New Mexico regulators have voted to accept Public Service Company of New Mexico’s 2023 integrated resource plan, despite concerns about an escalation in costs and resources since the utility’s 2020 IRP.

The New Mexico Public Regulation Commission (PRC) voted 3-0 on April 4 to accept PNM’s IRP — even though PRC utility division staff had several criticisms of the plan, including its “incredibly expensive” capacity additions.

PNM could reduce costs by keeping two gas peaker plants in its resource mix for longer than proposed, staff said.

Commissioners noted that their approval of the IRP was “narrow,” merely finding that the document’s statement of need and action plan were compliant with IRP rules. The vote did not approve resource acquisitions or costs or determine prudency, steps that will come later.

“Staff brought up some extremely important points,” Commission Chair Pat O’Connell said before the vote.

PNM said in its plan that the 2023 IRP “lays out an aggressive plan to achieve a carbon-free portfolio by 2040.”

“The sustained, rapid pace of new capacity additions needed to meet environmental goals and ensure reliability is unprecedented in PNM’s history,” the IRP stated.

In a report filed March 14, PRC staff recommended that the commission reject PNM’s plan, saying it did not meet the key objectives of an IRP, namely reliability, environmental compliance and affordability.

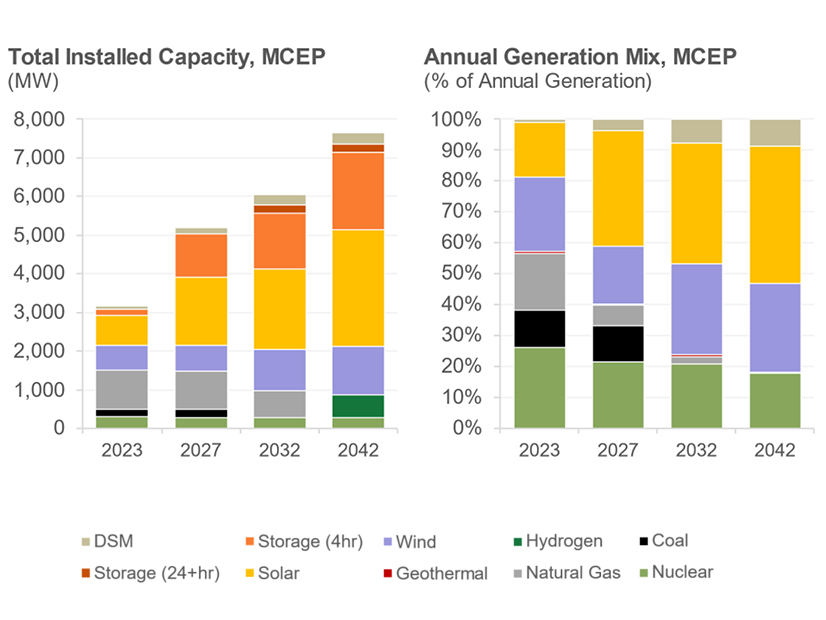

“In the three years since the 2020 IRP, PNM’s net load has not changed significantly and it has not filed a notice of material change with the commission,” staff said in its report. “Yet PNM’s 2023 IRP requires an increase in resources over the 2020 IRP of 2,690 MW at an additional cost of $2.7 billion!”

Even if adjusted for removal of 300 MW of existing resources and a 500-MW increase in the load forecast for 2042, the increase in capacity additions is 1,890 MW, the report said.

The increase in resources in the 2023 IRP is because the utility postponed the addition of 480 MW of hydrogen-ready combustion turbines to the 2031-2042 time frame, according to the report.

As a substitute for the delayed hydrogen-ready turbines, PNM is planning additional solar and battery storage — 800 MW and 905 MW more, respectively, compared to its 2020 plan.

“PNM represents that it takes over three times as much new solar and storage to provide the same equivalent capacity as hydrogen CT capacity,” PRC staff said in the report.

According to the IRP, the hydrogen-ready turbines may run on natural gas until PNM transitions to a carbon-free portfolio in 2040.

The PRC staff report said the four-hour battery storage proposed in the IRP is “overbuilt,” creating a risk of stranded costs when longer-duration storage becomes available.

In addition, the report said, PNM uses an “island” rather than “integrated” approach to its planning, “by its very limited consideration of regional energy markets and an expanded transmission network.”

Longer Life for Peakers

The report identified a potential solution to some of the issues it raised: extending the Valencia and Reeves gas peaker plants.

PNM receives about 155 MW of peaking capacity from the Valencia power plant under a 20-year power purchase agreement ending May 2028. Reeves Generating Station, which the utility owns, is scheduled for retirement in 2031.

“Extending the lives of the Valencia and Reeves gas-peaking facilities prevents overbuilding [and] out-of-control rate hikes and allows time for the development of long-duration storage,” the PRC staff report said.

O’Connell said much of what staff said in its report “would have benefited from having a response from PNM.” PNM in February filed a response to issues raised by stakeholders, but the staff report was filed in mid-March, just a few weeks before the commission’s vote.

O’Connell also cautioned against taking “as fact” the resources detailed in the IRP’s most cost-effective portfolio, particularly in later years. For example, geothermal energy could develop into a more prominent resource in New Mexico.

“It’s something that could play out over 20 years,” O’Connell said of PNM’s future resource mix.

“The truth of it is the bids that will be received in the [request for proposals] is what’s going to determine the next resources.”