Independent measures show Southern California Edison has sharply reduced its financial risk from catastrophic wildfires compared with pre-2018 levels, Pedro Pizarro, CEO of SCE parent Edison International, said during a Feb. 22 earnings call.

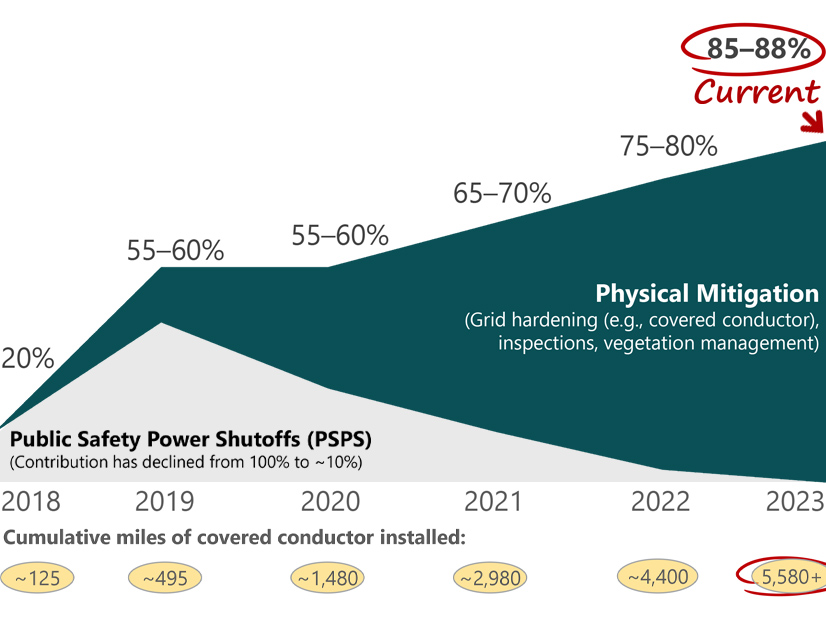

The utility exceeded its own targets for hardening its system against fire risk last year when it installed 1,100 circuit miles of covered conductor across its distribution system, raising the total to 5,850 miles installed over the past five years.

“We are proud of this progress, which, combined with enhanced vegetation management, asset inspections and other programs, has significantly reduced the need for public safety power shutoffs,” Pizarro said, referring to the fact that the physical measures have meant power shutoffs now account for just 10% of SCE’s fire avoidance, compared with 100% five years ago.

On the heels of those developments, SCE last year showed an 85 to 88% reduction in its wildfire-related risks compared with pre-2018 levels based on an independent risk model managed by Moody’s RMS, he said.

The utility in 2023 saw no fire ignitions due to the failure of covered conductor. Last year also marked the fifth straight year with no catastrophic wildfires in its service territory, according to a presentation shown during the call.

The presentation also noted that SCE expects to have hardened 90% of its distribution lines in high-fire-threat areas (HFRAs) by the end of 2025, prompting one analyst on the call to ask whether the company is preparing to address new areas that emerge as high-risk in the future due to changing climate conditions.

“Clearly, we continue to monitor how the landscape is changing,” Pizarro said. “We do that in partnership with fire agencies, with [California Office of Energy Infrastructure Safety], so to the extent that additional areas are designated HFRA, high-fire-risk areas, in the future, then we would make sure that we’re using the same standards that we use for high-fire-risk areas today.”

Electrification to Boost Load, Reduce Energy Costs

Edison expects a significant boost from California’s push to decarbonize its economy, an outlook shared by its neighbor to the north, Pacific Gas and Electric. (See PG&E Foresees Strong Growth from Electrification, Data Centers.)

“After years of flat demand, SCE is projecting an uptick in electricity usage of about 2% annually over the coming years,” Pizarro said, in line with PG&E’s forecast load growth of 1 to 3% through 2028.

“As more and more vehicles and buildings are electrified, the electricity demand will increase by 80% over the next 20 years, which will benefit customer affordability through a 40% decrease in their total energy costs across electricity, gasoline, and natural gas,” he said.

Pizarro said the expansion of high-voltage transmission and local distribution networks will be “critical” to California meeting its climate goals. Edison estimates a 6 to 8% compound annual growth rate in its rate base over the next five years, from $43 billion this year to $55.2 billion in 2028. That growth will be “driven by wildfire mitigation and important grid work to support California’s leading role in clean energy transition,” the company said in its presentation.

The company also foresees the opportunity to expand its rate base by an additional $2 billion through investments in a “next-generation” enterprise resource planning system, advanced metering infrastructure, and grid reliability and resilience upgrades, as well as another $2 billion in transmission projects subject to FERC approval.

In January, the California Public Utilities Commission rejected SCE’s 2021 proposal to spend $744 million to install new heat pumps in 250,000 homes in its territory and assist lower-income households with necessary electrical upgrades. The regulator expressed concern about spreading the costs for the program across the utility’s customer base at a time of already high energy costs.

“A substantial amount of federal, state and ratepayer money is already being spent, and has been allocated for future use, to largely implement the same building electrification efforts in SCE’s proposal,” the commission said in its decision (A2112009).

“Although the CPUC denied SCE’s building electrification application due to their near-term affordability pressures, it acknowledged SCE’s leadership in proposing programs to accelerate much-needed building decarbonization,” Pizarro said. “The utility will continue to evaluate the results of other building electrification pilots it has in progress and look for different ways to support the state in advancing its clean energy priorities.”

Edison reported 2023 profits of $1.197 billion ($3.12/share), compared with $612 million ($1.61/share) in 2022. Fourth-quarter earnings came in at $378 million ($0.99/share), compared with $415 million ($1.09/share) a year earlier.