The Organization of MISO States’ sixth annual survey on amounts of distributed energy resources in MISO tracked a nearly 1-GW rise in residential DERs year over year.

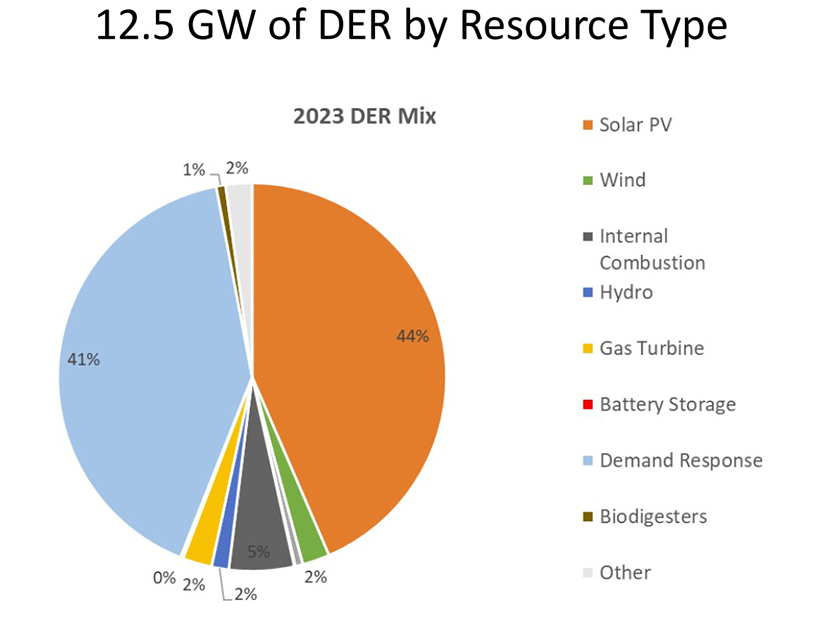

This year’s utility survey recorded almost 12.5 GW of DER capacity operating in MISO, up from 11.5 GW in 2022. OMS found that residential customers’ additions are responsible for all gains in DER capacity, up from 1.8 GW in 2022 to now more than 2.9 GW. For the first time, solar overtook demand response as the most plentiful DER class in the footprint, at 5.5 GW to 5.1 GW, respectively.

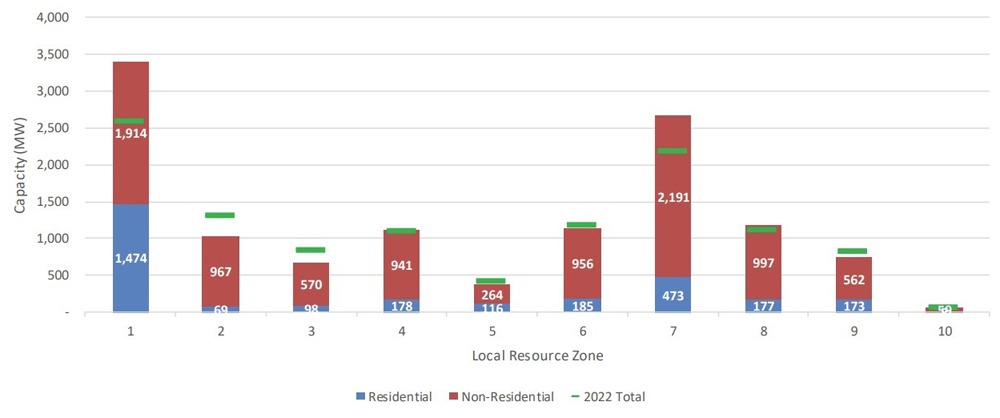

OMS also found that virtually all DER increases this year occurred in Minnesota, Wisconsin and the Dakota’s Zone 1 and Michigan’s Zone 7. Those zones together contain most of MISO’s DER amounts, at a combined 6 GW. Zone 1 alone holds almost 3.4 GW.

Five years ago, the OMS DER survey identified just 2.6 GW of DERs operating in the footprint.

During a Sept. 25 webinar to discuss survey results, OMS Executive Director Marcus Hawkins said a “steady trend of DER growth continues in MISO.” He said the surge in unregistered, residential DERs might be introducing load forecasting complications for MISO because it doesn’t have visibility into residential DER contributions. Hawkins also said the survey results could be undercounting the actual amount of demand response resources.

According to OMS, utility respondents to the survey agreed DERs soon will begin shaping load forecasting in MISO.

MISO over the summer tended to over-forecast load on its hottest days. Independent Market Monitor David Patton has said MISO’s forecast model overestimated load between 2-8 GW on the hottest days in July and August and might not account for voluntary load reductions and behind-the-meter solar. (See MISO: Could Have Employed Wait-and-see Approach for August Emergency.)

OMS said utilities this year expressed a willingness to work with DER aggregators and mentioned the need to build distributed energy management systems in the future, though they said it’s still an open question as to who will pay for those communication systems.

Some respondents also told OMS they’re waiting on MISO’s participation model for DER aggregation to be active before they move ahead on more comprehensive DER planning.

MISO has asked FERC to allow it until 2030 to comply with the commission’s directive to open its wholesale markets to DER aggregators under Order 2222. (See MISO Defends 2030 Completion for DER Market Participation.)

The RTO has said it needs time first to finish its ongoing market platform replacement and then require additional years to introduce a multi-configuration resource participation model before it can tackle offers from DER aggregations. MISO will lean on its electric storage participation plan for DER aggregations, limiting them to a single pricing node. The aggregations must self-commit in the RTO’s markets based on their own forecasts.

OMS has said MISO’s Order 2222 compliance plan is too drawn out and should include DER aggregations into its markets sooner.