CAISO’s Western Energy Imbalance Market (WEIM) played a crucial role in managing energy flows around the West to help support Northwest utilities during an extreme cold snap in January, according to a new report from the ISO describing its response to the winter weather storm.

The 80-page report released March 6 represents the latest volley in an ongoing skirmish among Western electricity sector stakeholders over exactly what occurred on the regional grid during the Jan. 12-16 deep freeze.

“The cold-weather event again demonstrated the benefits of the Western Energy Imbalance Market, an interstate electricity market that covers much of the West,” CAISO said in the report. “The market’s diversity of weather and generating resources allows Western regions to aid each other during winter and summer peak demand periods.”

The event plunged the Northwest into near-record cold and triggered five energy emergency alerts (EEAs), including one critical EEA 3, which requires a utility to prepare for rolling blackouts to protect its system.

It has provoked a debate in the Northwest over how vital CAISO and its WEIM were in supporting the region during the storm, or if other factors were more important. The dispute has become a stand-in for the contest between CAISO’s Extended Day-Ahead Market (EDAM) and SPP’s Markets+ and the related disagreement over whether the Bonneville Power Administration and other Northwest entities should join a single Western electricity market based on EDAM or continue to help SPP develop its alternative. (See NW Cold Snap Dispute Reflects Divisions over Western Markets.)

Analyses from the Western Power Pool, the Public Power Council (PPC) — which represents the Northwest’s publicly owned utilities — and others have downplayed CAISO’s role. They’ve pointed to interchange data showing that most of the generation that rescued the Northwest originated in the Rockies and Southwest regions — and not California. That was evidenced by the fact that CAISO itself was a net importer of energy during the five-day weather event. (See WPP: Cold Snap Showed ‘Tipping Point’ for Northwest Reliability.)

CAISO’s report hits back at that assertion — and other complaints about the ISO’s response — by explaining the mechanisms that directed the movement of electricity across the WEIM over the course of the cold snap.

The report says the WEIM “economically rebalanced supply across the West to meet increasing demand as real-time conditions evolved over the Martin Luther King Jr. Day weekend.”

“The market identified least-cost solutions within the wider WEIM footprint, transferring lower-cost electricity from the Southwest into California,” it says. “These transfers allowed exports scheduled in the day-ahead and hour-ahead markets to flow to the Northwest, replacing more expensive generation while managing congestion on key transmission lines.”

CAISO notes that its hourly exports in the day-ahead and real-time markets “increased significantly” during the event, exceeding 6,000 MW.

“CAISO became a net exporter over the Martin Luther King Jr. Day weekend for all hours of the day, excluding WEIM transfers,” the report says.

The ISO said WEIM transfers into the CAISO area were not the result of limited supply within CAISO but rather a function of the “economic displacement and opportunities optimized by the market and bounded by the transmission and transfers availability in the wider footprint.”

Congestion Response

Several factors were at play during the freeze, which the report notes. They included derates on the Pacific AC (PACI) and DC (PDCI) interties, generation outages and a fault in a fiber optic cable that caused Washington’s Jackson Prairie natural gas storage facility to briefly halt sendout Jan. 13, prompting pipeline operator Williams to declare a force majeure that cut deliveries to interruptible customers, including some power generators.

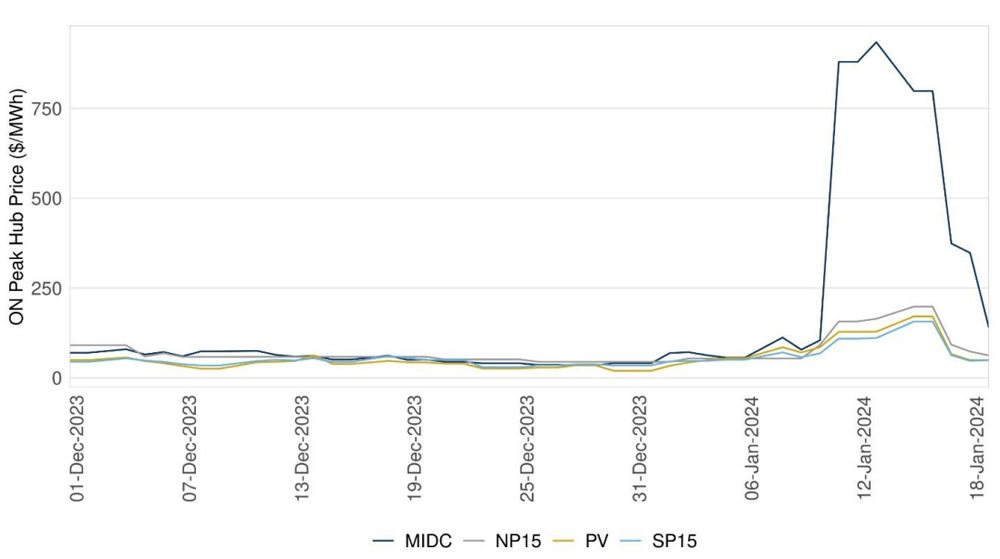

The ISO notes that day-ahead prices surged in the Northwest bilateral market, with Mid-Columbia peak prices hitting $934/MWh on Jan. 13 while off-peak spiked to $927/MWh. While prices rose at the West’s other major trading hubs (NP-15 and SP-15 in California and Palo Verde in Arizona), they never exceeded $250/MWh. The power price spikes in the Northwest in part resulted from the region’s high spot natural gas prices, but gas prices also were elevated in California.

As Fred Heutte, a senior policy associate with the Northwest Energy Coalition, explained in a recent interview with RTO Insider, the price differentials created a situation in which Northwest load-serving entities looked south for cheaper supply. The CAISO report shows the WEIM did the same.

“First, the WEIM market relied on the most economic supply available which was located in the Southwest; in turn, these import transfers displaced generation in California, which has been priced more expensively given higher gas prices,” the CAISO report said. “Second, there were transmission limitations to afford additional exports or WEIM exports transfers to the Pacific Northwest because Malin [PACI] capacity was already fully scheduled, and no exports could flow on NOB [PDCI].”

During some intervals, northbound segments of Path 15 in California also experienced congestion, limiting flows into Northern California and the Northwest.

The CAISO report additionally addresses a complaint by the PPC that congestion revenue rights (CRR) holders in the ISO’s market financially benefited from $125 million in congestion rents collected on interties into the Northwest during the freeze, while owners and capacity rights holders on the northern portions of those lines earned nothing.

“Before January, participants bought more than 900 MW of CRRs in anticipation of potential northbound congestion on California’s northern boundary,” the ISO’s report says. “None of these rights were held by external load-serving entities, such as Northwest utilities, although they could have obtained the CRRs through the CAISO’s CRR auction or the allocation process that provides CRRs for free to qualifying load-serving entities.”

The report additionally notes that CAISO is the only Western balancing authority in the West “that manages transmission congestion through electricity prices at specific locations in its day-ahead market.”

“Congestion in the Northwest can still result in higher prices, but those costs are not as visible to market participants as they are in the CAISO market,” the ISO said.

In the report, the ISO points out that EDAM “provides additional mechanisms for managing congestion on either side of balancing area borders for participating entities and provides transparency on the distribution of congestion revenues collected through nodal pricing. The EDAM will be able to help Pacific Northwest transmission operators better manage and allocate the costs of congestion on their systems.”

CAISO said it will discuss the report’s findings during a March 11 public meeting.

RTO Insider will provide additional coverage of the report after having more time to delve into its analysis.