The U.S. Department of Energy will put $1.3 billion in federal funds into becoming the anchor off-taker for three interstate transmission projects that together will put 3.5 GW of new transmission capacity online, Secretary Jennifer Granholm announced on Oct. 30.

Under a program set up by the Infrastructure Investment and Jobs Act (IIJA), the department will start negotiating contracts for up to 50% of the capacity on the lines, with the goal of de-risking and accelerating construction of projects that provide vitally needed new interregional transmission, according to DOE.

Located in the Southwest, Mountain West and New England regions, the projects were selected based on regional needs and priorities detailed in DOE’s final National Transmission Needs Study, also released on Monday, according to the department.

Speaking during an advance press call on Friday, Granholm explained that having DOE as an anchor off-taker — an entity that commits to buying a significant amount of power from a project — will minimize upfront financial risk and give “developers the confidence that they can actually build.”

Calling the contracts a “unique and creative solution,” Granholm stressed that “these awards are not for construction costs.” A developer would not receive any cash until a project is completed and online, and DOE will be able to sell its capacity to other off-takers, ensuring funds are available for contracts or other support for additional projects.

Ideally, the risk to the department will also be minimal. DOE’s commitment could draw in other off-takers, so the project is “fully subscribed by other customers before the project is finished and energized,” according to a DOE email.

The IIJA provides $2.5 billion for the initiative, officially called the Transmission Facilitation Program (TFP), which is being administered by DOE’s Grid Deployment Office. The money will be used in a revolving fund that can be awarded to projects via capacity contracts, loans or public-private partnerships.

The program webpage says TFP awards are best suited for projects that are nearly shovel-ready, and that no awards will be made to projects that are already fully subscribed or “have a fully allocated source of revenue.”

A second round of funding, for up to $1 billion, is expected in the first half of 2024, DOE said.

The three projects selected for the first round of TFP funding, all in the form of capacity contracts, are:

-

- The Cross-Tie Transmission Line, a 1,500-MW line running 214 miles between Utah and Nevada. The line will improve grid reliability and resilience, relieve congestion on other lines and allow access to low-cost renewables in the region.

- The Southline Transmission Project, a 748-MW line stretching 175 miles between Hidalgo County, N.M., to Pima County, Ariz. This project will support ongoing renewable energy development in southern New Mexico while delivering clean energy to areas in Arizona currently dependent on fossil fuels.

- The Twin States Clean Energy Link, a 1,200-MW line connecting New Hampshire and Vermont to clean energy resources in Canada. The bidirectional line will also allow New England to export power to Canada from future offshore wind projects. The 185-mile project includes 75 miles of new underground line and 110 miles of upgraded lines in an existing right of way, according to the project website.

The Cross-Tie and Southline projects are expected to break ground in 2025, with the Twin States line to follow in 2026, an administration official said. According to the Transmission Needs Study, all three projects are in regions that will need major amounts of new transmission or interregional transfer capacity by 2030.

In the Mountain West region, the DOE study anticipates a need for nearly 2,300 GW-miles of new transmission as clean energy projects come online, leveraging incentives in the Inflation Reduction Act. The study also predicts 1.5 GW of interregional transmission will be needed in New England.

DOE defines gigawatt-miles as capacity multiplied by distance. The department said the figures in the Needs Study could be met with a mix of projects; for example, the 2,300 GW-miles needed in the Mountain West region could be broken down into nine 200-mile, 500-kV lines, but other configurations are possible, the department said.

Top Need: Reliability

The Biden administration sees high-voltage transmission as critical to reaching its goal of a decarbonized grid by 2035 and net-zero greenhouse gas emissions economywide by 2050.

Speaking on Friday, National Climate Advisor Ali Zaidi noted the TFP announcement follows other administration initiatives on transmission, such as DOE’s recent selection of 58 projects to receive $3.46 billion in IIJA funds for local grid improvements. (See DOE Announces $3.46B for Grid Resilience, Improvement Projects.)

Such federal funding “is doing exactly what it was designed to do,” Zaidi said. “It’s catalyzing the private sector, industry and labor all to step up at this moment of critical need.”

Granholm also hailed the number of jobs the projects could create — 13,500 direct and indirect positions — and the community benefit packages all the projects have negotiated with stakeholders and communities affected by their projects. The Twin States project is providing a community benefits package that includes $60 million to be divided between the nonhost states of Massachusetts, Connecticut, Rhode Island and Maine, according to a DOE fact sheet on the project.

Extreme weather events have also underlined the need for more interregional lines to move power in emergency situations and to allow clean energy produced in remote areas to move to where there is demand for it. The Needs Study calls for the U.S. to double existing regional capacity by 2035 and expand interregional capacity fivefold, according to a DOE press release.

The report’s top takeaways, Granholm said, are, “no surprise, that we need to seriously build out transmission in order to improve reliability and resilience, and of course, to lower energy costs and relieve congestion on the grid.”

