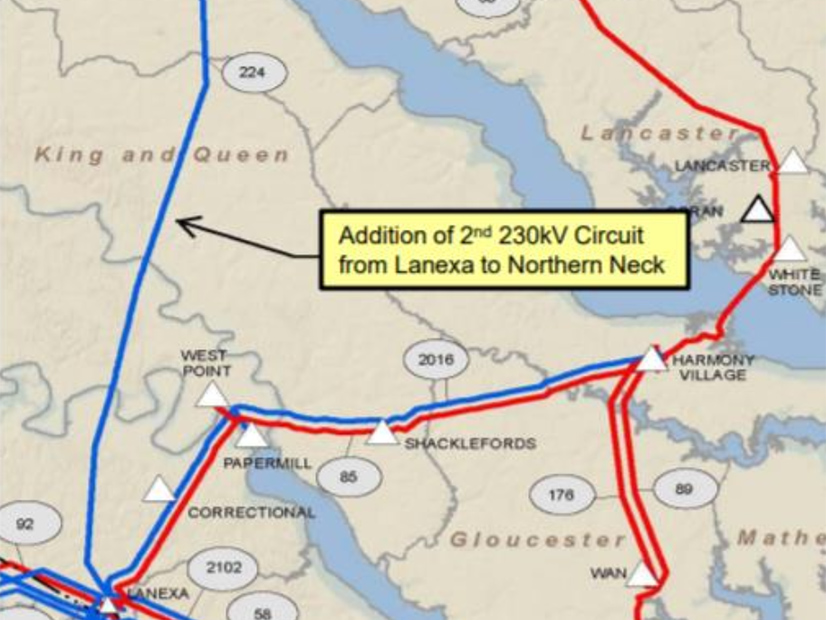

The TCPF caused prices to spike on the peninsula in the Chesapeake Bay after a transmission line was taken out of service early last year so the local grid could be upgraded. Cheaper generation or demand response were not available in the area to offset its impact, so PJM requested it suspend the rule in this case as the higher prices were incapable of eliciting any kind of market response.

FERC approved PJM’s request, with a dissent from Commissioner James Danly. Energy trading firm Citadel FNGE appealed the decision to the D.C. Circuit. Judge Justin Walker (a Trump appointee) dissented from the majority in the case, saying the court should have remanded it to the commission. (See FERC Approves Pause of PJM Tx Constraint Penalty Factor in Va.)

PJM since has changed the rule so the TCPF will be suspended automatically in similar circumstances going forward. (See FERC Approves PJM Proposal to Reduce Congestion Penalty During Grid Upgrades.)

Chief Judge Sri Srinivasan and Judge Patricia Millet (both Obama appointees) sided with FERC, saying it was reasonable to suspend the rule, which is meant to get a market response that ultimately would solve the congestion at issue.

“Because application of the penalty factor increased costs for consumers without a commensurate benefit, the commission reasonably found that its application in this context was unjust and unreasonable,” the court said.

The TCPF represents the maximum cost that PJM will incur to resolve the problem-causing congestion, with an algorithm seeking the least-cost way to relieve congestion, which if not available leads to prices of $2,000/MWh.

With the transmission line out, the peninsula’s customers could be served only by two other transmission lines and a set of combustion turbine units.

“That lack of available resources caused the local marginal price to fluctuate drastically in times of congestion,” the court said. “For example, even when the turbine units were fully operating in the early morning hours, they were insufficient to prevent congestion, so the penalty factor kicked in.”

Local solar plus those combustion turbines were able to mitigate prices when the sun was out, but the penalty factor was unable to send consistent or reliable signs about whether an investment or response to the congestion was needed.

“Material short-term investments would not occur, PJM explained, because new resources would not come online until after the Lanexa line upgrade was completed,” the court said. “At that point, the demand for the newly placed resource would evaporate.”

Citadel challenged PJM, saying the RTO failed to prove a link between the temporary $2,000/MWh prices and what consumers in the area actually paid. It also argued that PJM failed to prove that nothing could respond to the price signals and argued suspending the rule would inject regulatory uncertainty into the market.

The court said FERC was not required to show the spiking congestion costs would impact retail rates because the Federal Power Act refers only to the unjustness and unreasonableness of rates.

“The commission concluded that increased prices on one side of the balance without any value on the other side of the scale — all pain and no gain — were unjust and unreasonable,” the court said.

While customers pay a zonal rate, the higher congestion costs would go into that calculation, leading to overall higher rates, and Citadel failed to show any offsetting impacts, it added.

The firm also argued the suspension would harm the financial transmission rights market, in which it participates.

“But the temporary suspension of the penalty factor in one geographically unique area does not stop financial firms from benefiting from congestion pricing,” the court said. “Financial firms will still receive congestion costs, albeit less in one small part of the grid, during the temporary suspension of the penalty factor.”

Walker’s Dissent

Judge Walker said the court should have remanded the order to FERC for further proceedings, with Citadel’s arguments having convinced him. Transmission expansion was sped up after FERC’s order, which Citadel argued showed the constraint was working.

“Yet when FERC was later given evidence that the penalty factor was incentivizing transmission investment, FERC moved the goalposts,” Walker said. “Instead of reasoning, as it had before, that the rate was providing no benefit, FERC instead said any benefit it provided wasn’t big enough.”

That shift in standards was arbitrary and capricious, so the order should have been remanded, he added.