Duke Energy has upped its forecast for growth across its territories, driven by migration, economic development and government funds, the company said during a Feb. 8 call to report its year-end earnings.

The company is entering the year with “significant momentum,” CEO Lynn Good said. For the first time in decades, Duke is beginning the year as a fully regulated utility following the July sale of its last renewables business. (See Duke Energy Sells Distributed Renewable Business to ArcLight.)

With this regulatory “transformation,” Good said, the company is “poised to deliver on [its] simplified, 100% regulated growth plan.”

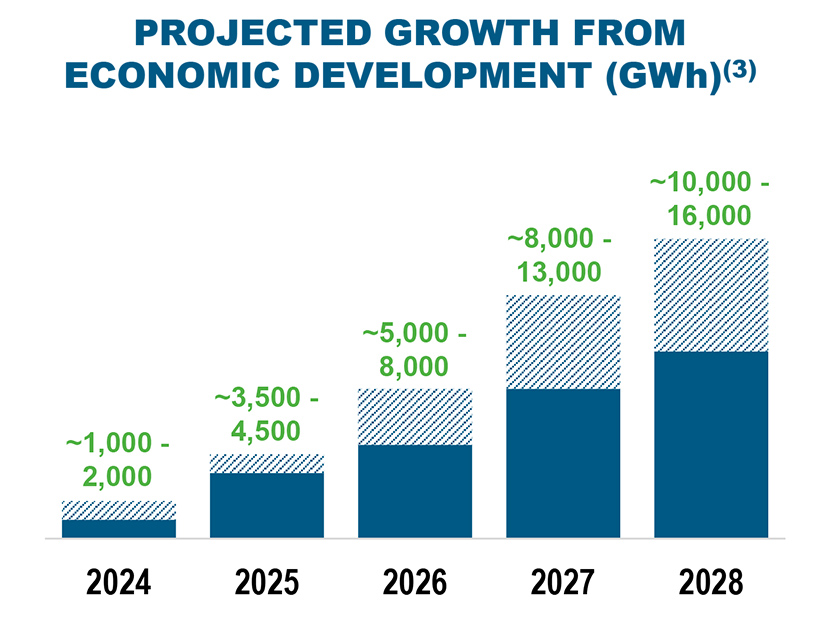

Duke’s long-term load growth projections increased to 1.5-2%, CFO Brian Savoy said. This growth is underpinned by economic development projects coming online, strong residential growth and a post-COVID trend of customers returning to their offices. “Those three factors give us confidence that 2% load growth in ’24 is definitely in our sights,” Savoy said.

Duke Energy’s third-quarter earnings call projected load growth of 0.5-1%. (See Duke Earnings Slip on Low Demand, but Long-term Growth Expected.)

To keep up, Good said a “record infrastructure build” is ongoing across Duke’s fastest-growing jurisdictions.

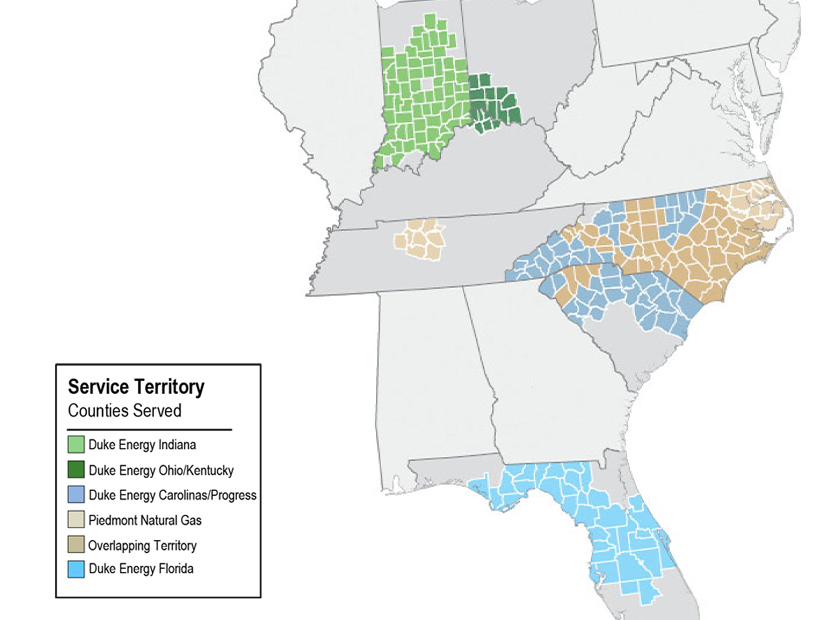

In Florida, where the number of customers grew 2% from 2022 to 2023, 300 MW of solar additions are under construction, with expectations of 1.5 GW of in-service solar in the state by 2025.

In the Carolinas, which grew by 2.1%, annual solar procurement targets of over 1 GW are in place. Duke plans to file Certificates of Public Convenience and Necessity for 2 GW of natural gas generation in North Carolina this year as well. Growth in the Carolinas is outpacing the forecast from August’s resource plan, Good said, leading the utility to file supplemental plans in January.

Duke added 195,000 customers in 2023 across all jurisdictions, Savoy said.

Nuclear PTCs

2024 marks the first year Duke can claim the nuclear production tax credits (PTCs) implemented under the Inflation Reduction Act. Savoy said the utility expects to claim several hundred million dollars of the credits.

These benefits will be amortized over four years, reducing customers’ electric bills during that time, Savoy added.

Financials

Adjusted earnings per share were $5.56, compared with $5.27 at the end of 2022, a growth rate of about 6%. This growth came primarily from rate case outcomes, multiyear rate plans and rider growth across the utility’s territory.

The utility projected yearly growth of another 6-7%, to a range of $5.85-$6.10. This is expected to be driven primarily by electric utilities and infrastructure, particularly North Carolina’s “historic” base case, Savoy said. Updated rates in Kentucky and expected updated rates in South Carolina also will drive this growth, he added.

This growth will be offset by the utility’s average tax rate, which sits at 10% but is expected to increase to 12-14%, as well as “depreciation and property taxes on a growing asset base,” Savoy said.