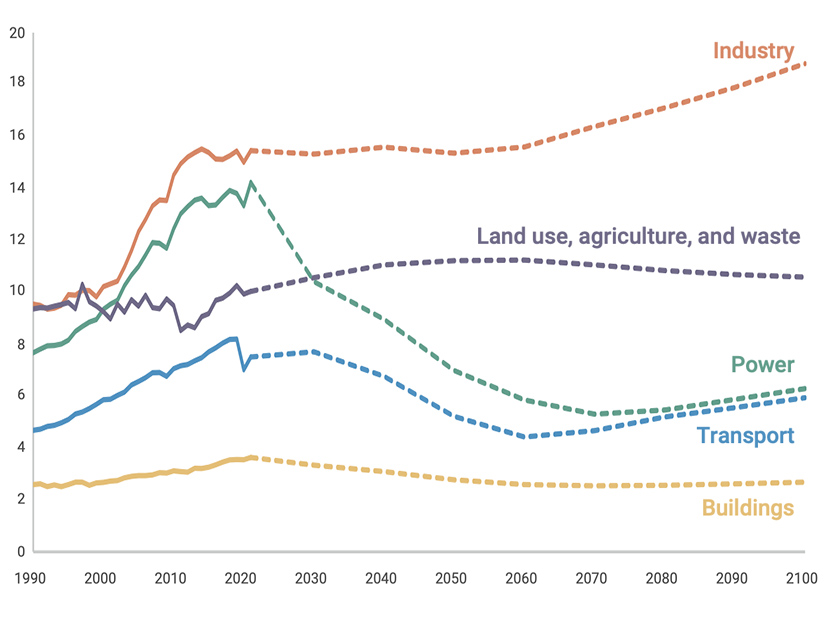

While the power and transportation sectors can highlight some success in cutting emissions, hard-to-decarbonize industry is severely lagging behind them, with the sector likely to become the biggest emitter in coming decades, according to a report released by the Rhodium Group last week.

“As other sectors decarbonize, industry very likely remains the biggest source of emissions by a wide margin,” Rhodium said. “In fact, by 2050, industrial emissions exceed all emissions from power, transportation and buildings combined in our projection mean. Without meaningful solutions to decarbonize industry, global emissions will remain stubbornly high for the foreseeable future.”

The lack of viable alternative technologies to power industry means Rhodium’s projections are based largely on pure economic considerations, such as China’s decadeslong growth slowing down. The legacy industries such as steel, chemicals and cement are already built out in the U.S., so they are going to change over to cleaner energy production measures when their equipment needs to be replaced, Intersect Power CEO Sheldon Kimber said in an interview.

“We see emerging electrification of whole new industries that don’t even exist today,” Kimber said.

Kimber’s firm wants to attract new industries such as clean hydrogen, artificial intelligence data centers and direct air capture to areas such as the Texas Panhandle, where both wind and solar resources offer high-capacity factors.

Bringing industry to where clean energy resources can produce the most power at the best price also gets around the issue of needing to build out the transmission grid, which to successfully decarbonize needs to expand by 60% by the end of this decade and triple by 2050, according to widely cited estimates from Princeton University. That is a massive political, regulatory and economic lift; Kimber doubts the grid can grow that much on that time scale.

Getting the equipment to meet that 2030 target given the realities of the supply chain is going to prove difficult, with Kimber saying it would take five to seven years to even start construction on major new lines even if the policy questions were all answered correctly tomorrow.

“So, you’re talking about mid-2035, before even the first trickle of transmission comes online, if you get it perfect right now,” Kimber said.

That would likely require additional legislation because the kind of lines that need to get built are not shipping power across one state, but across multiple jurisdictions to bring renewables to market.

“The big projects we need are to get essentially the really high-capacity factor, low-cost cheap renewables into the load pockets,” Kimber said.

It is not just about connecting any kind of clean power, but getting to those areas where the wind and the sun can offer 60 to even 70% capacity factors without battery storage, he added. It will make sense for big industries to move to areas where they can get wind and solar nearby and then ship their products, rather than transmitting electricity across multiple jurisdictions.

Creating new jobs and economic growth in rural areas, which are largely conservative, also can bolster the political consensus around clean energy.

“This country needs a durable, sort of political consensus around clean energy,” Kimber said. “And the only way we’re going to get that is if everybody can participate in the clean energy industry: across the political spectrum, socioeconomic spectrum, different parts of the country. And I think we’re starting to get that now under the” Inflation Reduction Act.

The IRA has showered the clean energy industry with incentives just as the era of worry-free, cheap solar panels from China is slowing down, with a renewed focus on stable supply chains. Intersect has domestic supplies of panels lined up through deals with First Solar.

“We’re going to build $20 billion of infrastructure before the end of the decade,” Kimber said. “And we’re going to get all those modules from Ohio, Alabama and Louisiana.”

Building out high-quality renewables to directly serve new sources of load also avoids the issue of finding space on the grid, which is becoming increasingly crowded. Data center growth in Northern Virginia has made it so some sites have to run their on-site, inefficient gas generation as baseload to keep running, Kimber said.

