Consolidated Edison last week reported its plan to invest nearly $20 billion over the next four years in transmission infrastructure as part of its Reliable Clean City initiative and to mitigate climate vulnerabilities.

The New York-based utility, which serves parts of New Jersey via Orange & Rockland (O&R) Utilities, made significant strides in the past year with the Clean City project, completing several sections and receiving state authorization for further upgrades to the six-mile-long Queens-based underground transmission line. It also was approved to start its $810 million Brooklyn-based interconnection hub for offshore wind power. (See $1.2B Con Edison Clean Energy Upgrade Approved.)

“Clean energy is the future of our industry, and we are making strategic investments to build a grid capable of carrying that clean energy and protecting our infrastructure from climate change while maintaining our world-class reliability,” said ConEd CEO Tim Cawley in a statement.

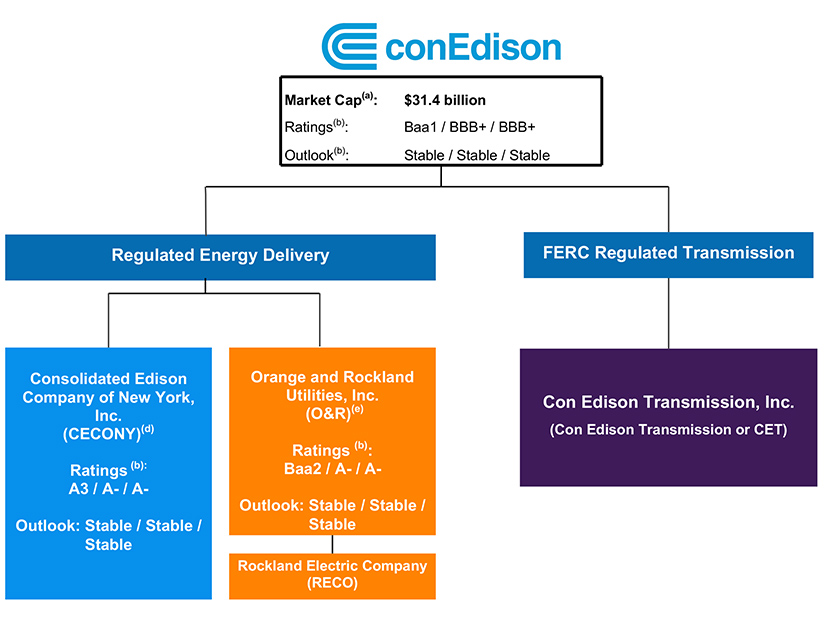

ConEd’s subsidiaries, Consolidated Edison Co. of New York (CECONY) and O&R, submitted plans to the state’s Public Service Commission (PSC) to invest $1.3 billion over five years to prepare for climate change (22-E-0222). They also proposed investments of about $2.82 billion in heat pump programs (18-M-0084) and obtained approval to increase their electric vehicle implementation budgets to nearly $450 million (18-E-0138).

The subsidiaries submitted utility thermal energy network pilot proposals totaling $289 million but await PSC approval (22-M-0429).

ConEd plans to fund these investments by issuing $3.25 billion of long-term debt in 2024 and an additional $1 billion in 2025, with $6 billion more in long-term debt expected through 2026 and 2028 at CECONY and O&R.

“Con Edison closed the year with no long-term debt at the parent company, due to the strategic sale of our former subsidiary, the Clean Energy Businesses,” said ConEd CFO Robert Hoglund.

ConEd sold off CEB, consisting of 3,300 MW of renewable energy projects, to RWE Renewables America in 2022 for $6.8 billion and continues to realize financial benefits. In its 10-K filing, the utility reported a nearly 41% increase in annual net income, which rose to just under $2.52 billion ($7.25/share) in 2023 from $1.66 billion ($4.68) in 2022. (See Con Ed Yearly Earnings Continue to Rise.)

Adjusting for the CEB sale, and other financial hypotheticals, ConEd’s annual earnings saw a more modest 9.6% increase, rising to $1.76 billion ($5.07/share) in 2023 from $1.62 billion ($4.57/share) in 2022.

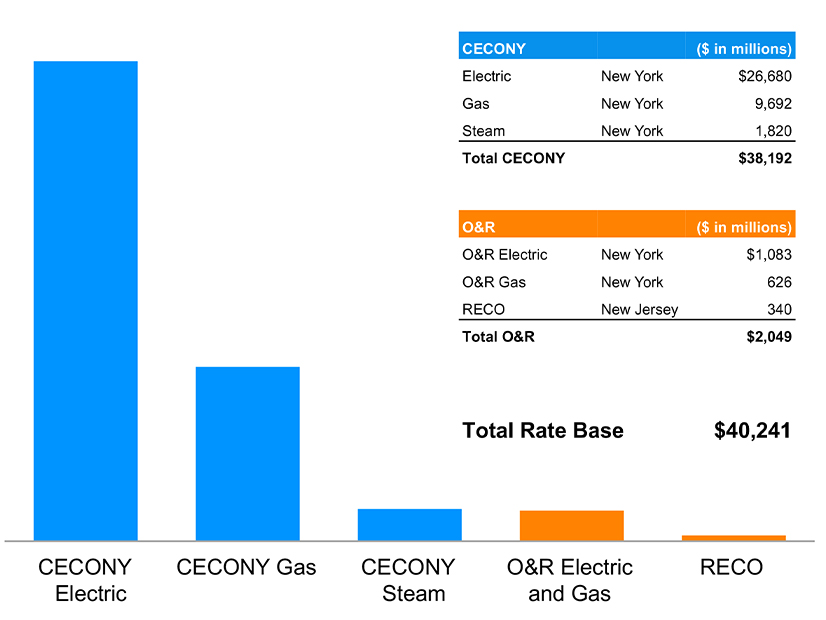

ConEd forecasts its 2024 adjusted earnings per share to be between $5.20 and $5.40 and expects an average annual increase in peak demand for electricity and gas over the next five years to be 2.7% and 1%, respectively. It also anticipates a 6.4% annual rate base growth through 2028.