A bad week for the U.S. offshore wind industry just keeps getting worse.

The latest: SouthCoast Wind is on the verge of falling out of the development pipeline, having reached agreements to buy its way out of too-low power purchase agreements, and Ørsted says it is facing a massive cost impairment on its Northeast U.S. projects.

Ørsted’s CEO followed up Wednesday morning by saying the company is prepared to walk away from its projects, if necessary, though it does not want to. The world’s largest offshore wind developer saw its stock price plummet 25% in trading later that day.

The developments followed the acknowledgment Monday by New York state that its offshore wind projects may not be able to proceed without significantly more money.

And on Tuesday, the first federal wind energy auction in the Gulf of Mexico was underwhelming — two lease areas went unclaimed, and the winning bid on the third was just $5.6 million.

The three auctions in 2022 drew a total of $5.44 billion in winning bids.

SouthCoast Wind

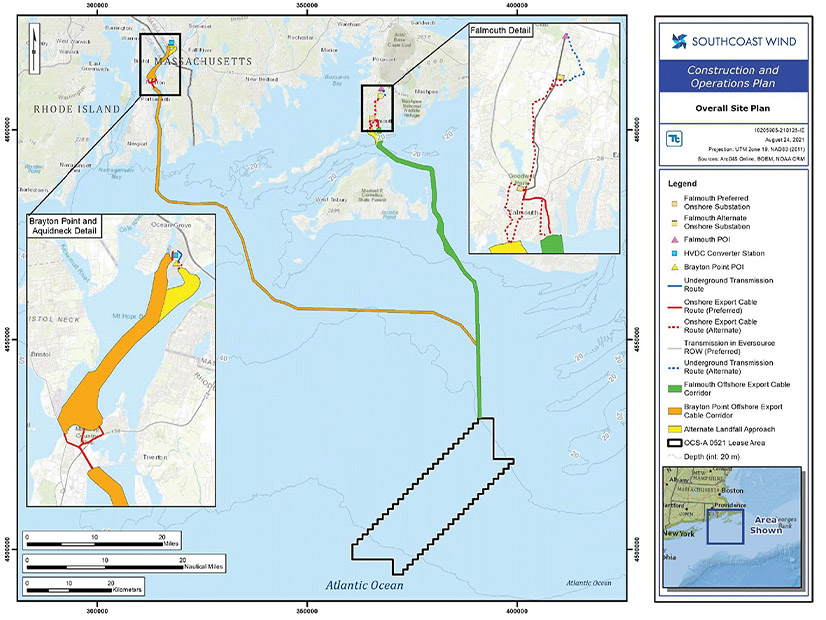

Like several other offshore wind projects along the Northeast coast, SouthCoast Wind says it cannot go forward with construction amid soaring costs under the terms of the power purchase agreements it negotiated with three Massachusetts utilities. Commonwealth Wind reached the same conclusion around the same time last year.

SouthCoast and Commonwealth both sought to renegotiate nearly a year ago and were rebuffed; Commonwealth then moved to cancel its PPAs, but SouthCoast did not follow until several months later.

Commonwealth Wind in July agreed to pay Eversource, National Grid and Unitil $48 million for their cooperation in its bid to terminate the PPAs. The Massachusetts Department of Public Utilities approved that deal last week. (D.P.U. 22-70, 22-71, 22-72.)

SouthCoast has negotiated similar deals with the same three utilities for $60 million. Its proposals to the DPU were made public on Tuesday. (D.P.U. 20-16, 20-17, 20-18.)

Both projects remain in active development, but without PPAs, they will be in limbo.

These recent events are a setback for the clean energy transition in Massachusetts, which is seeking 5,600 MW of offshore wind installed by 2027. Only the 800 MW Vineyard Wind would be left in the state’s offshore wind portfolio if the DPU approves the SouthCoast termination.

But construction of Vineyard is proceeding at a steady pace. It is expected to produce its first electricity this year and reach full capacity next year.