“I think that hydrogen is going to be very similar, in that a lot of these folks are expecting to see an availability of interconnection that just isn’t going to be there,” he added.

Even if a large customer can plug into the grid, the only generation they will be able to find could be too far away.

“Any generation you can possibly source in the wholesale market is so far away from you on a basis perspective that you’re going to be paying four times as much, and you’d be better off building a pipe from the panhandle to that site than you would be building a wire from the panhandle to that site,” he added.

Producing clean hydrogen is a good example of an industry that Intersect wants to support because the electrolyzers to produce the fuel are costly, so the more they run, the greater amount of product those costs can spread around.

“That’s why I think in the near term, you’ll see a lot of those folks moving to places where you can get high-capacity factors from renewables only so you can get to 65 to 70% in the Panhandle of Texas; you add some batteries, [and] you can start getting closer to 80, 90 or 100%,” Kimber said.

Big Customers are Considering Going Nuclear

Renewables are not the only way to decarbonize. Lately industry has focused on building out its own nuclear plants for uses historically reserved for combined heat and power systems. Even Microsoft posted a job notice in September looking for a nuclear expert to help its energy strategy for data centers.

On the other side of Texas from the panhandle, Dow is developing small modular reactors at its Seadrift facility near the middle of the state’s coastline.

The firm is working with X-energy to deploy four 80-MW SMRs to supply its factory with power and steam, which will replace the more traditional cogeneration units on the site, Edward Stones, Dow’s vice president for energy and climate, told a Senate hearing recently. (See Senate Energy Committee Examines the State of Advanced Nuclear Reactors.)

Dow’s Seadrift facility is massive, covering 4,700 acres and producing 4 billion pounds of materials a year that go into applications ranging from food packaging and preservation, to wire and cable insulation, to packaging for medical and pharmaceutical products.

“Advanced nuclear provides a huge opportunity for industrial users of power and steam,” Stones testified. “Navigating the deployment challenges will require continued engagement between the private sector and federal government, particularly around the financial and operating risks to early adopters of this technology.”

One key consideration is timing because the SMRs Dow plans to install will replace aging cogeneration facilities so they cannot be tied up in regulatory processes that drag on so long the old plants break down, he added.

While 80 MW is small compared to the major nuclear plants with two or more reactors producing 2,000 MW or more, even smaller reactors are being developed that could help cut carbon from remote facilities such as mines.

NANO Nuclear Energy CEO James Walker said the market for “micro-reactors” — nuclear reactors that can fit inside a standard shipping container and be easily transported to sites that need power — was largely untapped when the company was forming.

“So, it’s almost like a nuclear battery and you’re competing with a diesel generator, and you could ship that anywhere in the world using conventional transportation infrastructure: trains, trucks, helicopters,” Walker said in an interview.

That kind of easily transportable reactor could serve mining sites, oil and gas production, data centers and car-charging stations, or it could replace the fossil fuel engines used on commercial ships around the world, he added.

Similar-sized reactors have been used in naval applications since the 1950s, so it is a matter of taking what is known from their use and adapting it for commercial purposes. The micro-reactor space is new, and it will take some time to win regulatory approval for such technologies, but Walker said they should be ready to start deploying by the end of the decade.

“We know that there are a lot of industries that were very keen on, say, wind and solar like that, but it was too intermittent,” Walker said. “The storage costs involved were enormous. The land usage required was prohibitive, often so prohibitive that it actually looked like it had increased their carbon footprint by the amount of land they would need.”

The Grid Will Still Serve Many Industrial Loads

While industry is considering building its own generation to help decarbonize, plenty of big customers will continue to draw power from the grid as they reach for net-zero emissions, but that is no longer just a matter of matching up some renewable energy credits with the amount of power consumed.

A shorthand for the new concept of deep decarbonization is “power to X,” which Lancium Director of Regulatory Affairs Andrew Reimers explained on a webinar hosted by the Energy Systems Integration Group. It refers to taking electricity and making something else with it, which is easily understood when it comes to clean hydrogen.

“If these loads can be operated in a flexible or controllable way, they can play a big role in allowing greater adoption of intermittent renewables,” Reimers said. “And so there is a pro to the con of the reliability impact they pose.”

The reliability impact is that many of these loads are very big, so if they were to unexpectedly trip offline, it could lead to grid stability issues. Reimers highlighted the plans for the “Hydrogen City” project in Texas that could scale up to 60 GW — while ERCOT’s all-time peak demand record is just 85.5 GW.

“The reliability issue is very significant, particularly because of how big some of these facilities are,” Reimers said. “And it’s going to take a lot of kind of creative thinking about how to deal with all of that as far as maintaining the reliability of the grid.”

Even beyond reliability issues, electricity is going to be difficult to plan for by grid operators who are ill equipped to monitor global commodity prices for different industries. Some industrial load might curtail significantly when residential air conditioning drives up the demand curve, but others might have contracts they need to meet or inflexible industrial processes incapable of responding to shifts in power prices, Reimers said.