Duke Energy on Tuesday reported a second quarter loss of 32 cents/share in the second quarter, attributed to mild weather and an impairment of $1 billion from the sale of its commercial renewable business.

The firm’s core market of the Carolinas saw the mildest January and February in the past 30 years, while May and June were mild enough to make the top five, CEO Lynn Good told investors on a conference call. The mild weather was enough to cut earnings by 30 cents/share, she said.

“We’ve had an early look at July, and as you would expect July weather, it’s positive, consistent with the trend across the U.S., and August and September are in front of us,” Good said. “With our largest quarter ahead, we are reaffirming our guidance range for 2023.”

The firm sold off its commercial renewables business earlier this year, with deals expected to close by the end of the year. (See Duke Energy Sells Distributed Renewable Business to Arclight.)

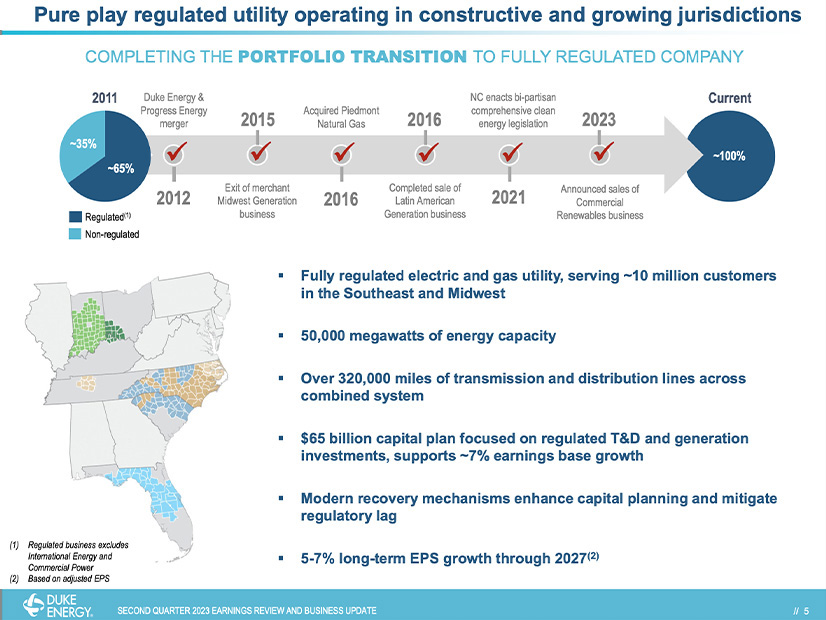

“We’re a wholly regulated company operating in constructive and growing jurisdictions with a wealth of clean energy investments driving growth for years to come,” Good said. “The regulatory constructs in our states have also meaningfully improved over this time, including landmark bipartisan energy legislation passed in North Carolina in 2021.”

Now the firm’s sole focus is on its regulated businesses and its ongoing work on the clean energy transition, she added.

“Our energy transition in the Carolinas remains a top strategic priority, and we’re working diligently on updated resource plans to be filed with the Public Service Commission of South Carolina and the North Carolina Utilities Commission in mid-August,” Good said. “Similar to previous filings, the plans are based on significant stakeholder engagement and will outline multiple portfolios, each of which preserve affordability and reliability while transitioning to cleaner energy resources.”

The plans will include benefits from the Inflation Reduction Act and will reflect healthy load growth in the Carolinas as they continue to see population growth because of migration, she added.

Duke has been adding solar to its generation mix with a procurement in North Carolina finalized recently that will see 1,000 MW added to the grid by 2027 and another approved recently by the NCUC that will add 1,400 MW in the coming years. In Florida, the firm added 300 MW of solar this year and now operates 1,200 MW in the state, with plans to add 300 MW per year there going forward.

“In Kentucky, we’ve partnered with Amazon to install a 2-MW solar plant on top of their fulfillment center in Northern Kentucky, the largest rooftop solar site in the state,” Good said. “This partnership supports the carbon-reduction goals of both Duke Energy and Amazon.”

The firm has a clear strategy focused on “organic” growth of its regulated businesses, said Good.

Some of the analysts on the call asked about “inorganic” growth, with one asking if Duke was interested in buying Dominion Energy’s Public Service Company of North Carolina subsidiary. Dominion has sold off some of its other non-core assets recently.

Good declined to comment on “another company’s process,” but earlier in the call she explained her thoughts on mergers and acquisitions generally.

“Our sole focus is on this organic plan that’s in front of us,” Good said. “And, so, any idea about M&A has to beat what we have in front of us, and it is an increasingly high hurdle because of the confidence we have in our plan.”