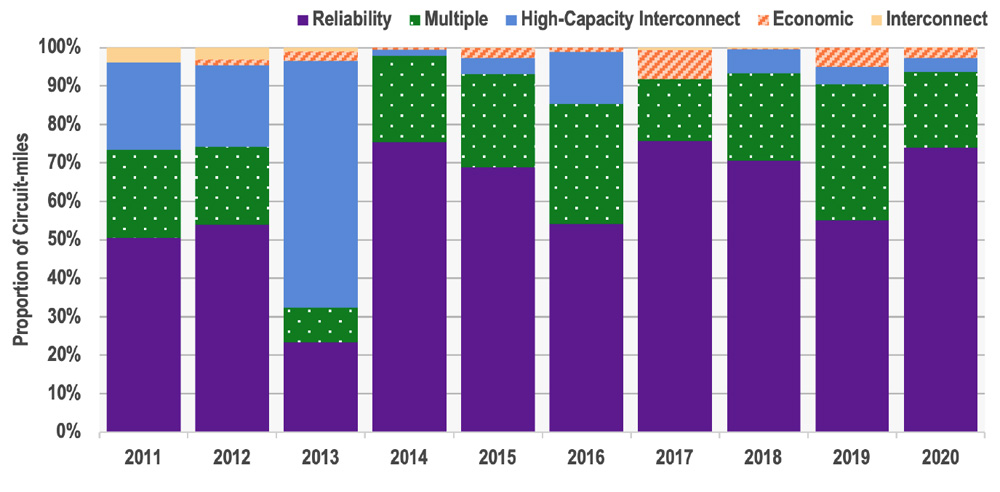

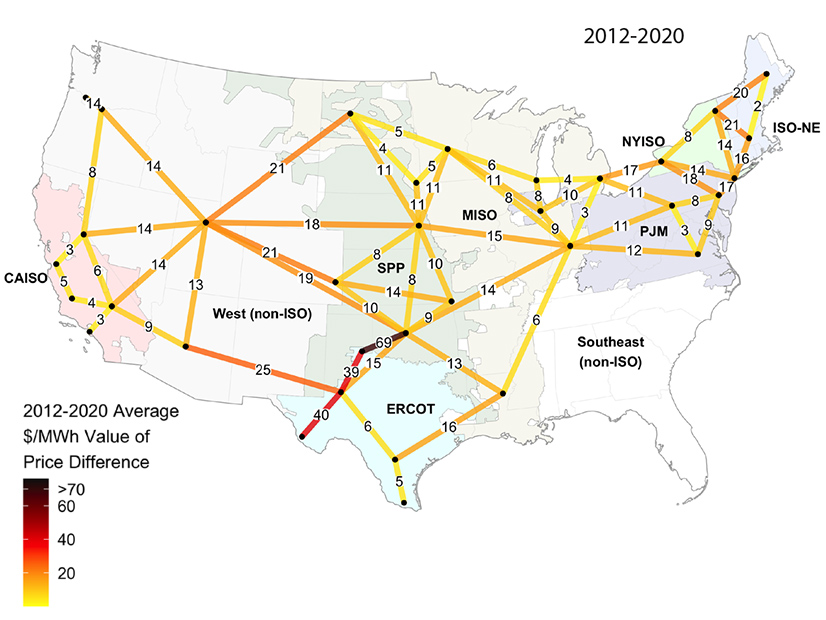

Reliability has remained a key driver for new transmission, growing from 44% of new lines in 2011 to 74% in 2020, according to the report. The most pressing and valuable new lines are needed between Texas and all its surrounding regions, and between the Plains and Mountain West, the report says.

The report anticipates that by 2035, Texas will need a median of 9.8 GW of additional transfer capacity with the Plains region, a whopping 1,201% increase over 2020 levels. Slightly less eye-popping, New England will need to expand its interregional lines with New York about 255%, or 5.2 GW, and the Midwest will need a 156% increase, or about 33.8 GW, of new interregional capacity with the Mid-Atlantic.

Reactions

One of the developers on the Southline project, Michael Skelly, CEO of Grid United, sees the TFP as a kick-starter for interregional transmission growth.

Developers want to sign up off-takers for as much of a line’s capacity as possible before putting steel in the ground to minimize their risk, Skelly said in an interview with RTO Insider. For Southline, getting the line’s 748 MW fully subscribed is “a tall order even in today’s markets. So, this lowers the bar. If we get one customer [taking] a few hundred megawatts and we have DOE, off we go,” he said.

Echoing DOE, Skelly said having the department on board will draw in other off-takers, so its share of the project’s capacity likely will be sold before it goes online. DOE “might actually never put a penny out the door,” he said.

Stephen Woerner, New England president for National Grid, the lead developer for Twin States, said the TFP announcement “is an important step forward … as we work to make the project a reality for the region. DOE has recognized the significant economic and environmental benefits of this project to New England communities, residents and businesses.”

Rob Gramlich, president of Grid Strategies, said TFP “can address the perennial ‘chicken and egg’ problem with transmission,” in which construction may wait upon demand, but demand waits upon construction. Having DOE as an anchor off-taker “promises to work a lot better than the current stalemate,” he said in an email to RTO Insider.

But Gramlich also feels the program’s $2.5 billion pot “only allows [it] to support a very small set of lines. Congress and the administration should prioritize raising that pot in future appropriations.”