Fourth Solicitation

Also this week, Massachusetts on Wednesday issued requests for proposals in its fourth and largest offshore wind solicitation.

Under terms of the solicitation, SouthCoast and Commonwealth can bid for new contracts, though they may lose points in the scoring system for having bailed out of their previous agreements. The developers have said they intend to pursue this option.

State and labor leaders focused on the positive Wednesday as they announced the solicitation. Their news release did not mention Commonwealth or SouthCoast, but instead played up the expected benefits offshore wind will provide the economy and climate of the Bay State.

“This adaptive RFP was drafted to create a transparent, competitive process that will benefit Massachusetts’ residents and businesses with cleaner air, lower energy bills, jobs in a growing industry and economic development opportunities,” Energy and Environmental Affairs Secretary Rebecca Tepper said. “Offshore wind is the cornerstone of Massachusetts’ clean energy transition and will help us build a healthier, more resilient Massachusetts.”

The new solicitation offers bidders the option of adjustment mechanisms for inflation and changes in tax policies, which could help avert a repeat of the turmoil now facing the U.S. offshore wind industry.

Bids are due Jan. 31, and projects will be selected June 12.

Ørsted

Danish wind power giant Ørsted is among the developers getting squeezed by construction costs that soared after electricity prices were locked in.

The company on Tuesday announced anticipated impairments of up to 16 billion Danish Krone — $2.34 billion U.S. — on the three U.S. offshore wind farms for which it holds contracts but has not started construction.

Ørsted stock closed at 420.90 Krone on Wednesday, down 24.7% from Tuesday. It is now 40% off its 2023 peak, reached in February.

CEO Mads Nipper told analysts in a conference call early Wednesday that the situation comes down to the same problems other developers are having: rising costs and supply constraints.

However, Ørsted isn’t projecting impairments on projects in other countries — the problems are worst in the U.S., because of the newness of the industry here.

Nipper’s tone was markedly different than just three weeks earlier, when he discussed the struggling Northeast U.S. offshore wind sector on another conference call.

Analysts pressed him Wednesday on why the outlook had changed so much so quickly.

“In recent weeks we have seen an increasing probability that some risks will materialize,” he said. “We have concluded that there is a continuously increasing risk in [our suppliers’] ability to deliver on their commitments and contract schedules.”

Ørsted sees an impairment of up to 5 billion Krone on supply chain constraints, up to 6 billion on the investment tax credits it so far has been unable to secure and up to 5 billion on rising long-term interest rates.

Nipper listed other troubling news:

-

- Ørsted has pushed the expected commercial operations date for Ocean Wind 1 back from 2025 to 2026.

- The first wind turbine installation vessel being built in the U.S., the Charybdis, is behind schedule and over budget and is unlikely to be ready in time for some of Ørsted’s construction work, boosting costs.

- Foundation components are not available on the schedule anticipated.

- Ørsted has decided to reconfigure its Skipjack and Ocean Wind 2 projects to improve their financials.

- The company has “adjusted” its recent offshore wind bids to avoid future problems. (Apparently, “adjusted” means “jacked up the price tag”: Last month, Rhode Island rejected Ørsted’s Revolution Wind 2 bid as too expensive and New York invited Ørsted and other bidders to resubmit lower bids.)

Nipper said Wednesday that Ørsted has invested about $4 billion so far in U.S. offshore wind development and walking away now would not be the best or most responsible use of shareholder money. So, it is exerting “maximum pressure” in negotiations.

However, he added:

“Let me be clear: We will continue to carefully assess all of our options … to ensure that we make the most financially responsible decisions. As we communicated earlier, we are willing to walk away from projects if we don’t see value creation that meets our criteria.”

Nipper said he expects the company to make a final investment decision on three large projects in three states — Ocean Wind 1, Revolution Wind and Sunrise Wind — in late 2023 or early 2024.