WESTMINSTER, Colo. — The competing efforts by SPP and CAISO to build and deploy an RTO in the Western Interconnection have sometimes been painted as a race in which the winner will be first grid operator to reach the finish line.

Hold your horses, now (pun intended).

Some in the West have come to the conclusion there are likely to be two day-ahead markets in the West: CAISO’s Extended Day-ahead Market, and SPP’s Markets+ and/or RTO West. They’re also saying it is now time for CAISO and SPP to begin talking about seams issues.

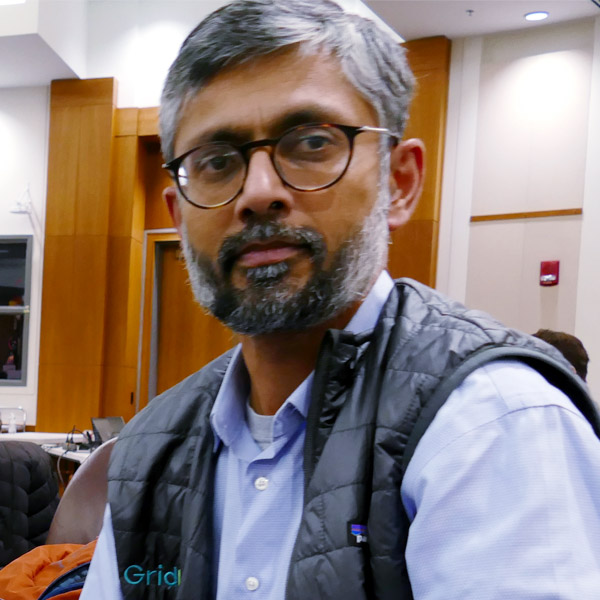

“We are accepting the possibility of two day-ahead markets,” Vijay Satyal, deputy director of regional markets for Western Resource Advocates (WRA), said last week during SPP’s first Markets+ Participants Executive Committee (MPEC) meeting of the year. “For now, we will seek to ensure there’s little seams impact from possible bifurcated day-ahead markets in the West.”

Satyal raised the possibility of two markets several times during the meeting. WRA, a nonprofit environmental law and policy organization, has maintained for five years that the region’s economic, reliability and environmental benefits are maximized with one large Western RTO.

Now, Satyal says, “the sooner, the better” that CAISO and SPP start talking with each other.

SPP said its Markets+ staff and CAISO began regular informal monthly meetings in July to discuss the design and status of both markets. The RTO has much more regular communication over reliability issues with CAISO as a neighboring reliability coordinator in the West.

Carrie Simpson, SPP’s senior director of seams and Western services, said the conversations include “making our seams as seamless as possible” and present an opportunity for SPP to work with CAISO and stakeholders to find a better way to mitigate the risks on both sides.

“This could be one of those areas that we’ve worked for improvement. This [design item] is a good way to just recognize that [participants] might have to carry more [flexibility reserve] because this type of product is coming in,” she said, noting tariff language brought forward by the Markets+ Seams Working Group (MSWG). “The seams group felt it was appropriate to allocate the uncertainty costs to these types of transactions. It allocates the cost to those who are buying from CAISO to sell into SPP because of the uncertainties around those types of transactions.”

Chelan County Public Utility District’s Tuuli Hakala chairs the MSWG. She suspects most members of her team joined to work on those very issues.

“My expectation is that as we’re working through protocols, we’re identifying elements where this is an area where this policy could be improved through formal coordination,” she said.

Satyal said he didn’t think the discussions between the grid operators go far enough or give enough transparency to stakeholders that might be affected by both market footprints.

“It is going to be extremely important to build interoperability agreements (i.e., seams management) so that we have better coordination between the two markets,” he told RTO Insider. He called for agreement on issues “involving either reliability management or the economic impacts, transmission and greenhouse gas management that come with two adjoining markets at work together.”

“This is a proactive request that WRA feels is important and in the interest of the public, ratepayers and customers,” Satyal said. “The next year and a half are critical for both markets to come to the table and agree on a principle statement around the seams, to agree on what are the operational areas and then what are the specific practices that require coordination. [CAISO and SPP] have had initial discussions, but if there’s going to be a true transparent stakeholder process … the utilities and market participants that are going to sign participation agreements should be aware and be part of this.

