Electricity restructuring is often discussed as a binary — either a state uses market forces, or it does not — but a recent webinar from the Energy Choice Coalition dove into all the complexities it has led to since it started in the 1990s.

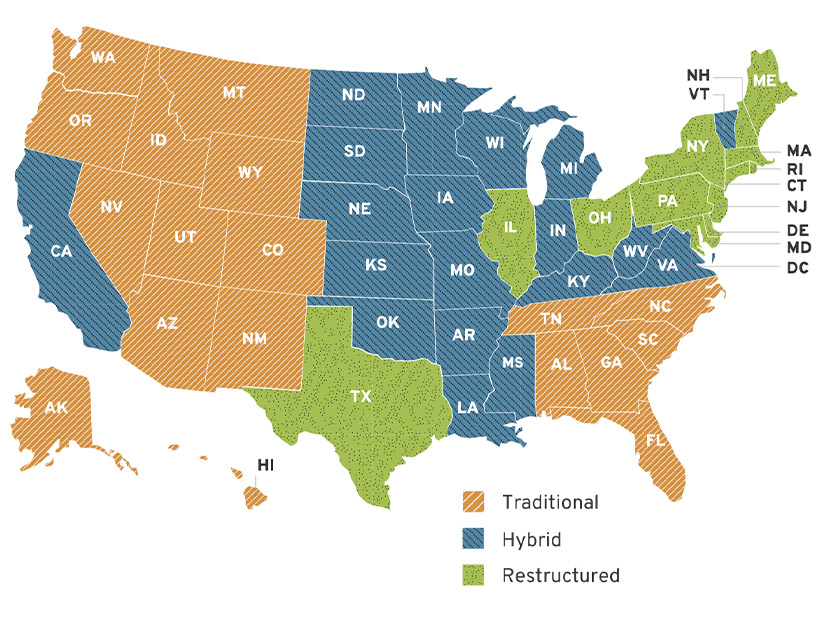

While individual states all have their own unique mix of rules, the R Street Institute’s paper, “Electric Paradigms: Competitive Structures Benefit Consumers,” puts them into three categories: 18 traditionally regulated, 19 with a hybrid system of wholesale competition and no retail, and 14 (including D.C.) with both wholesale and retail competition.

“We wanted to diagnose that as sort of a basic fact about the current system,” Michael Giberson, R Street senior fellow and the report’s co-author, said on the webinar. “And then we wanted to see for each of these three systems, how does the evidence stack up in terms of how they’re serving customers.”

The report dives into details around how markets have been viewed as saving or costing money for customers; how they have impacted reliability; and their environmental outcomes. It summarizes numerous other studies from both sides of the argument.

“Restructuring, when done well, has done well,” the paper says. “Restructuring likely benefits reliability, reduces emissions and unleashes efficiencies at the wholesale level that get passed along to consumers when retail competition is allowed to work.”

Most of the change in recent years has come from states joining MISO and SPP but not deregulating their retail sides. That trend is ongoing in the West with discussions around market alternatives, but Meghan Nutting, Sunnova Energy executive vice president of government and regulatory affairs, said technological change has made generation monopolies at the retail level functionally nonexistent.

“Because of rooftop solar, and because of other technologies and alternatives that consumers have, it means they don’t have to rely solely on their monopoly generation provider for electricity,” Nutting said. “And so, the more that regulators and the more that our government structures try to support and protect those former generation monopolies, that’s just protectionism of individual companies at this point, because there is competition within their market.”

Retail competition has seen pushback in some states like New York and Massachusetts because retailers were offering higher prices than the standard offers from the utilities, which for the most part in restructured states were left as providers of last resort (POLR) for mass-market customers. Only Texas eliminated the utilities’ POLR role in its market, which even then is only inside ERCOT and only required of investor-owned utilities (leaving out Austin, San Antonio and other cities served by municipally owned utilities).

