Texas regulators last week endorsed ERCOT’s proposed modifications to the operating reserve demand curve (ORDC) designed to retain and attract dispatchable generation.

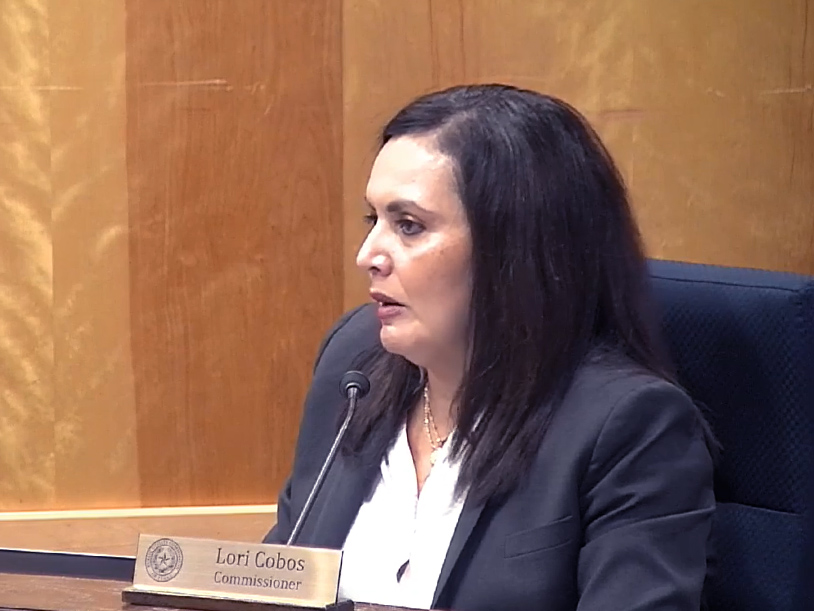

“I believe that near-term action is important to retain our long-duration, dispatchable thermal generation assets that I believe are extremely necessary to maintain reliability during extreme weather conditions,” Commissioner Lori Cobos said during the Public Utility Commission’s open meeting Thursday.

Under ERCOT’s multistep proposal, price adders of $20/MWh and $10/MWh will be set when operating reserves hit floors of 6,500 MW and 7,000 MW, respectively. Staff’s analysis indicates the floors would have increased revenues to generators by about $500 million during the 2020 and 2022 pricing years. Thermal generators would have received 80% of those revenues.

ERCOT says the ORDC increasing during substantial operating reserve surplus periods will improve pricing signals, help retain existing assets, add new dispatchable generation and reduce the frequency of reliability unit commitments (RUCs).

Cobos filed a memo before the meeting explaining the need for a “market-based tool” that incents generators’ self-commitment in the real-time market to help reduce RUCs. To ensure the ORDC modification’s goals are met, she also laid out three metrics ERCOT will be required to track and report back to the commission (53298):

-

- The amount of new revenue specifically resulting from the adders;

- The specific type of generation resources that received the new revenue; and

- Performance data showing whether the adders have reduced ERCOT’s use of RUC.

“I think these metrics will help us keep track of whether or not this action is accomplishing what we set out to do,” Cobos said.

She also recommended the PUC re-evaluate the need for the price-floor adders after ERCOT deploys dispatchable reliability reserve service in December 2024 to check that RUCs are reduced by the amount of the new ancillary service ERCOT procures.

Commissioner Jimmy Glotfelty said he struggled with ERCOT’s proposal but joined the PUC’s unanimous decision.

“It’s not clear to me that we are creating a bridge solution to eliminate RUC or that we’re creating a bridge solution to bridge us to a reliability capacity issue to solve our resource adequacy issue,” he said. “If we want to eliminate RUC, I think we should be looking at all of the solutions that could eliminate RUC, not just one. I know RUC is problematic for generators, but what I don’t want is another out-of-market solution to solve an out-of-market solution that we created which solved a conservative operations out-of-market solution that we created. We’re just piling on by trying to fix the market with other modifications.”

The PUC in January directed ERCOT to propose a bridge to the commission’s proposed market redesign, a performance credit mechanism (PCM). However, the design’s chief proponent, former commission Chair Peter Lake, stepped down from his post in June after Texas lawmakers suggested other market structures during their recent legislative session. (See Texas PUC’s Lake Steps Down as Chair.)

The grid operator’s stakeholders and Board of Directors approved the staff’s proposal in April. (See ERCOT Stakeholders Endorse Staff’s Bridge to PCM.)

ERCOT’s ORDC values the wholesale market’s operating reserves on their scarcity, reflecting that value in energy prices.

The curve has been modified several times since it became part of the market in 2014. The value of lost load, which is set equal to the system-wide offer cap, was changed from $9,000/MWh down to the $2,000/MWh low-system-wide offer cap after the 2021 winter storm, then back up to $5,000/MWh in January 2022. The minimum contingency level also was increased last year from 2,000 MW to 3,000 MW.

Entergy Texas Gets Rate Increase

In other actions, the PUC approved an unopposed settlement that increases Entergy Texas’ base rate revenues by $54 million, resulting in a nonfuel revenue requirement of $1.23 billion. PUC staff, the Office of Public Utility Counsel and Texas Industrial Energy Consumers were among the signatories to the agreement (53719).

At the same time, the commission severed into a new proceeding two contested issues related to Entergy’s proposed electric vehicle charging riders. The PUC will determine whether it is appropriate for a vertically integrated utility to own EV charging facilities or other transportation electrification and charging infrastructure.

The commission also rejected rehearing requests by Texas Energy Association for Marketers, Alliance for Retail Markets and Texas Competitive Power Advocates over the approval of a partial settlement that reduced CenterPoint Energy’s distribution cost recovery factor by $7.8 million (53442).