“Doing so now would make future seams agreement work more flexible to update and propose to FERC for approval,” he added, calling for a seams evaluation or study scenarios that look at three different levels of power flows as the ideal next step. “It’s important that all parties come to the table and support the two market operators in the minimum elements of a seams framework.”

MMU, MSC to Collaborate

SPP’s Market Monitoring Unit and the Markets+ State Committee (MSC) agreed to collaborate on clearly defining an observed participant obligation gap in the tariff that was identified by state regulators.

At issue is a 2022 FERC Notice of Proposed Rulemaking related to “duty of candor.” It would require all entities communicating with the commission or other organizations — e.g., the MMU — about FERC matters to provide “accurate and factual information” (RM22-20). (See FERC NOPRs Would Require ‘Candor,’ Improved Accounting for Renewables.)

Oregon Public Utility Commissioner Letha Tawney called into the meeting and said the MMU’s “continued concern” of a weakness in the existing Markets+ tariff “concerns the MSC.” She said the committee is seeking rules that “explicitly apply” to all entities, with everyone held to the same expectations.

“We all know when there is trust, and that is built on transparency, and the rules apply to everyone who participates … and you are seeking those customer benefits that an efficient, well-functioning market can deliver. From that perspective, we are all very aligned,” Tawney said. “We all know from our shared experience in the West that there is a fragile trust that the West has begun to build in the concept of security-constrained economic dispatch.”

The MMU argued before the MPEC in November that “duty of candor” language was missing from the tariff. Asked for examples of duty-of-candor violations, Monitor Keith Collins said he could offer hypothetical examples, but he would be breaking FERC rules by giving specific examples of what counts as privileged information.

“There are times when we asked for more information, and we would expect that information to be accurate and factual,” Collins said. “Unfortunately, that has not always been the case, and that can create some problems for us.”

“It remains unclear to MSC members that all market participants will have the same obligations in how they respond to requests for information from the MMU outside of a specific market-manipulation situation,” Tawney said. “There have been challenges [in the Eastern Interconnection] to holding everybody to that obligation to respond.”

The Markets+ legal subgroup will assist the MMU and MSC in determining any changes that need to be made in addressing the issue and bring recommendations to MPEC’s Feb. 20 virtual meeting. If consensus is not reached, the MPEC will move forward with the existing tariff language.

The MPEC also asked the MSC to update the Interim Markets+ Independent Panel (IMIP) that is overseeing the first phase of the market’s development.

Independents Sector Changes

MPEC members unanimously endorsed a recommendation from the Independents sector to create a Markets+ Interim Governance Task Force that would review and process governance issues before they go to the committee. The group’s makeup is subject to MPEC’s determination.

Those issues include the weighting of votes within the sector, a sticking point since last year, and potential improvements of Markets+ sector definitions. (See IMIP Approves SPP Markets+ Governance Tariff Language.)

The Independents sector has also proposed that its votes be calculated on a single-vote-per-member basis, with at least half of the sector reserved for Markets+ participants, stakeholders with at least 1 MW in the market’s footprint or stakeholder organizations with at least five members, a majority of whom must be involved in wholesale markets.

The sector is a catch-all comprising public information groups, independent power producers, markets and other participants that aren’t investor-owned or public power utilities.

“It’s a very broad sector,” said Kylah McNabb, speaking for the National Resources Defense Council. “This helps the Independent sector manage itself, given our diversity.”

Draft Tariff Posted

Stakeholders endorsed several more pieces of tariff language during the meeting, with SPP posting the draft’s 592 pages Jan. 26. MPEC members have until Feb. 9 to submit their comments on the tariff and its 14 attachments detailing the market’s services, terms and conditions.

The IMIP will take up the tariff for approval in late February. The SPP Board of Directors will then consider it during a special meeting in late March, after which it will be filed at FERC.

SPP is hoping for the commission’s approval in about nine months, allowing it to begin Phase II of Markets+’s development.