The paper says that critics of those higher-priced contracts have identified “valid problems” with the markets that can be fixed with better rules, such as improved licensing processes and oversight. It calls on states to move to “better paradigms” — i.e., those in hybrid states moving to full restructuring.

“When moves to a better paradigm are impossible at present, policymakers should seek out improvements within existing structures,” the paper says. “Importantly, even policymakers in fully restructured states have opportunities to improve competition within that paradigm as well.”

Moving toward more competition takes “significant decisions away from utilities and regulators” and places them in the private sector. Regulators are ostensibly supposed to make decisions that take into account the interests of consumers and other groups, but the paper notes that process can be corrupted in ways the market cannot, citing recent scandals with traditionally regulated utilities influence peddling, bribing officials and intimidating journalists.

“What we’re seeing is competition within these spaces that exists already, protectionism for the incumbent, and then inadequate regulation in place of markets that would allow consumers to drive the outcomes that would likely be better,” Nutting said.

Regulators have to make sure that utilities do not give into the economic incentive of investing in higher-cost resources to earn higher returns, while markets outright offer the opposite incentives, said Lynne Kiesling, director of Northwestern University’s Institute for Regulatory Law & Economics.

“If I come in with a lower-cost technology, and I’m competing in a market against higher-cost technologies, I’m going to earn more profit, because I’m lower-cost,” Kiesling said. “And that incentive is very, very powerful, and it benefits both producers and consumers.”

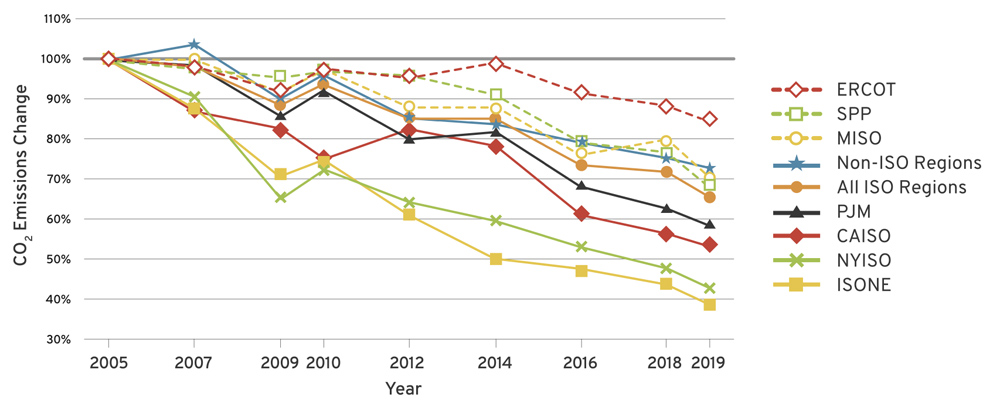

The paper highlighted how that effect of markets can influence environmental outcomes, as they have favored natural gas plants and renewables over coal.

“An earlier study found that reductions in natural gas prices and the growth of wind power both contributed to the decreased use of coal plants in RTOs, with a resulting reduction in carbon emissions,” the paper says. “The effects pushing emissions down were weaker in SPP, which researchers speculated was caused by the ways in which monopoly-owned generators — dominant in SPP — respond to market incentives as compared to non-utility generators.”

Natural gas prices have had major impacts on markets in other ways, with the report suggesting that the outcome of lower prices in retail markets depends on a state’s access to cheap supplies of the fuel.

A soon-to-be-published study in The Energy Journal has found mixed results with retail competition’s prices — finding they have gone higher in four of the five restructured states in New England while falling in Pennsylvania and Texas, the R Street paper says.

“Both Pennsylvania and Texas were well positioned to access cheap natural gas resulting from advanced drilling techniques like fracking,” the paper says. “New England, on the other hand, has limited ability to bring in domestically produced natural gas and must resort to importing expensive liquefied natural gas to run natural gas generators during periods of high gas demand.”